It's been a bumpy six months for the global startup ecosystem. It is both exciting and alarming to see the advancement of generative AI conversations with the breadth of increasingly understood applications.

It is nearing the end of the cycle exaggeration, and startups, even those that previously had no generative AI blueprint at all, are starting to look for immediate uses rather than just the airshots and associated disruption it can cause, including in schools and workplaces.

Exploring immediate uses will help us make micro-adjustments over time that ensure impact and distortion are minimized once longer-term projects begin to materialize. This topic has been well explored in other articles on TRPlane.com, so let's move on to other developments in the first half of 2023.

we had the fall Silicon Valley Bank, which caused significant discomfort but had limited long-term scarring on the ecosystem, particularly in Europe, given the actions of partners and governments. In the UK, this respite was provided by HSBC, which stepped in to ensure the stability of thousands of start-ups across the country, but the distortion was minimal in the European Union, given the bank's limited presence in that market.

Turning now to global edtech, the market has continued to stutter, exemplified in the fluctuating valuation of Chegg, started not by unexpected negative results, but simply by recognizing the risks of generative AI to the business.

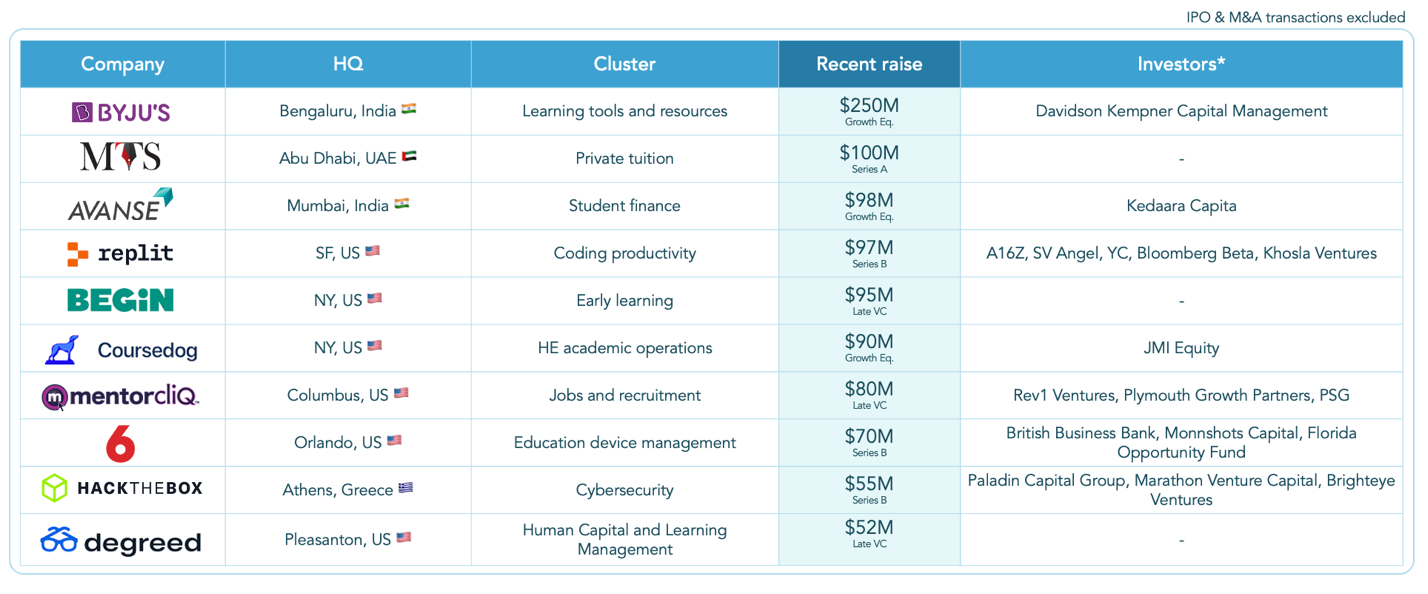

Edtech companies that generated rounds in the first half of 2023

My Tutor Source (MTS) became the first MENA (Middle East and North Africa)-based edtech company to raise $100 million, which bodes well for the region's ecosystem, which previously relied more on startups from the US and UK for educational technology than from local companies. The remaining large $80 million – $100 million deals tended to be companies that raised funds at later stages, such as degrees y Begin. Another European deal made the top 10: the $55 million Series B of hack the box (portfolio company of brighteye, VC specializing in Edtech).

With this transition to Europe, the announced privatization of Kahoot, based in Norway/UK, by a group led by Goldman Sachs, worth $1700bn, presents a bright start to the second half of 2023, with an attractive cash offer that represents a multiple of more than of 10 times on income. The deal highlights a trend anticipated in reports as early as January: rising M&A activity as companies begin to favor exits rather than ramp up rounds and risk going zombie.

