Europe suffers a big hangover after the technological investment party of the 2020-2021 period. That said, compared to pre-pandemic levels, venture capital investment in European startups has increased, historically speaking, and reached $60 billion. However, the anomaly of increased investment in the wake of the pandemic stands in stark contrast to that growth and has created significant headwinds, although there are some signs of “green shoots.”

The Orrick Global Law Firm has analyzed more than 350 venture capital and growth capital investments its clients completed in Europe last year.

The total capital raised in Europe was $61,8 billion. 2023 marked a reset and a major correction in investment levels globally. Of the three main world regions of risk capital (Europe, Asia and North America), Europe is the only one that will exceed 2019 levels in 2023.

According to the report, Europe is at “record levels of dry powder” and “produces more new founders than the United States,” funding remains lenta.

Last year only 11 new unicorns emerged from Europe, the fewest in a decade, and a significant number of unicorns lost their status.

Climate Tech surpassed FinTech as the most popular sector in Europe

AI's share of total investment in Europe soared to a record 17%5.

Orrick showed that investors, emboldened by the drop in funding, are “tightening the screws,” exercising greater control over investments, with founders being required to provide guarantees on 39% of venture deals.

There was a clear drop in funding in later stages of startup maturity, transaction volume decreased and founders were forced to opt for other strategies, such as alternative financing methods or focusing on revenues and profits.

There was an “unprecedented surge” in the ability of new investors to enter the technology, as founders sought new lead investors, and an “uptick” in convertible debt, SAFE and ASA, with convertible financings set to account for 23 % of rounds in 2023.

Investors generally focused on managing their existing portfolios, secondary transactions increased, and SaaS and AI remained popular. Interestingly, the number of investments in FinTech decreased.

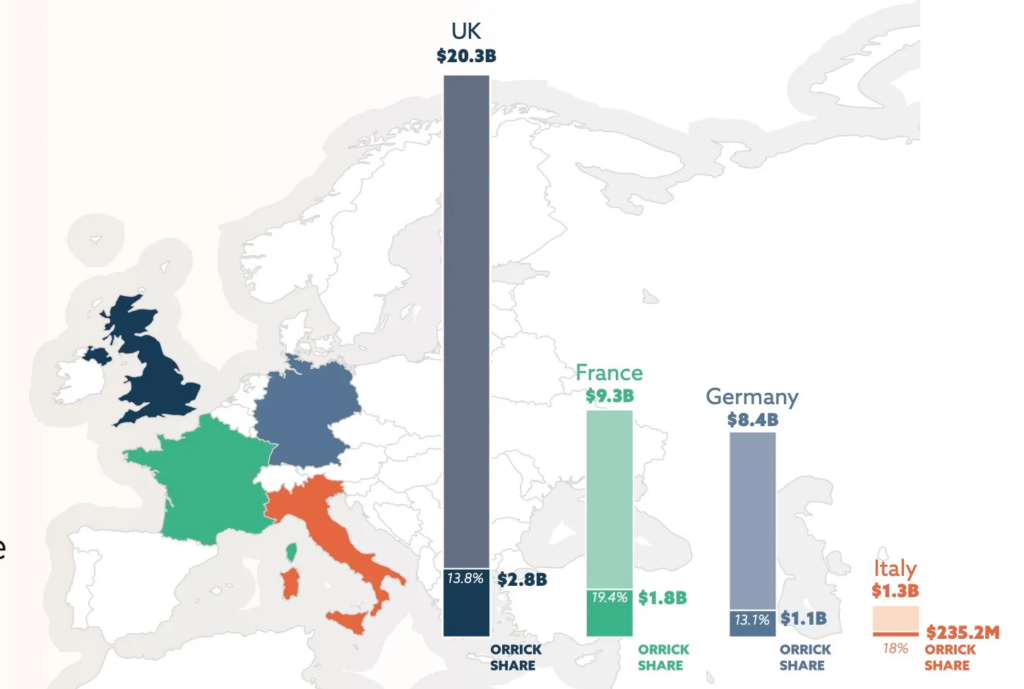

European technology investment agreements for 2023. Information obtained from Orrick offices in these countries.

At each stage, deal value declines, with the most dramatic drop being in post-founding and early-round deals.

The value of early-stage deals fell 40%, even though early-stage investors remain the most active.

There was a decline in 'mega waves' exceeding $100 million or more. However, the IPO landscape showed “signs of life” with ARM's $55 billion IPO, and M&A activity showed some opportunity.

At United Kingdom, venture capitalists are under pressure to generate profitability, which is likely to lead to increased demand for secondaries, increased M&A activity, and consolidation.

In France there has been a shift from “founder-friendly” terms to more investor-friendly terms, in stark contrast to the United Kingdom, where the opposite occurs.

In Germany, a growing demand for liquidity by LPs is expected to “drive the technology M&A process.”