Plan A a carbon accounting and ESG (environmental, social and governance) reporting platform for corporations, has raised $27 million in a Series A funding round led by partners at US venture capital giant Lightspeed Venture.

Technically, the funding is an extension of a $10 million Series A round it announced almost two years ago, meaning that for all intents and purposes, this is the closing of a $37 million Series A round, which which brings the total raised to $42 million over its six years. But perhaps most notably, its latest round also includes participation from some big names in the business world, including Visa, Deutsche Bank and Opera Tech Ventures, the venture capital arm of BNP Paribas, among many other investors.

“The urgency of the climate crisis, combined with the complexity of navigating the path to net zero emissions for companies, made it imperative for us to bring in top-tier investors now,” he explained. Lubomila Jordanova founder and executive director of Plan A.

Exploring

Founded in Berlin in 2017, Plan A (a reference to 'no plan B', climate action mantra) is one of numerous venture capital-backed startups emerging from Europe with the express goal of helping companies measure (and reduce) their carbon footprint. The perennial problem, it seems, is that even with the best will in the world, reducing carbon emissions can be difficult unless a company makes a real effort to figure out exactly what emissions made, and where They are in your supply chain.

A survey last year by Boston Consulting Group (BCG) he discovered that 90% of organizations did not measure their greenhouse gas emissions “completely.” As usual, so-called “scope 3 emissions” were identified as a major obstacle, whereby a company fails to address emissions throughout its supply chain involving partner companies. While it is true that Scope 3 is more difficult to measure compared to Scope 1 (which refers to emissions directly under a company's control), there is increasing pressure for organizations to address emissions across their entire network. .

This is important for several reasons, but mainly because the carbon footprint of many companies is largely made up of scope 3 emissions. For example, a Coca-Cola bottling partner, Coca-Cola European Partners (CCEP), has estimated that 93% of its emissions were scope 3.

Furthermore, rather than decreasing, global energy-related Co2 emissions continue to increase, growing 0,9 percent in 2022.

“Given that the climate crisis is largely defined by the growth of emissions, one of the most pressing challenges – and the only economically viable option – is to rapidly flatten the emissions curve, especially for companies,” Jordanova said.