Overall, however, a smaller increase in European activity is expected in the second half of 2023. The first half of 2023 saw an increase in funding than the previous period in the second half of 2022 and many of the companies that raised large rounds in early to mid 2021 will return to the venture market to raise more funds.

However, these should not be seen as special signs one way or the other in the health of the ecosystem; what will be most revealing will be:

- The foundation on which these companies are built (to seize opportunities or to stay afloat).

- Whether these companies are raising more or less funds than their previous rounds.

Let's take a closer look at what happened in the European ecosystem. Here are our five key points:

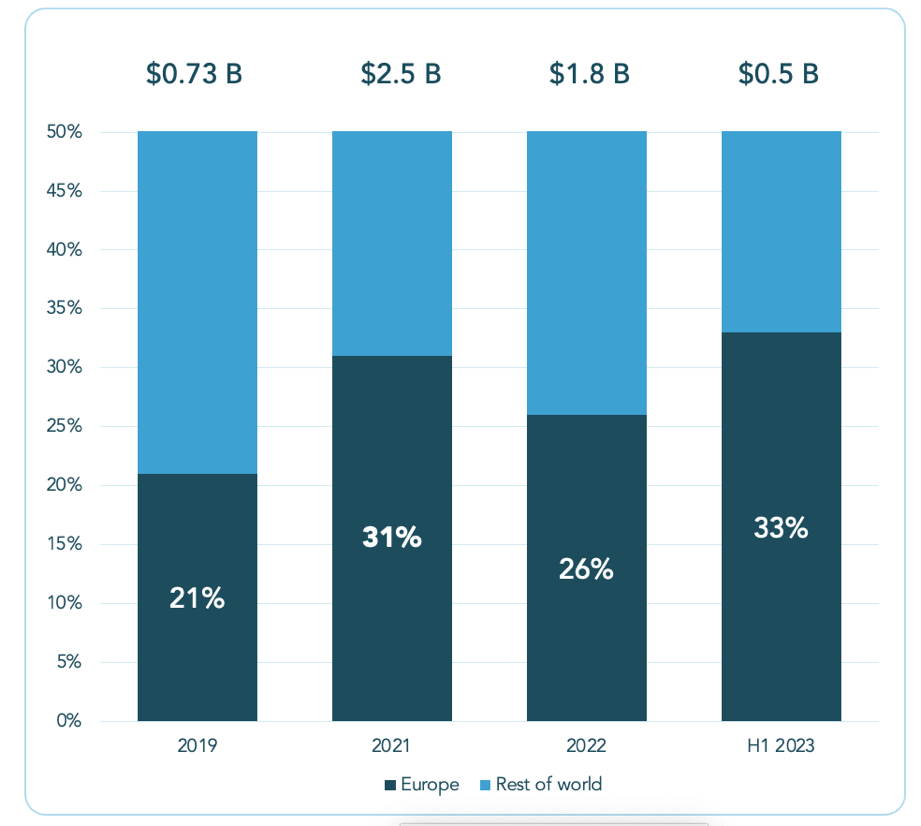

1.- A third of global edtech deals are made in Europe

It's positive to see the European edtech market holding firmer than other major markets in North America and Asia in terms of deal activity, but funding activity and deal counts are down across the board.

European edtech has a bigger slice of a smaller pie:

2.- The first half of 2023 saw more financing and a higher average transaction size than the second half of 2022

Although the pie has gotten smaller, the European ecosystem has had a better first half of 2023 than the second half of 2022, with more funding and a higher average deal size than the previous period. In the second half of 2022, the European edtech sector secured $400 million, but this rose marginally to $500 million in the first half of 2023, despite some major deals.

However, this can hardly be described as a head start – the rise is significant, though not enough to signal a recovering market.

3.- Only one agreement of more than $250 million, in Europe the largest was $55 million

As mentioned in other articles, no more mega deals. Just one company raised over £250m globally in the first half of 2023, and this deal was relatively unusual in that it was a growth round for Byju rather than a company that raised a mega round to massively boost its growth.

The slowdown in mega deals is even sharper in Europe, with the biggest deal being Hack the Box's $55 million raise.

