In the fast-paced world of B2C startups, mastering marketing spend is the key to achieving sustainable growth and securing a leading market position. While there is often a formula to follow, it's not uncommon to see startup CEOs and founders grappling with these crucial decisions for the first time.

To shed light on this critical issue, we surveyed select portfolio companies to understand their current marketing spending patterns. Additionally, we meticulously analyze the journey of older companies, looking at their growth from early stage to IPO readiness.

We delve into best practices and successful strategies that have been proven to elevate B2C fintech companies to the forefront.

1: Prioritize focus on one or two dominant channels

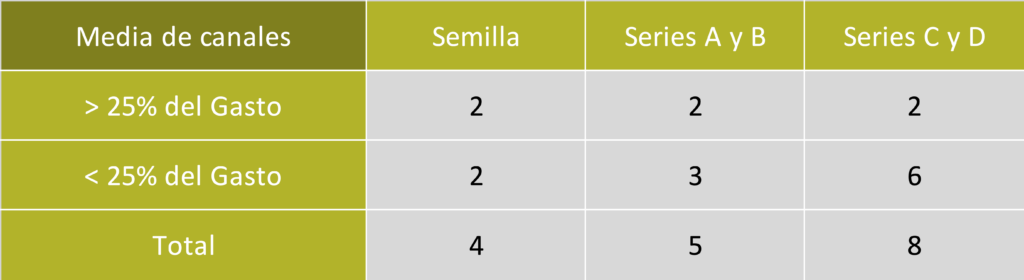

Amid the avalanche of marketing channels available, the mantra for B2C fintechs is “less is more.” The analysis of companies from the initial stages to the Series D revealed that allocating marketing spend to just one or two dominant channels can be a game-changer.

This is also independent of the size of the company. While the analyzed late-stage companies tended to diversify their marketing efforts and invest in a greater number of channels compared to their early-stage counterparts, they consistently maintained a strategic focus on just two core marketing channels that made up more than 25%. of your annual spending.

The findings clearly demonstrate that, despite expanding their marketing channels as they grow, successful B2C fintechs consistently prioritize your investments on the most impactful and effective channels.

This approach allows them to leverage their proven strategies while exploring new avenues for growth. By focusing on these core channels, B2C fintechs can ensure they are acquiring customers efficiently and with purpose.

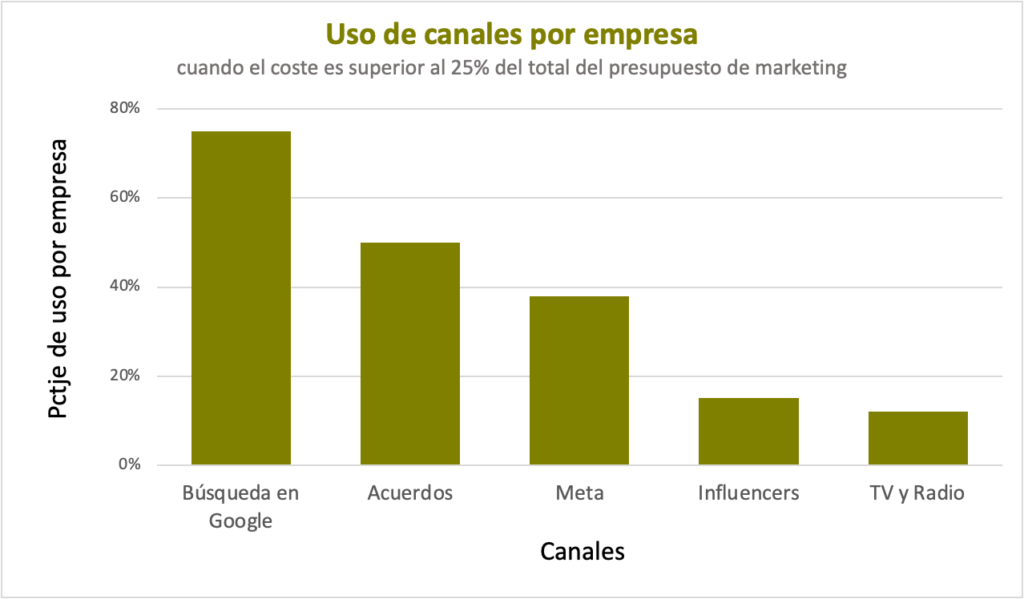

2 There is no single way to grow. Google, agreements and Meta are common channels

While there is no one-size-fits-all approach to growth, analysis has found Key information that suggests considering Google search, associations and meta-platforms as central channels in the marketing strategy:

- Google Search: Unlock the potential to connect with users in times of financial need and drive conversions with powerful Google search advertising.

- Agreements: Collaboration drives exponential growth. The deals can be quite amorphous, with possibilities ranging from a couples financial management app that leverages influencers to a mortgage provider that partners with media publications like NerdWallet. These collaborations help expand reach, improve credibility, and rapidly grow the customer base.

- Meta Platforms: Take advantage of the vast user bases of platform giants social media like Facebook and Instagram. Engage customers with creative ad campaigns and engaging content to build loyalty and drive engagement.

By integrating these core channels into marketing strategies, B2C fintech companies can leverage valuable opportunities and navigate the ever-evolving fintech landscape to achieve sustained growth and success.

3: Duplicate core channels as you scale

The triumph of B2C fintechs lies in discovering and amplifying the main channels by scaling their businesses. Analysis of the marketing budgets of a couple of companies over a five-year period provided valuable insights, revealing that successful B2C fintechs focus on their most effective marketing channels while leaving room for experimentation and the adaptation.

For example, companies that find success with Google Search advertising don't settle for the status quo. Instead, they leverage evidence-based insights to explore adjacent platforms like Bing or Apple Search, reaching new audiences and driving expansion.

Similarly, those entrenched in Meta platforms, such as Facebook, do not stay there alone. They use research-backed recommendations to explore untapped areas like TikTok, spreading their message and magnetizing diverse customer bases.

By doubling down on their proven core channels while allowing new strategies to be tested, B2C fintechs can confidently navigate their growth journey. This approach ensures optimal resource allocation, precise targeting and continuous adaptation to meet changing market demands. Emulating these data-driven strategies enables fintech companies to achieve sustainable growth, market dominance, and lasting success in the dynamic and competitive fintech landscape.

In the hyper-competitive B2C fintech space, decoding the mystery of marketing is the key to sustainable success. Adopting the “less is more” mantra, prioritizing one or two dominant channels, such as Google Search, Deals, or Meta, and doubling down on the most successful channels is key to your success.

While this journey is far from rigid and requires agility to fiercely scale and adapt, this winning formula helps create certainty in a landscape where testing and learning is key.