Companies could still be dealing with lower demand

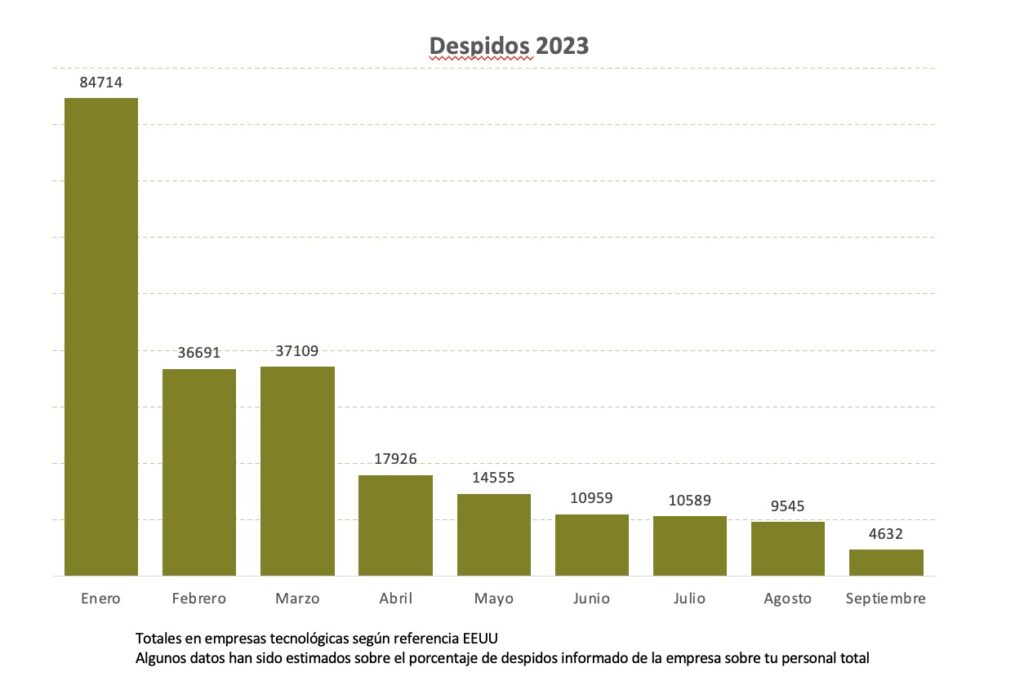

In January, nearly 90.000 tech workers were laid off. By September, that figure had fallen to less than 5.000, suggesting that perhaps the mass layoffs had, thankfully, ended and that we could look ahead to a brighter 2024 with better economic conditions. Then October arrived with a new wave of layoffs from companies large and small.

At first glance, it is disconcerting. It appeared that some of the economic factors that were putting pressure on businesses late last year and into this year were easing, and that would suggest a turnaround at some point, even if it took a while. Many economists have been saying recently that there was actually avoiding a recession, which would seem cause for optimism. However, technology companies continue to cut their labor force.

Nokia, after a terrible quarter in which its profits fell by a surprising 69%, announced last week that 14.000 employees were laid off. The commercial reasons seem very clear in this case, even though that huge number increases the overall October numbers quite a bit. But it did not happen in isolation. In fact, it comes on the heels of Qualcomm announcing it was laying off more than 1200 people, Qualtrics 780, and LinkedIn 668. Startups fared no better: Flexport laid off 600, Stitch Fix 558, Hopper 250, and so on. . And the year is not over yet.

But as we delve into the reasons we're seeing a new wave of layoffs in the tech sector, let's not forget that this is more than an academic exploration. These are real people losing their jobs, and maybe it's helpful to understand why these people are having their lives ruined: because the companies they worked for couldn't meet their revenue numbers.

The economic/buyer conundrum

If the economy is truly improving, it has been a frustratingly slow process. Federal Reserve Chairman Jerome Powell recently indicated that there would be no additional rate increase in November, but said the Federal Reserve would continue to watch economic signals, although it did not rule out additional increases in the future.

