When it comes to cloud growth, it's probably safe to say, even though revenue growth rates have been, that the crisis isn't as deep as it is in other digital business models. Public cloud revenue growth has slowed from 32% in the first quarter of last year to 19% this year. That's quite a steep drop, and it shows that the cloud has run into some headwinds.

As a result, you see people talking about a big repatriation where cloud workloads will go back on-premises, but the evidence doesn't suggest that's happening. Instead, companies may be slowing down their migration to the cloud as they search for the most efficient way to distribute their workloads.

Clearly, enterprises have learned that not all workloads are well suited to the cloud. Some that can't deal with even a bit of latency to get to the cloud and back, for example, must be hosted at the edge to be closer to the compute source. But it doesn't seem like many IT departments will be long in returning to the days of stockpiling and stacking new servers.

So why is public cloud growth slowing? Customers have begun scrutinizing their skyrocketing bills in the cloud, with budgets coming under increasingly intensive review this year, looking for ways to cut costs, which Amazon chief financial officer Brian Olsavsky acknowledged incompany profits with the analysts.

“Enterprise customers continued their decades-long shift to the cloud while working closely with our AWS teams to carefully identify opportunities to reduce costs and streamline their work,” he said. In CFO parlance, that means they're not abandoning the cloud, but they're taking a hard look at spending, which is having a pretty significant impact on the company's cloud growth numbers.

He added that the slowdown in growth could continue for another couple of quarters, but that customers generally remain aligned with the cloud strategy. “So far in the first month of the year, AWS's year-over-year revenue growth is in the middle of the decade. That being said, going back, our new customer pipeline remains healthy and strong, and there are many customers who continue to implement plans to migrate to the cloud and commit to AWS for the long term.”

By now, the value proposition of the cloud, regardless of vendor, is clear. It allows for a level of flexibility that simply isn't possible when you run your own data center, and running your own data center is expensive and requires a completely different skill set than running workloads in the cloud.

So what does all of this mean for revenue growth? cloud infrastructure market? If the data is correct, it's going to be fine, even if it's a bit risky in the short term.

positive trends

Goldman Sachs regularly surveys CIOs on spending priorities, and while overall IT spending is down this year (cloud growth numbers bear this out), Goldman sees a bright future for cloud.

