Fundadores e Inversores

Es clave demostrar a los inversores por qué este es el momento adecuado y es la empresa adecuada

Al hablar con los inversores, está respondiendo qué (producto), por qué (misión), dónde (si es relevante) y cómo (estrategia y lanzamiento al mercado). Pero los fundadores a menudo ignoran otra pregunta importante: ¿Por qué ahora?

¿Por qué no hubiera sido posible construir la empresa hace cinco años? ¿Por qué dentro de cinco años sería demasiado tarde? La respuesta a menudo está relacionada con algo que está cambiando y cambiando, ya sea en el mercado o con la capa tecnológica. Anclar la empresa con un buena diapositiva de «¿por qué ahora?» es una gran adición a la presentación.

Las empresas exitosas suelen tener estas cosas en común: Eran la empresa correcta, resolviendo el problema correcto en el momento correcto. Como ejemplo todas las nuevas empresas que surgieron durante los primeros años de la pandemia que estaban resolviendo problemas específicos relacionados con el acceso a la atención médica o la presentación de reuniones.

Demostrar que se sabe por qué see está lanzando ahora en lugar de en cualquier otro momento creará una sensación de urgencia: los inversores no querrán perderse un negocio que está resolviendo lo que ven como un problema inmediato. Es su trabajo resaltar las formas en que su empresa puede abordar esos problemas y por qué ahora es el momento adecuado para hacerlo.

A menudo es posible ver convergencia de algunas tendencias importantes del mercado, pero cuando se trata de tiempo, básicamente estás tratando de leer el futuro. En palabras de Wayne Gretzky, quieres patinar hacia donde estará el disco, no hacia donde está el disco. El «¿por qué ahora?» La pregunta se puede responder de varias maneras, pero generalmente se reduce a al menos una de estas tres cosas: sincronización tecnológica, sincronización del mercado y/o sincronización regulatoria.

Por ejemplo, los drones de fotografía de consumo. ¿Por qué llegaron a la escena cuando lo hicieron? Después de todo, los aviones y helicópteros RC han existido desde la década de 1970. Las cámaras de video compactas (como las GoPro) existen desde principios de la década de 2000. No es que la tecnología no existiera; es que la tecnología requerida era prohibitivamente costosa para un equipo de consumo.

Sin embargo, el iPhone de Apple cambió eso. A medida que los teléfonos inteligentes se hicieron omnipresentes, los pequeños módulos de cámara, los acelerómetros de estado sólido, los conjuntos de chips de radio y GPS se volvieron muy baratos, disponibles para los aficionados, y bien documentados y pirateables. Una vez que la tecnología se volvió lo suficientemente pequeña y barata, construir drones equipados con cámaras fue el siguiente paso lógico.

Las nuevas empresas más exitosas de nuestra era hicieron tres cosas: detectaron una tendencia temprano y desarrollaron una solución para aprovecharla. Google, Facebook y Apple son buenos ejemplos aquí: no fueron los primeros motores de búsqueda, redes sociales o fabricantes de teléfonos inteligentes/computadoras, pero vieron la oportunidad de hacer que la tecnología fuera más fácil de usar. Fueron capaces de construir soluciones que eran mejores que cualquier otra cosa disponible. Luego terminaron definiendo las industrias en las que ingresaron, montando la ola hasta la cima.

