Accumulating points is a lifestyle for many. Getting good deals on flights, for example, by carefully accumulating and spending points, can make the difference between living in the slums, or living it up in great luxury.

In 2022, real-time flight rewards search engine Point.me's $2 million round was covered, and now the company has raised an additional $10 million. We analyzed the presentation the company used for its new round to find out if the startup missed the mark or if it is meeting its goals.

When you see what the company does, you immediately become curious about how it is going to tell its story in a way that inspires urgency. Everyone loves a good flight with airline points as much as the fuzzy feeling you get knowing you've “beat the system,” but is this a product that solves a “real” problem? Or is it a disposable luxury good? Let's dig in and find out.

Slide index

Point.me used a 16-slide deck to raise its $10 million in Serie A:

- Main

- Problem slide

- Problem Impact Slide

- “How it is currently resolved” slide

- Solution Slide

- Value Proposition Slide

- Product Benefits Slide

- Product Slide

- Product Delivery Slide

- Product Screenshots Slide

- Traction slip

- Press clippings slide

- Advantage Protection

- Team slide

- Previous investors fall

- Closing

Three things done well

Point.me does a lot of things right in this presentation. It's obvious that it has greatly refined its messaging for its customers throughout its existence.

Great consumer-focused messaging

There are a lot of great messages in the presentation, but the closing slide is perfect

As you can see from the “slides in this presentation” overview, Point.me spends quite a bit of time on the product. It may seem excessive, but taking into account the curiosity it arouses, it makes you want to go check it out and with your pricing page They almost have the client captured.