“The consensus among economists seems to be that the United States will avoid a recession at this time. However, no one expects a quick recovery either,” said Atta Tarki, founder and president of executive search and staffing firm ECA Partners and author of the book “Evidence-Based Recruiting.” However, his prognosis for next year and beyond does not seem very promising either.

“The most likely scenario is that 2024 and the first half of 2025 will be slow,” he said. “Many companies were trying to avoid overreacting and then facing a situation like Covid, where they first suffered massive layoffs and furloughs, followed a few months later by a massive worker shortage when demand recovered. Now that they think the recovery will be longer, they are choosing to go into hibernation mode, preparing for a longer winter.”

And that could explain the additional job cuts being seen now.

But he also points out that there are always layoffs, regardless of conditions, and we shouldn't overreact to individual announcements. “The total number of layoffs is still not abnormally high compared to historical standards. But since everyone is nervous about the economy and people have been expecting mass layoffs for a long time, any high-profile company announcing layoffs sets off alarm bells for people,” he said.

From growth to efficiency

In fact, the entire investor mindset seemed to shift from growth to efficiency in a minute during 2022. Efficiency in business terms often means cutting costs, and that's when you started seeing massive layoffs at large companies like Meta, Amazon , Google, Salesforce and Microsoft, as well as much smaller startups.

As conditions changed in 2021, we know there were a number of factors at play, including a suddenly high cost of capital related to higher interest rates, higher inflation, and currency headwinds due to a strong dollar, some of which have decreased since then.

Scott Raney, a partner at Redpoint Ventures for more than 20 years and whose investments include companies like HashiCorp, Heroku, Stripe and LaunchDarkly, believes the startup funding system was fundamentally skewed between 2019 and 2021, and companies have had to rethink why full its value.

“So in 2021 there was a complete reset in terms of valuations and a change in monetary policy in the US, which actually changed the way these companies were valued and access to capital, but for companies, it also changed their calculus. internal and the cost of capital,” Raney said.

That resulted in the round of layoffs that began late last year as corporate buyers began scaling back their purchases. Today, those conditions are not improving enough, and both startups and larger companies are taking additional steps to reduce workforces in the face of these changes in business purchasing habits.

"Now a lot of different companies are realizing that, 'Hey, things are not going to get better.' We will have to operate with this mindset and this reality for some time,” she said. "And so we're seeing a whole set of companies that are making significant layoffs because they have to adapt to that new reality, and that's happening now."

Tim Herbert, director of research at CompTIA, notes that despite the layoffs we've been seeing, tech unemployment is still just 2,2%, but it's important to note that this figure refers strictly to roles like IT. , engineering and programming. , and certainly the layoffs also include non-technical roles.

But he agrees with Raney that tighter purchasing budgets could lead to more job cuts. “The tightening of technology return investment decisions that began last year continues and many companies prioritize quantifiable business value over digital transformation which can be viewed through a higher risk/reward lens. “This is likely to have a ripple effect on hiring in some areas, especially in the emerging and tech startup space.”

And the negative buying signals we're seeing now could filter into 2024. “While there are positive signals across the economy and we're likely to avoid an 'official' recession, as a tech sector we've still experienced a significant reset in expectations. and tolerance in a way that I think is very healthy in the long term,” according to Lily Lyman, general partner at Underscore.

As companies plan for 2024, he says they should continue to preach efficiency and operate with the expectation that current market conditions are unlikely to change significantly.

“We are likely to see companies struggle next year to meet their efficiency and growth goals. Sales cycles are slower. Budgets are tighter. Risk tolerance is lower. We will continue in an environment of “do more with less” and those who can survive and perhaps be rewarded for it,” he said.

In the meantime, until that changes, we will likely continue to see companies cutting staff, and perhaps even startups closing, as these steady market conditions persist.