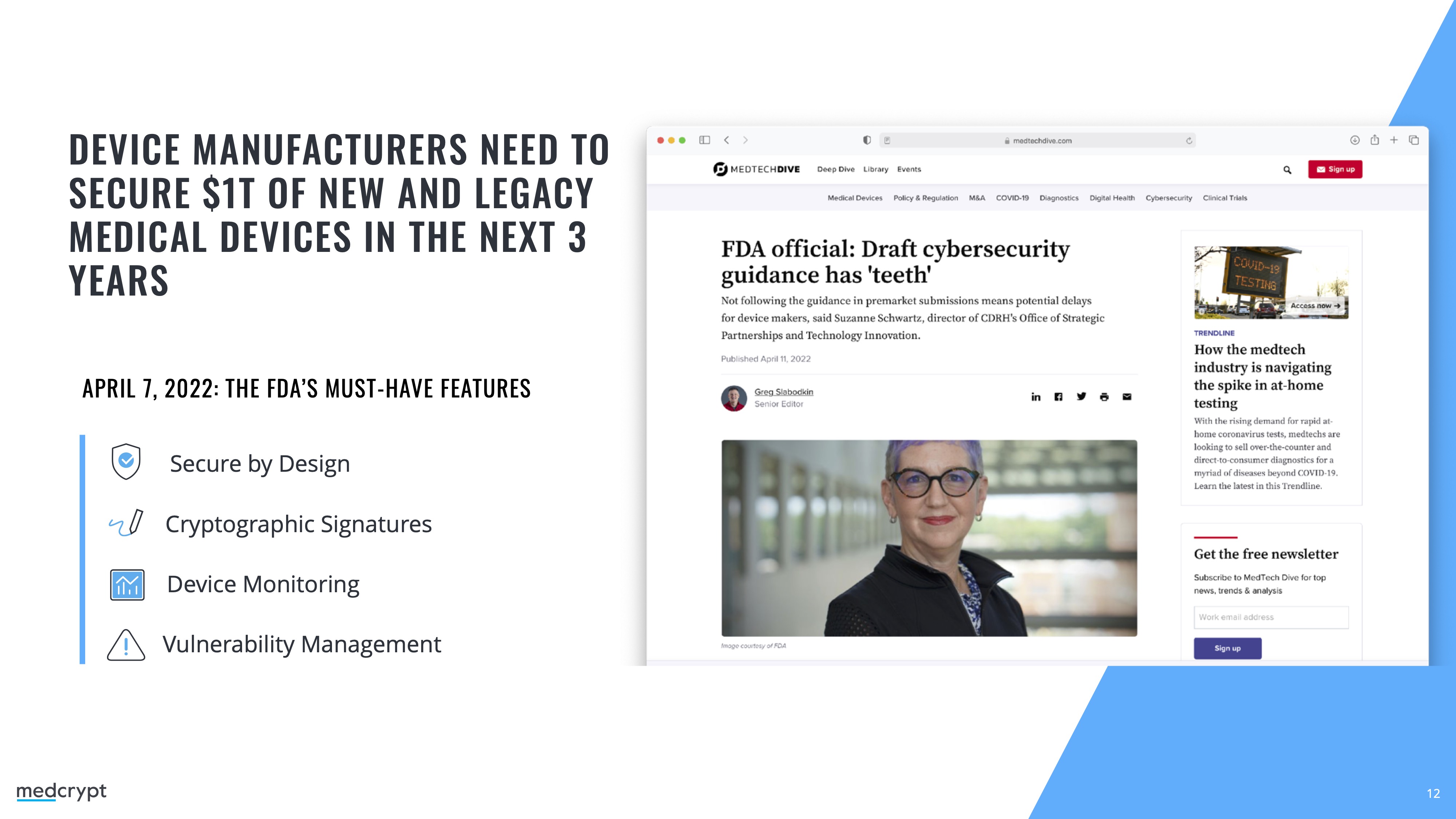

Los cambios regulatorios también pueden ser un poderoso impulsor del mercado. En la presentación de MedCrypt, la compañía explica un cambio en los requisitos de seguridad de datos de la Administración de Drogas y Alimentos de los EE. UU. que hacen que la compañía esté perfectamente posicionada para resolver ese problema para los millones de médicos dispositivos que ya existen.

El «¿Por qué ahora?» de MedCrypt captura perfectamente la urgencia que acompaña a invertir en este negocio.

Puede usar su línea de tiempo para reiterar algunas de las mayores fortalezas de la startup. Debe explicar la macrodinámica de su espacio, cómo está evolucionando el mercado y cómo las nuevas innovaciones tecnológicas hacen posible su empresa cuando antes no lo habría sido.

Recordar a los inversores cómo los cambios en los marcos regulatorios están abriendo nuevas oportunidades. Eso incluye cambios demográficos (la población en su conjunto está envejeciendo); cambios tecnológicos (vehículos autónomos, energía solar, vehículos eléctricos, redes de telefonía móvil 5G); cambios en el mercado (cifras de propiedad de vivienda, épocas de auge/caída del mercado); cambios significativos en la forma en que se realiza el trabajo (la economía de los conciertos, el trabajo desde casa, las primeras empresas remotas). Muchas de estas tendencias son algo predecibles, y los mejores fundadores de startups saben cómo detectarlas y aprovecharlas para su beneficio.

Es una oportunidad para recordar a los inversores cómo su equipo ha estado en esta industria durante mucho tiempo. Algo como, «Vimos todos estos cambios cuando fui vicepresidente de banca de inversión en Goldman Sachs durante 15 años», es una excelente manera de recordarles a los inversores que tiene experiencia y un conocimiento profundo del dominio.

El «¿por qué ahora?» se trata parcialmente de historia, pero recuerda que no es una lección de historia; se trata de tendencias. Puede utilizar los datos del pasado y la innovación para trazar una línea de tendencia hacia el futuro. Combine eso con lo que su empresa está haciendo y hacia dónde se dirige. La diapositiva perfecta de «por qué ahora» tiene un disco que se mueve rápidamente y un inicio que se mueve a una velocidad vertiginosa para interceptarlo donde estará en cinco años.

Este es el tipo de cosas que hace salivar a los inversores; Las oportunidades más importantes del mundo son movimientos de alto riesgo y alta recompensa. Piensa en grande y teje una historia de cómo estás en el vector correcto para estar en el lugar correcto en el momento correcto.