Usuarios del Club TRPlane

Getsafe, una startup de insurtech digital con sede en Alemania, adquirió la cartera en dicho país de Luko, una startup de insurtech francesa que recientemente estuvo al borde de la insolvencia antes de aceptar ser adquirida por la aseguradora británica Admiral Group en una transacción que no incluía sus operaciones en Alemania o España.

Getsafe está presente en cuatro países desde su expansión a Francia. La propia expansión de Luko en Alemania se remonta a 2022, cuando adquirió la startup alemana Coya, y es en gran parte de su antigua base de clientes de la que ahora se hace cargo Getsafe. «Aproximadamente el 90% de los clientes alemanes de Luko son antiguos clientes de Coya», dijo el director ejecutivo y fundador de Getsafe, Christian Wiens.

Cuando se le preguntó si Getsafe también había intentado adquirir Coya en ese momento, Wiens dijo que las dos compañías sólo tuvieron «discusiones vagas» que «nunca se materializaron». Luko se mostró más serio en sus intereses, porque con la adquisición de Coya obtendría una licencia de aseguradora de la Autoridad Federal de Supervisión Financiera (BaFin); Getsafe no necesitaba esto, ya que ya había obtenido su licencia de aseguradora de BaFin en 2021.

La adquisición anunciada, que, según Getsafe, fue aprobada por BaFin, no tiene nada que ver con licencias y sí mucho con los objetivos de crecimiento de Getsafe. Después de la adquisición de la cartera alemana de Luko de 50.000 pólizas, incluidos seguros de responsabilidad civil, mascotas y contenido del hogar, Getsafe tiene ahora 550.000 clientes en toda Europa, frente a los 400.000 antes de la expansión francesa en enero de este año.

Los términos del acuerdo no fueron revelados, por lo que no se sabe mucho sobre lo que ayudará a Luko a saldar sus deudas. Pero le da un nuevo hogar a una base de clientes alemanes que Admiral no estaba interesado en asumir. Durante el verano supimos que el grupo británico buscaba principalmente acelerar y diversificar su crecimiento en Francia, donde su filial L’Olivier se hizo un nombre con los seguros de automóviles.

Rentabilidad operativa

El CEO de L’Olivier, Pascal Gonzalvez, en julio pasado, mencionó que el historial de Luko de lanzar rápidamente nuevos productos y en varios países había sido clave en el acuerdo con Admiral, ya que demostraba que los futuros lanzamientos e integraciones serían rápidos. Parece que también ayudó en Alemania: “La integración posterior a la fusión nos llevó sólo unas pocas semanas. Desde un punto de vista técnico, integrar la base de clientes de Luko Insurance fue tan fácil para nosotros como lanzar un nuevo producto”, dijo Wiens en un comunicado.

En declaraciones, Wiens proporcionó más detalles sobre lo que facilitó lo que suele ser un proceso largo. “Una transferencia de cartera llevaría a las aseguradoras actuales varios meses (en la mayoría de los casos años) debido a incongruencias en los sistemas informáticos. […] Aprendimos de los errores de la vieja economía y construimos nuestra plataforma patentada de forma modular para que podamos escalar y adaptar fácilmente nuestra infraestructura a medida que crecemos”, dijo.

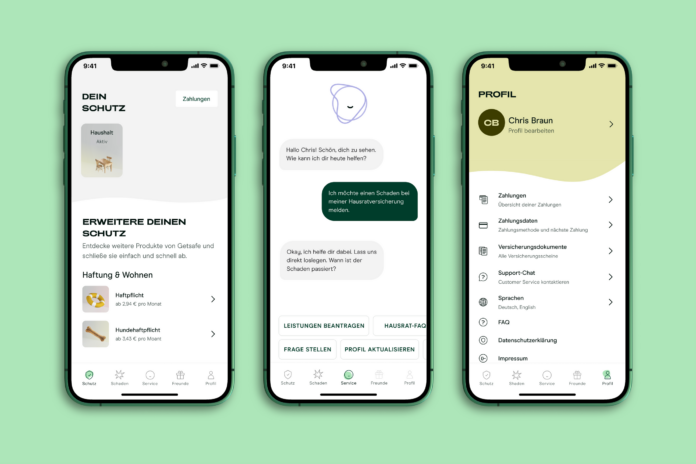

Otra gran diferencia entre los operadores tradicionales y Getsafe es que vende sus productos de seguros directamente a sus clientes (DTC), en su mayoría un grupo demográfico más joven, y con una estrategia que prioriza los dispositivos móviles. Según la empresa, el 35% de sus clientes utilizan su aplicación cada mes. Wiens dijo que “el 10% del uso es para presentar una reclamación y el 90% del uso es para explorar más opciones de seguro o obtener más información sobre la protección”.

La capacidad de vender más productos al mismo cliente puede ser lo que le faltaba a Luko: durante mucho tiempo solo ofrecía seguros de hogar. Luko se centró durante demasiado tiempo en una estrategia de un solo producto (monolínea)», dijo Wiens. «Especialmente en un mercado directo en línea, es difícil amortizar los costes de adquisición de clientes si no logras convertirte en el socio de seguros integral para ellos».

La estrategia multiproducto y DTC de Getsafe parece estar dando sus frutos; Si bien no reveló cifras, la compañía dijo que «nuevamente duplicó los ingresos después de quintuplicarlos el año anterior y logró rentabilidad la operativa en sus mercados principales». También añadió que sus ingresos por cliente «se han duplicado cada año desde el inicio de Getsafe».

Wiens señaló que la estrategia DTC de Getsafe da como resultado mayores márgenes y se mantiene optimista al respecto. “DTC Es la única forma de alterar fundamentalmente los seguros”, dijo Wiens. No todo el mundo está de acuerdo; Su rival alemán Wefox depende de socios de distribución, y el negocio de seguros propios de Wefox ha perdido prioridad en comparación con el negocio de distribución.

Con 32 millones de euros de pérdidas en 2022 (alrededor de 33,8 millones de dólares), Wefox está eorganizando su equipo ejecutivo al nombrar un nuevo director financiero “mientras nos enfocamos en impulsar un crecimiento rentable y expandimos nuestra huella internacional a través de adquisiciones”, dijo el director ejecutivo Julian Teicke en un comunicado.

En mayo, Wefox obtuvo 55 millones de dólares en una línea de crédito renovable de JP Morgan y Barclays con una valoración fija de 4.500 millones de dólares, la misma que en su ronda Serie D de 400 millones de dólares en julio de 2022. Getsafe recaudó una cantidad de financiación mucho menor hasta la fecha. 120 millones de euros, alrededor de 127 millones de dólares, incluida una extensión de la ronda Serie B en 2021, y será interesante ver qué estrategia da más frutos: ¿más o menos financiación? ¿DTC o no?