Some compelling facts

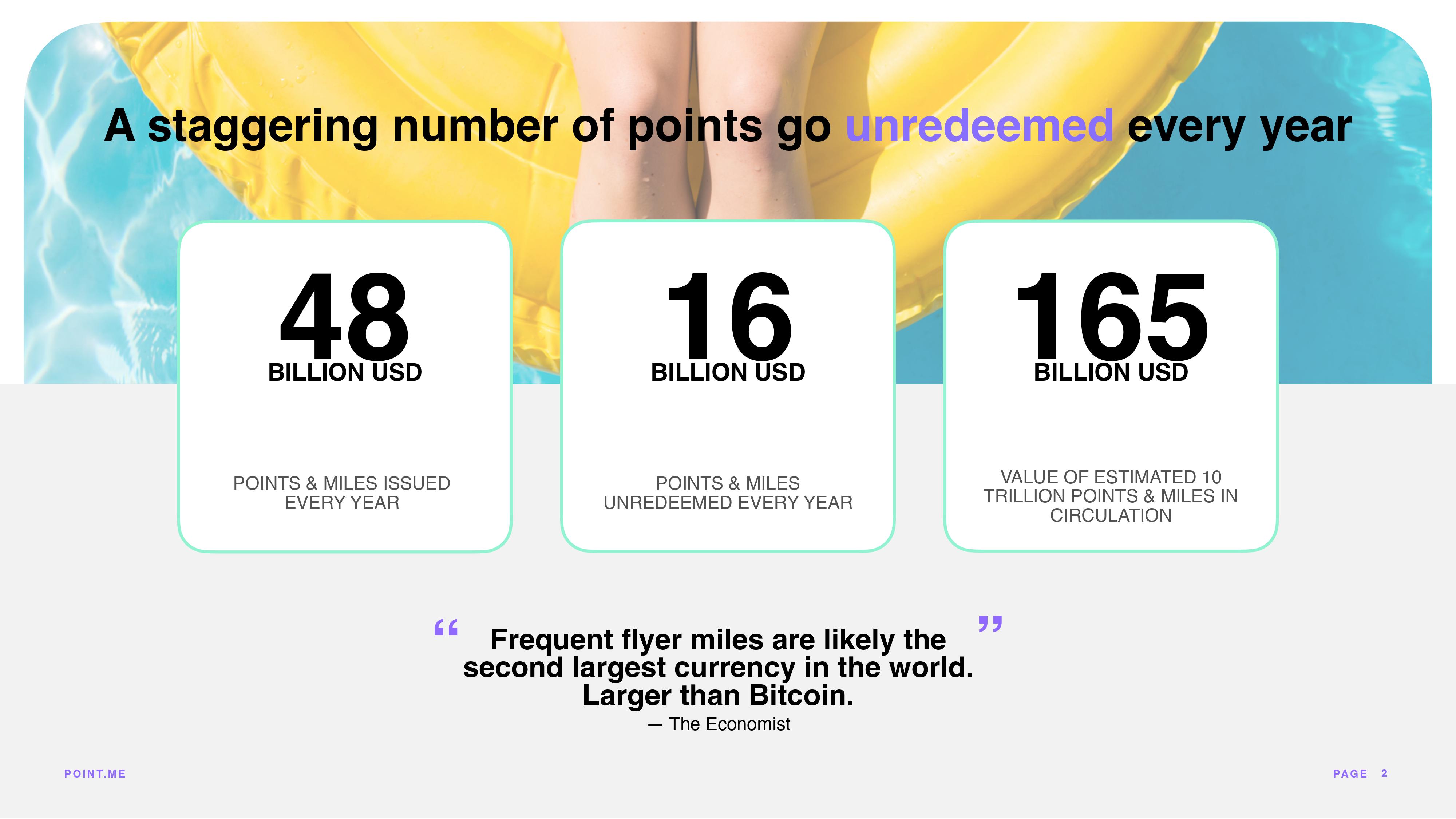

The story begins with some compelling facts.

This slide is really interesting for several reasons. On the one hand, it gives an idea of how big the airline points economy was, nor what a fantastic tool it is for those airlines. Issuing $48 billion worth of points and then letting a third of them go unredeemed is an incredible business model. It only gets worse: The founders tell me these numbers were correct when they went to raise money last time, but they claim that the value of unredeemed points and miles per year is now closer to $30 billion, not 16 billion dollars.

Of course, this is built into airline card templates. It is very cheap to issue points if you know that many of them will not be redeemed, especially if those points eventually expire.

However, every economist sees this as a risk for Point.me: it's a dangerous place to operate. The more successful you are, the more incentive there will be for airline companies to shut you down or at least make your life more difficult.

Still, if you're taking advantage of the time in the meantime, this seems pretty compelling.