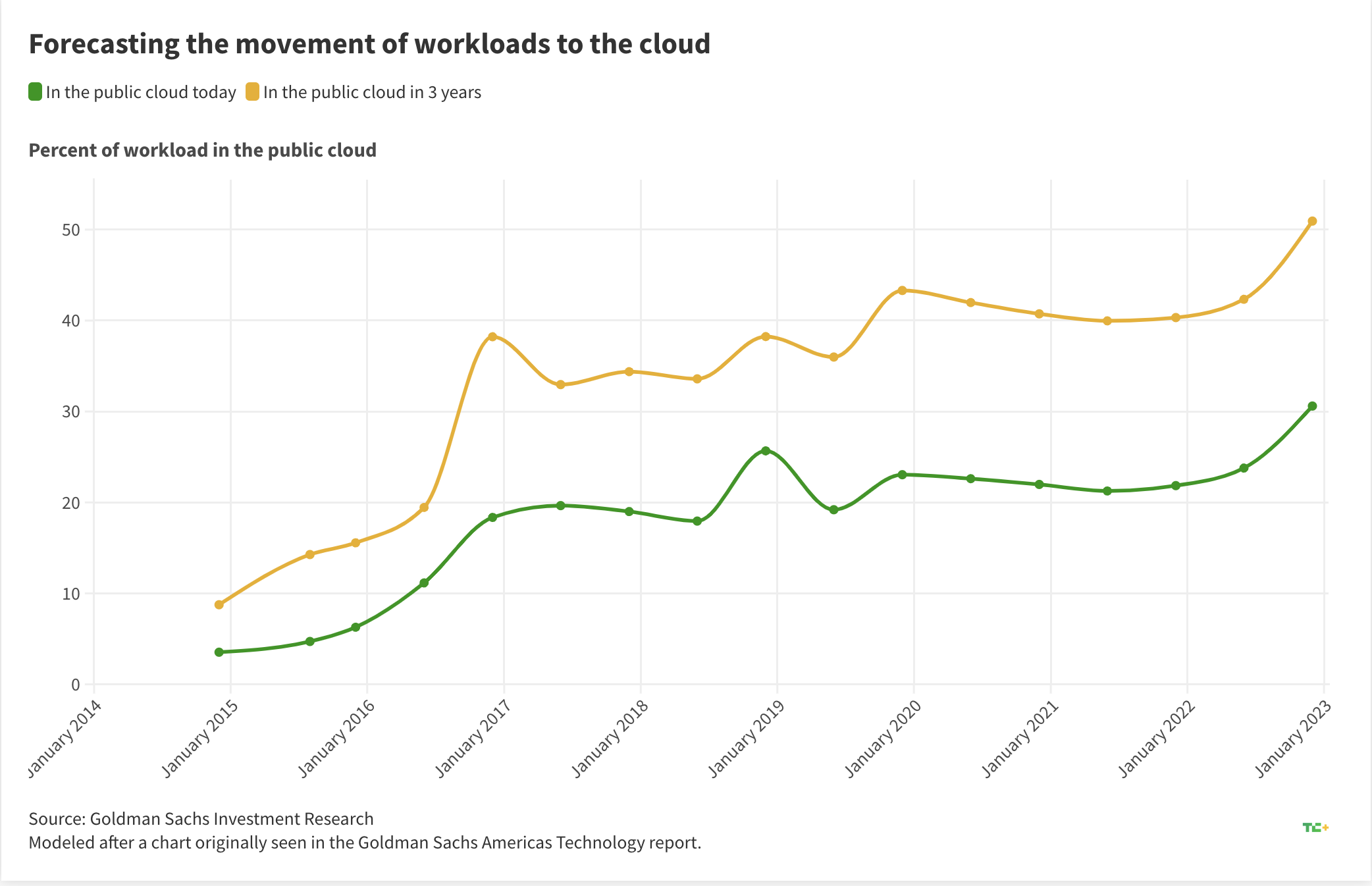

The company says that approximately 31% of workloads are in the cloud, which means there is still huge room for growth when we consider future public cloud spending. As the chart below illustrates, using survey data from Goldman Sachs, the next three years show a trend in the right direction for cloud providers.

Chart based on Goldman Sachs CIO survey data showing demand for cloud services will increase from 31% to over 50% in three years

Image: Data visualization by Miranda Halpern, created with Flourish

This is certainly good news for those providers trying to convince investors that things are going to be okay in the future. These data prove it. As Goldman Sachs wrote in its report, higher usage will also result in higher spending, even if the near-term outlook isn't so good.

“However, we see a long road ahead for continued migrations to the cloud, particularly in the wake of the COVID-19 pandemic, as the limitations and challenges of maintaining legacy on-premises architectures have become more acute. While we also recognize that a more challenging macroeconomic environment may pressure demand in the near term, we expect cloud demand to be largely recession-resistant, with some spending coming down but not lost," the firm wrote. .

Ed Sim, founder and managing partner of Boldstart Ventures, says Goldman's survey shows that some of the initial movement and spending associated with the migration has been made, but much remains to be done moving forward.

“So the point is that maybe it was all reversed in the initial spending and now we're going into a down cycle, but then maybe there's a rebound that starts again, maybe in the fourth quarter or January of next year.” said. "Things have slowed down because they were going so fast, but if you look at this data, companies are still spending on public cloud and moving more workloads for years to come."

Other key factors

If public cloud providers were anticipating a secular plateau in their future cloud growth rates, they would probably be cutting capital spending. But it's not happening. This ties in with previous notes regarding legacy workloads continuing, if not accelerating, their move to the cloud, continuing a long-standing trend that can be seen.

But new workloads are being created, namely AI, that have no real relationship to the movement of historical on-premises computing needs moving to public cloud providers.

A quick perusal of recently released earnings from the big three cloud providers—Amazon, Microsoft, and Google—indicates that AI is not only a hot topic among leaders of the world's most valuable tech companies, but also among analysts and investors in general. Enterprises themselves are investing to meet anticipated growth in demand for AI services, adding another expected growth vector for overall public cloud spending and thus revenue expansion.

Here is what added with emphasis the Microsoft CFO Amy Hood:

Continuaremos invirtiendo en nuestra infraestructura en la nube, particularmente en gastos relacionados con IA a medida que escalamos con la creciente demanda, impulsada por la transformación del cliente. Y esperamos que los ingresos resultantes crezcan con el tiempo.Microsoft offered a look ahead to the quarter, talking about the results it expects. In that prepared commentary was a note about how AI-related cloud spending is already showing in their numbers: “At Azure, we expect revenue growth to be a constant 26% to 27%, including about 1% point of the AI. services,” the company said.

With AI already driving a growth point for Microsoft's public cloud, how are other big companies discussing the same topic? This is how the Alphabet CFO Ruth Porat, spoke on similar topics, both in his prepared remarks, and in a subsequent response to an analyst's question:

En lo que respecta al CapEx para 2023, ahora esperamos que el CapEx total sea ligeramente más alto que en 2022. Como se discutió el trimestre pasado, el CapEx de este año incluirá un aumento significativo en la infraestructura técnica frente a una disminución en las instalaciones de oficinas. Esperamos que el ritmo de inversión tanto en la construcción de centros de datos como en servidores aumente en el segundo trimestre y continúe aumentando a lo largo del año.

Y en términos de CapEx, ahora esperamos que el CapEx total para el año 2023 sea ligeramente más alto que en 2022. Y traté de señalar que esperamos un aumento en el segundo trimestre, y eso continuará. para aumentar a lo largo del año. Y como discutimos el último trimestre, la IA es un componente clave. Es la base de todo lo que hacemos, y continuamos invirtiendo en el soporte de la IA, el soporte de nuestros usuarios, anunciantes y nuestros clientes de la nube. Y luego, como hablamos el último trimestre, el aumento en CapEx para todo el año 2023 refleja el aumento considerable en la inversión en infraestructura técnica, por otro lado, una disminución en las instalaciones de oficinas en relación con el año pasado.Finally, the Amazon CFO Brian Olsavsky, on the same subject in response to a question from an analyst:

Los aumentos en el gasto en AWS y la infraestructura es para modelos de lenguaje amplio (LLM) e inteligencia artificial generativa. Por lo tanto, estamos creando algo de margen en nuestro CapEx para su cumplimiento.Each of the Big Three cloud companies is spending today in anticipation of higher computing loads in the future with one indication that puts recent cloud growth numbers into clearer context. Yes, clients are working to squeeze value out of spend, but as those returns decline, we could see growth pick up. Add in the market-anticipated growth in demands for AI computing, and the way forward for public cloud spending in general is truly promising.