Es More than a feeling. According to new data from research firm Pitchbook and the National Venture Capital Association, venture firms are raising and deploying far less money than in recent years.

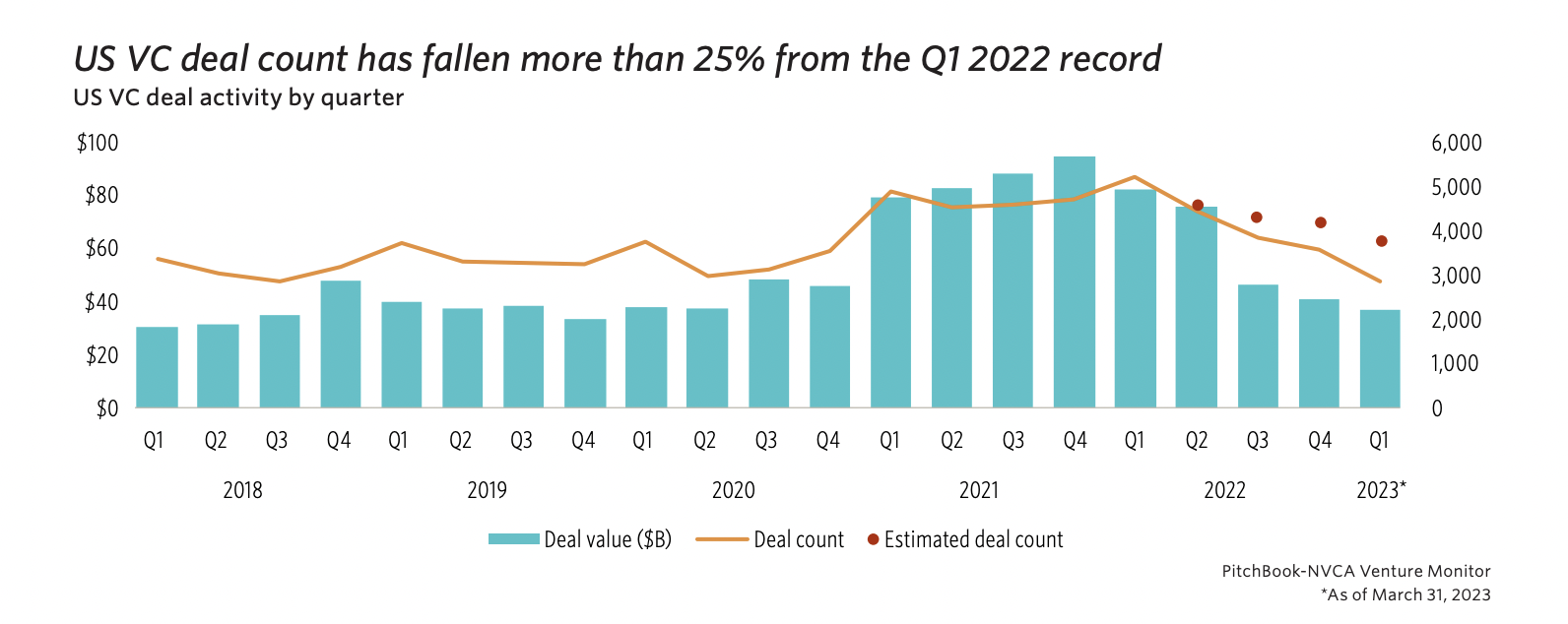

What to know: The overall number of transactions in the US has fallen more than 25% between the first quarter of last year and this year. Fewer than 3.000 deals were closed between the beginning of the year and the end of March, which doesn't sound so terrible until you realize that things haven't been that slow, comparatively, since 2018 (see chart below).

The value of late-stage deals also fell sharply in the first quarter. While it is obvious from recent headlines that the era of “mega round” has come and gone (for now), it's another thing to read that late-stage values have declined for the seventh straight quarter to $11.6 billion, according to Pitchbook and the NVCA. The two say only 19 late-stage mega rounds occurred in Q2023 98, compared to an impressive 2022 in QXNUMX XNUMX.

Unsurprisingly, that slowdown, or size correction, or whatever you prefer to call it, has had ripple effects. In the first quarter, based on the organizations' findings, the median late-stage pre-money valuation fell 16,9% from the full-year 2022 figure to $54 million, while the median pre-money valuation decreased by more from $100 million to $159. million.

The industry is being squeezed from all sides. According to the latest data, $11.700 billion was closed in 99 venture capital funds in the first quarter of this year; most of that money raised by larger vehicles and most of it, apparently, just by NEA, which said in January it closed on $6.2 billion in capital commitments in two new funds. In fact, while only two venture funds closed with $1 billion or more in the first three months of this year, last year 36 funds closed with more than $1 billion in commitments.

At the same time that they are getting fewer capital commitments, venture capitalists' portfolio companies are also getting stuck in a kind of exit purgatory. According to NVCA and Pitchbook, only $5.8 billion in exit value closed in Q1, which is apparently less than 2021% of the total exit value generated in 20 (it was a record year, but alas). With the IPO window closed (there were only XNUMX public listings in the first quarter), "pressure continues to mount within the ecosystem," observe the authors of this latest "risk monitor" report.

For more information, you have to be attentive; next week, organizations plan to release much more data. In the meantime, if you want to explore some of these numbers, you can find here.