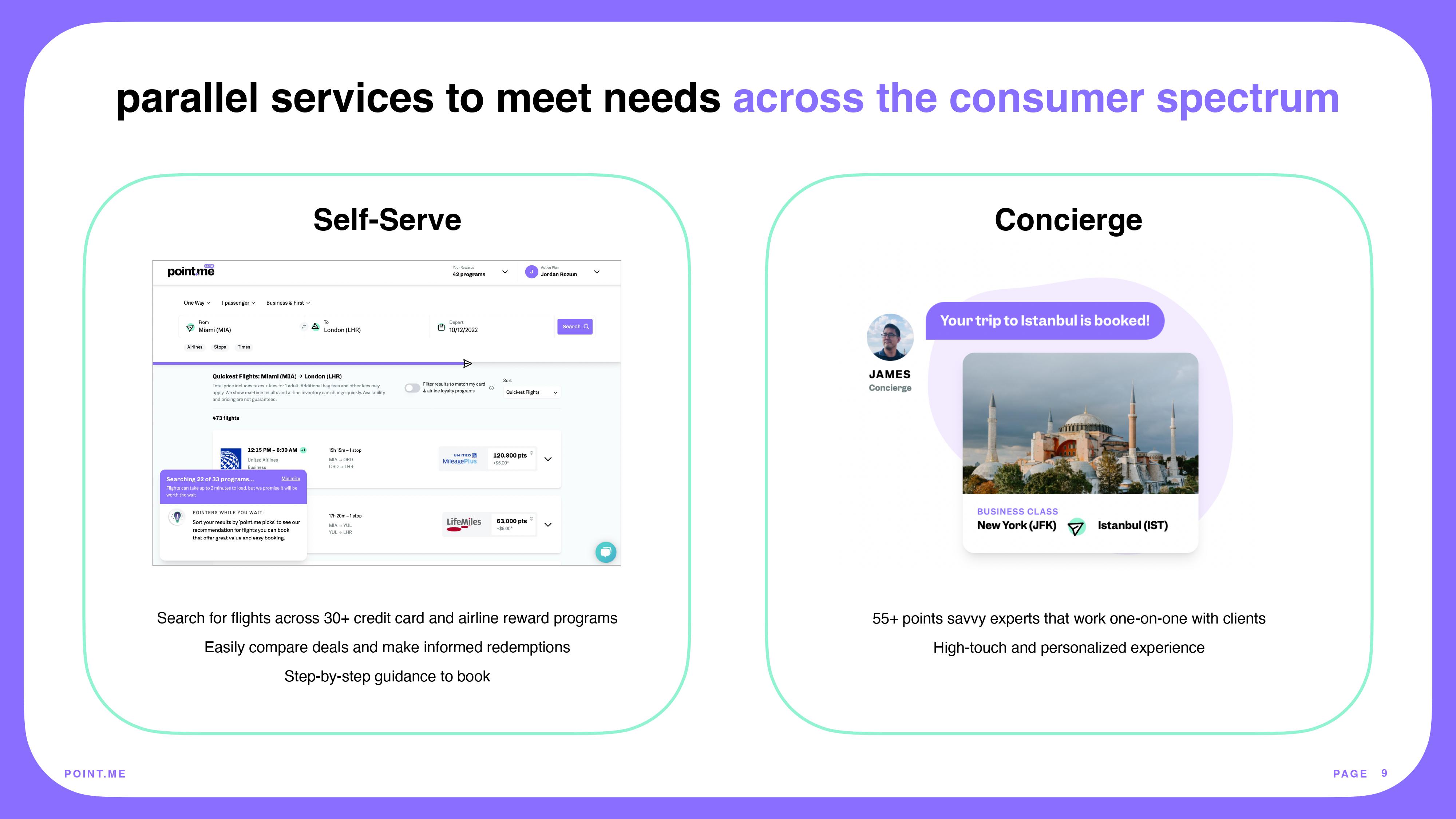

Two kinds of clients

Two options.

Point.me is especially useful for people who have a lot of airline points and who tend to travel a lot. That makes you an interesting target audience: if you travel a lot, it means you travel frequently, probably for work. That means you probably have even less time than most to resolve the points situation.

This company sets itself up for success in two ways: It provides a support solution for people who are willing to pay a fee for someone to figure out how to make the most of their saved points. y a self-service platform for people who want to do that work themselves.

The bad thing is that this slide is essentially a sales slide aimed at customers. Now, many VCs travel a lot, so I'm not kidding Point.me, but in general, remember that the “product” you are selling to the VC is not the product you are selling to Your clients. A VC is interested in shares of your company, so the sales pattern will be different.

In the rest of this review, we'll look at three things Point.me could have improved or done differently, along with the full presentation.

Three aspects to improve

Several elements of this presentation could be improved by simply removing much of the information. These are some of them:

Is it solving a real problem?

What is the reason for this company to exist, and is it surprising that it has successfully raised a round of 10 million dollars.

One theory is that investors saw something we didn't detect. Another is that the company got lucky and grew in a fantastically frothy market just as the pandemic was ending and many people had a huge reserve of unspent points. Whatever the reason, it's just not evident. This is a vitamin, not a pain reliever. It makes you think a lot about it.

The only thing that could have convinced us otherwise is the company's extraordinary traction. Unfortunately, this is one of the worst traction slides seen in an intense presentation minute.

The traction impulse does not reflect that it is traction.

Sure, some of the numbers are impressive ($2 million revenue and 26.000 subscribers), but they're cumulative. The company says it has signed up 26.000 subscribers, but doesn't tell us how many of them have dropped out. The $2 million revenue figure is great, but nowhere does it say when the company was founded. Any company can report revenue of $2 million simply on a fixed income of $200.000 a year for a decade, but no venture capitalist in their right mind would invest in a business like that.

The point you're trying to make is that traction needs to be graphed over time, because VCs invest in exponential growth. This slide does not mention a timeline, which makes one very cautious.

What's worse, many of the other "traction" metrics on this slide are completely useless. "We are incorporating new members every week." Sure, how many? “We are partnering with one of the largest consulting firms.” That sounds like future tense, so not real traction yet. “We partnered with a major card issuer.” Great, which one?

And perhaps the biggest sin of this slide: “Without marketing…” That is not a good thing. Organic growth is cheap, but it doesn't scale very well, and if you say you're not doing any marketing, you run the risk of communicating that you don't know how to scale your business. That's a big red flag.

And then there's slide 12, which is another slide full of press quotes. I have no doubt that for a very small subset of points-loving travelers, point.me is manna from heaven, but I'm still not sure if it's a VC-scale business