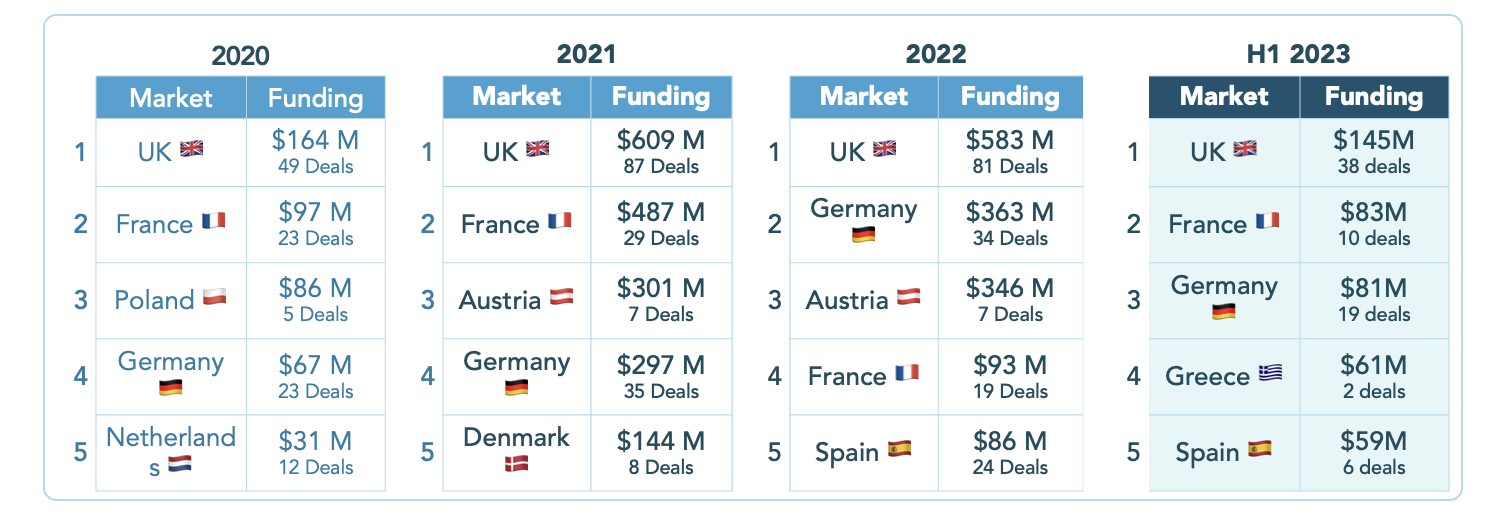

4.- The United Kingdom maintains the first position in Europe

Interestingly, against the slowdown in financing and transactions, the prominence of specific European markets reflects previous boom periods. He The United Kingdom maintains its leadership as the market with more financing and more operations, keeping its typical distance from Germany and France, which rank second and third, respectively.

It's also positive to see growing momentum in southern Europe, with Greece and Spain in the top five (Greece largely propelled to prominence by Hack the Box).

top five European edtech startups for funding, 2020-2023.

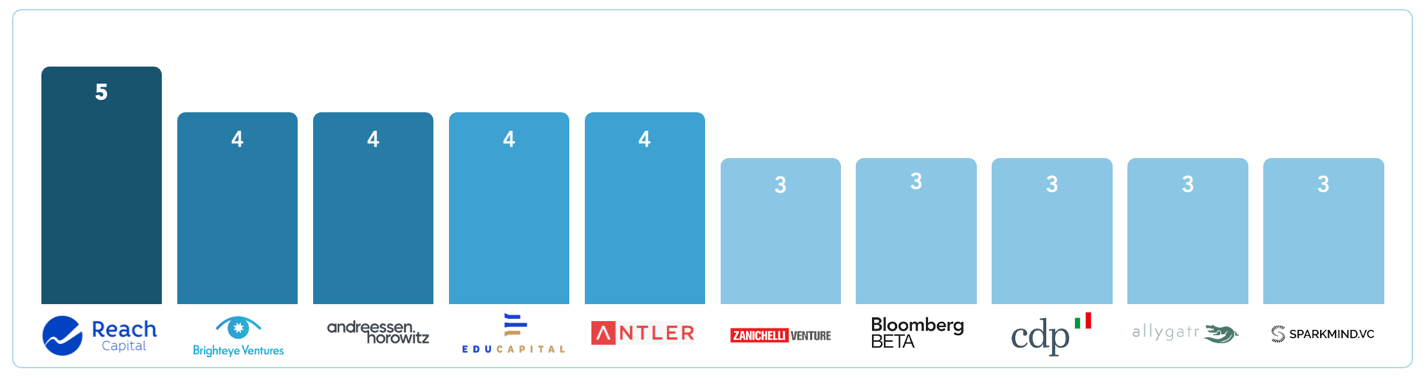

5.- A period for investors specialized in edtech

Both globally and in Europe, specialist investors have been significantly more active than generalists. This is not surprising given the current uncertainty, when investors need to be convinced of their thesis more than ever. That said, it is intriguing to see Andreessen Horowitz ranking jointly second among the most active edtech investors globally, having done the same number of edtech deals as Brighteye.

Most active edtech investors globally in the first half of 2023