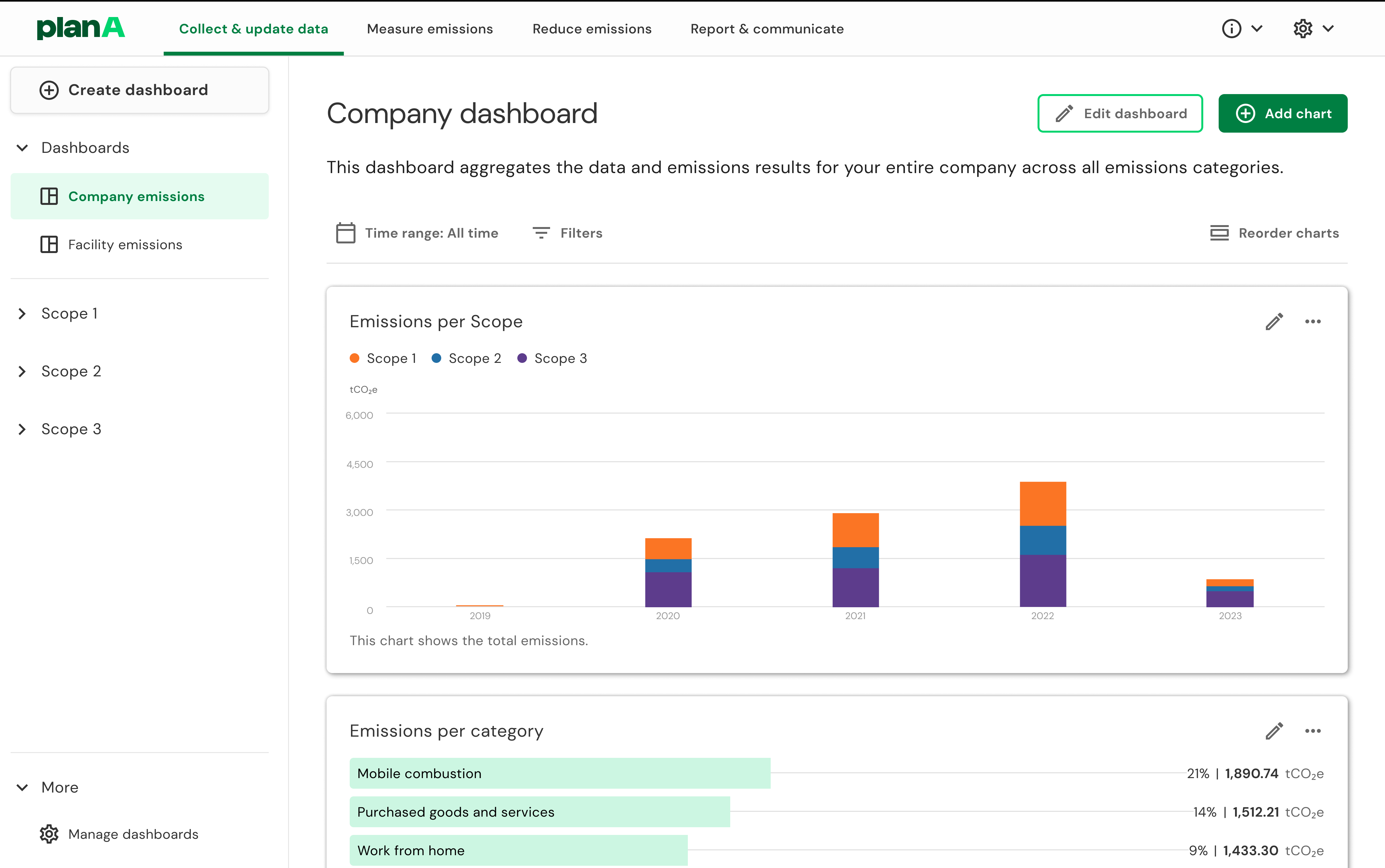

Therefore, Plan A has developed a sustainability platform based on SaaS that allows companies self-manage your net zero efforts; This includes collecting data, calculating emissions, setting targets and planning for decarbonisation. Fundamentally, it includes mapping emissions data across Scopes 1, 2 and 3, and aligning them with global scientific standards and methodologies, including Greenhouse Gas Protocol and the Science-Based Targets Initiative (SBTi).

While Plan A's core product is a web application, customers (including BMW, Deutsche Bank, KFC and Visa) can also connect directly to Plan A via API, which is useful for integrating business and customer data. emissions from countless applications such as business travel software and business intelligence (BI) tools.

Today, Plan A has 120 employees in Berlin, Paris and London, and with its new cash injection, Jordanova said it plans to "double down" with a host of new hires.

“The funding now heralds our next phase of growth,” he said. “With the fresh capital, we will double our headcount to expand our market penetration in Europe with a strong focus on France, the United Kingdom and Scandinavia, as well as deepen the capabilities of our platform.”

climate emergency

While the funding landscape is somewhat dry these days beyond a swathe of early-stage rounds, climate tech startups appear to have fared relatively well, although overall funding is still less than last year. The data suggests this is largely due to a decline in later-stage funding from Series B onwards, with early-stage trends looking a little better.

However, new companies ESG data in particular they seem to be in high demand. Climate data startup Persefoni was announced last month $50 million in new financing, which follows two other European rivals, Sweep and Greenly, which grossed $73 million and $23 million respectively, albeit last year. On the other hand, ESG data management startup Novisto raised $20 million in Series B funding a few months ago.

While funding in the startup space has declined, it still appears investors still view climate tech more favorably compared to many other sectors, with the overall share of venture capital dollars increasing from 10% to 13 % in the last year according to Dealroom data. And this, according to Jordanova, is due to several factors. While other industries have suffered due to macroeconomic factors and changes in investor preferences, the climate technology is thriving (relatively) due in large part to the severity of the accelerating climate emergency, which is prompting increased regulation and pressure on companies to change course before it arrives too late.

“European governments have implemented policies and regulations that favor clean technology, offering incentives and subsidies to attract investors,” Jordanova said. "Large corporations are also making sustainability commitments, driving investments in new companies that align with their objectives."

Lightspeed's London partner Julie Kainz He said climate “will likely be one of the most attractive investment themes” in the coming decades. “Solving the climate challenge has firmly advanced the strategic agenda of governments, corporations and the general public; and we firmly believe that consumer pressure will continue to increase,” Kainz said.