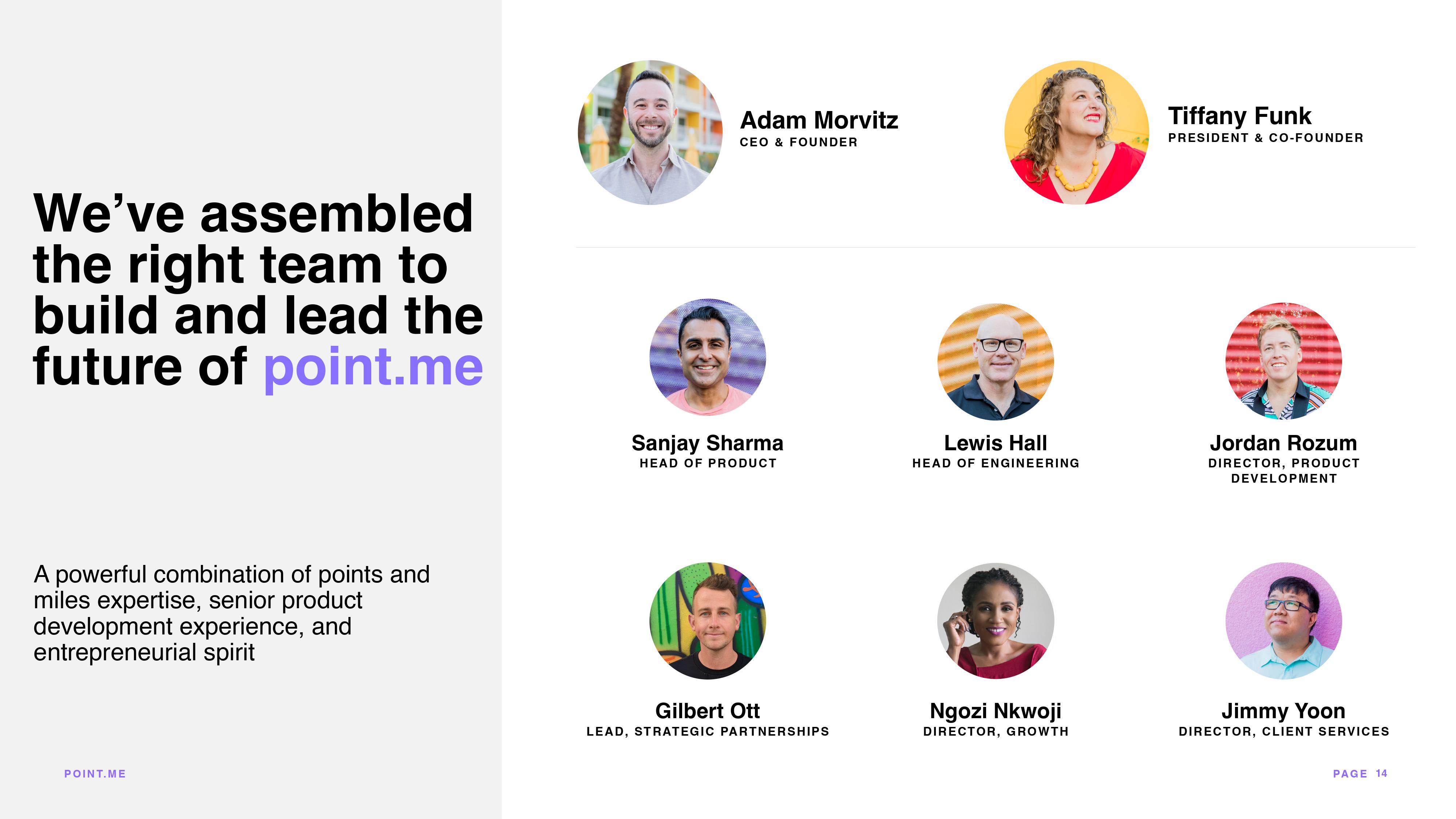

Why this team?

This is one of the worst team slides.

This is not a good slide. Even with the propaganda, I don't know which of these people has what kind of experience. Only after some light cyberbullying did I discover that the CEO has an amazing resume and that he had spent 10 years building his previous company, Juicy Miles. That's very impressive.

Unfortunately, when I looked at that company's page, it said: "Juicy Miles is now point.me", which caused the alarms that were activated by the traction slide above to go from loud to deafening. The company has been operating for a decade. Traction figures accumulated in a company that has been in operation for a long time… Yes, you would have to ask the team about their traction over time.

It's also curious that the company has a CEO and a president, because the latter is an unusual title in early-stage startups. It's also a role that doesn't really have a clearly defined meaning. Now I'm curious to know what Ms. Funk does at this company. His resume is also extraordinary., so the team is obviously a great fit between the founders and the market, but I would have liked to see it on this slide instead of having to search through LinkedIn.

Overall, this slide gave me both unpleasant and pleasant surprises, which mainly means that it could have been designed a lot better. And once it was improved, I would have pushed to present it as slide #2. Tell investors why this is an extraordinary team that is well positioned to lead this company and then tell the rest of the story. Good equipment is rare, so make the most of it!

How to read this point…

Okay, I don't trust your word.

I think what the company is trying to say here is, "Hey, we raise money from industry experts who understand what we're doing." But it seems a little desperate.

Of course, your first round of institutional investment will come from people who know the space well. But if you're trying to build a truly venture-scale business, you rather need to raise money from investors with a lot of experience in B2C retail or consumer services.

They also confuse the logos on the right until you realize that those are other companies that each of those investors has invested their money in. Honestly, that doesn't make the recipient feel any better. It means that the investors are discreet and/or unknown enough that the company is trying to partner with other big brands through co-investors.

The problem here, of course, is that every investor has a portfolio, and for every Getaway, Google Flights, and Brex, there will be a large number of failed companies. Presumably point.me doesn't want to be associated with them, so there isn't much point in including them here.

When you read this slide (especially in light of the other points mentioned above), you see a company that is desperate to prove it has traction, any traction, and is willing to go to some really strange ways to prove it.

That, in itself, is a pretty big red flag.