The European expense management startup payhawk received 100 million dollars in a round of Serie B. After that round, it reached the valuation of a unicorn, one billion dollars according to the information available.

Lightspeed Venture Partners is leading the new $100 million investment. Sprints Capital, Endeavor Catalyst, HubSpot Ventures and Jigsaw VC are also participating in the round. All previous investors in the company remain and expand their investment.

When the company raised the first part of its Series B, it raised 112 million at a valuation of 570 million. The new news represents an increase in the valuation of 75% in just three months.

If you are familiar with Brex o Ramp in United States, payhawk offers a somewhat similar product, but for the European market. It also competes with spenddesk, employment, Revolut and others. The company wants to replace multiple B2B payment services with a single, unified platform.

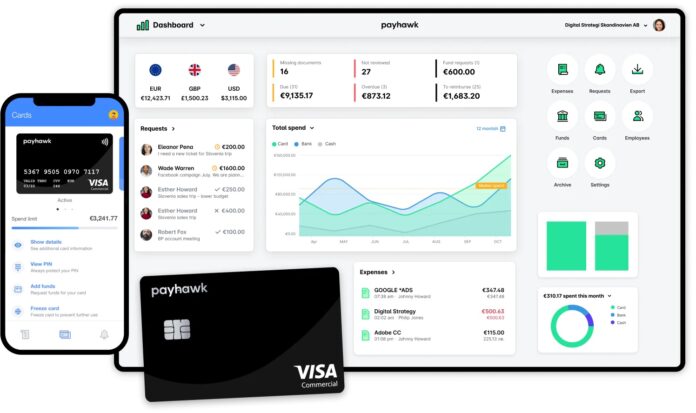

In particular, it can be used payhawk to centralize all your payments in a modern interface. When an account is opened payhawk for the first time, you get a dedicated IBAN where you can load money from your existing bank account.

After that, you can start using cards payhawk, track payments more efficiently and use the set of services of payhawk for all expenses.

When it comes to cards, employees can get cards payhawk virtual and physical to spend money more easily. Go live allows you to configure rules, budgets and an approval workflow. Customers of payhawk receive 3% cash back on card payments capped at the subscription price of payhawk.

Sometimes it is not possible to pay by card. Employees can also enter cash payments and get reimbursed later. Similarly, bills can be paid with outgoing bank transfers from the account payhawk.

There are several integrations with ERP and accounting systems. This could be useful for reconciling payments and collecting bills from payhawk directly.

The startup currently operates in 30 countries and focuses on large SMEs. It has been growing very well as the company's annualized recurring revenue has doubled every quarter for the past few quarters.

payhawk plans to release new features such as Oracle Netsuite integration, subscription management, and budgeting. It has offices in London, Sofia, Berlin and Barcelona. Next, the company plans to open offices in Amsterdam, Paris and New York. Based in Bulgaria, payhawk it is also the first Bulgarian unicorn.