Inteligencia Artificial

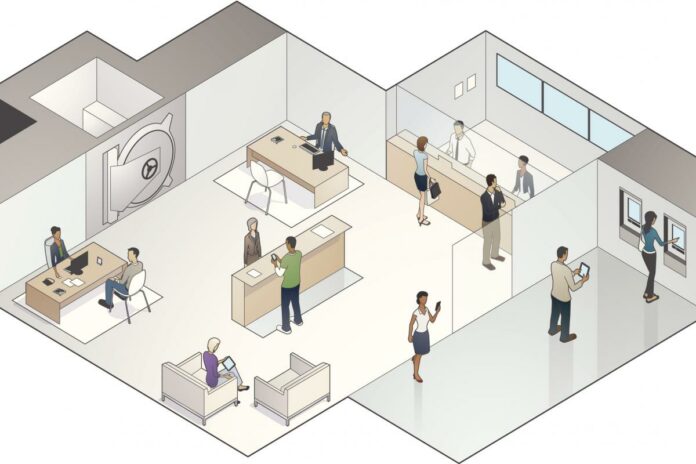

El informe de HSBC identifica los seis nuevos roles necesarios para la nueva banca.

Si bien la inteligencia artificial se ha promocionado como la nueva frontera de los negocios, un informe de HSBC considera que la inteligencia humana aún prevalecerá sobre la robótica en el lugar de trabajo.

El informe se anticipa al futuro de la banca, prediciendo seis nuevos tipos de trabajos y cómo la revolución digital evolucionará el papel de las personas de la organización.

“Hoy en día desconocemos muchos de los roles y puestos de trabajo del mañana”, dijo Andrew Connell, director global de innovación y asociaciones y director digital de Asia Pacífico. “Sin embargo, una cosa es cierta: la inteligencia artificial no reemplazará a la inteligencia humana.

«Combinar la mejor tecnología con el poder de las personas será la diferencia entre lo bueno y lo grandioso en lo que respecta a la experiencia del cliente.»

Diseñador de experiencias de realidad mixta

El consenso es cada vez mayor de que la realidad mixta o aumentada (MR / AR) será nuestra interfaz principal con el mundo digital.

Superponer el mundo físico con una capa de datos digitales permite a los bancos crear cualquier personaje u objeto imaginable y ubicarlos en el espacio físico como si fueran reales, y esta tecnología probablemente se utilizará para facilitar algunas necesidades bancarias.

Habilidades clave: diseñar estas complejas interfaces tridimensionales y hacerlas elegantes e intuitivas es una habilidad de empleo nueva e importante, que requerirá habilidades en diseño estético, marca, experiencia del usuario y mecánica 3D.

Diseñador de algoritmos

Cada vez más la toma de decisiones se realiza mediante algoritmos, que se alimentan de una variedad de fuentes de entrada para llegar a conclusiones rápidas.

Sin embargo, estos algoritmos operan en un entorno que cambia rápidamente con regulaciones cambiantes, nueva información y productos en evolución. Ajustar constantemente estos algoritmos para optimizar la experiencia del cliente bancario y evitar los momentos en los que la computación previa dice «no», será una habilidad en la creciente demanda.

Habilidades clave: a medida que los bancos cambian a un entorno de código bajo / sin código para la operativa de tecnología, esta función requerirá habilidades en gestión de riesgos, diseño de servicios y educación financiera, en lugar de competencia tecnológica.

Diseñador de interfaz conversacional

Las máquinas se han vuelto progresivamente más humanas en sus interacciones. Los chatbots ya se utilizan en la banca para responder consultas sencillas y recopilar información. Donde las instrucciones solían ser cadenas complejas de código, ahora podemos hablar con nuestras máquinas y ellas interpretarán nuestras necesidades.

El diseño de la interfaz conversacional es una habilidad emergente para ayudar a los bancos a aprovechar al máximo los chatbots de voz y texto, y crecerá en importancia a medida que la tecnología se generalice.

Habilidades clave: La construcción de interfaces naturales y de baja fricción que van más allá de la resolución de desafíos inmediatos para sorprender y facilitar a los clientes su experiencia requiere una combinación de habilidades creativas, lingüísticas y antropológicas.

Asesor de servicio universal

La separación entre los entornos de servicios digitales, físicos y remotos ya no existe. En cualquier momento, un cliente puede querer ser atendido en una sucursal, a través de una aplicación de chat, voz o en realidad aumentada o virtual.

Con la realidad mixta como interfaz principal entre personas y máquinas, los agentes de servicio capacitados, agentes de soporte a clientes y asesores comerciales de varios productos, podrán alternar sin problemas entre entornos físicos y virtuales desde cualquier lugar en cualquier momento para satisfacer las necesidades del cliente.

Habilidades clave: las habilidades críticas para el asesor de clientes del mañana son una combinación de conocimiento del dominio y del producto con una excelente comunicación y empatía con el cliente.

Esto requerirá un nivel de comodidad con las tecnologías de comunicaciones clave, incluido el desempeño en un entorno virtual.

Ingeniero de Procesos Digitales

Muchas interacciones bancarias con los clientes, desde la contratación hasta el reemplazo de una tarjeta perdida, siguen flujos estandarizados que equilibran los requisitos de seguridad y normativos con el deseo de una experiencia de cliente satisfactoria. Es probable que aumente la velocidad de cambio y simplificación de estos procesos, al igual que su complejidad, ya que combinan componentes de servicios e información de múltiples fuentes. Un ingeniero de procesos digitales analiza, ensambla y optimiza estos flujos de trabajo, ajustándolos constantemente para maximizar el rendimiento y minimizar la fricción.

Habilidades clave: el ingeniero de procesos digitales necesitará grandes habilidades de análisis, para comprender flujos de trabajo grandes e interconectados y diagnosticar problemas y cuellos de botella, y habilidades creativas para ayudarlos a crear prototipos y probar soluciones.

Habilitador de pasarelas de colaboración

En un mundo empresarial cada vez más interconectado, las relaciones digitales con socios bancarios, como fintechs y empresas de tecnología global, necesitarán un seguimiento, mantenimiento y negociación detallados. Dado que tanto el efectivo como los datos de los clientes fluyen potencialmente entre las organizaciones, alguien deberá vigilar la utilización y la conducta, así como garantizar el desempeño y el cumplimiento normativo.

Habilidades clave: los controladores de puerta de enlace equilibrarán el conocimiento técnico de las interfaces digitales con la comprensión de la seguridad y la gestión de riesgos. También se valorarán mucho las habilidades de comunicación para la participación con los nuevos socios del negocio.

HSBC cuenta con una serie de programas de formación: los empleados de primera línea en sus siete mercados principales asisten a un programa de mejora digital semanal dirigido por los «Campeones digitales» del banco.

El banco también cuenta con un Programa de Liderazgo Digital que ayuda a los altos directivos a comprender mejor las tendencias digitales y cómo se relacionan con las necesidades de los clientes.

¿Crees que este es el camino de la transformación de las personas? ¿Qué relelancia tiene? ¿Qué perfiles notas a faltar?