CertifID A startup that develops fraud prevention technology for the real estate market, announced it raised $20 million in a financing round led by Arthur Ventures at “more than double” its previous valuation.

CertifID primarily develops products to combat electronic fraud. The startup's co-founder, Thomas Cronkright, launched the company in 2017 after losing $180.000 to fraud at his real estate title agency in Grand Rapids, Michigan.

Typically, in wire fraud involving real estate transactions, criminals find information about upcoming real estate closings by hacking into email accounts (often of potential homeowners). Posing as legitimate representatives of financial institutions, they send emails to home buyers with fraudulent instructions for making wire transfers.

More than 13.000 people were victims of wire fraud in the real estate and rental sector in 2020 in the United States, with losses of more than $213 million, an increase of 380% since 2017. according to to FBI data.

Cronkright later partnered with Tyler Adams, former senior product manager for BCG's corporate investment and incubation division, to build a platform to protect home buyers, sellers and real estate companies from this form of cybercrime.

“The real estate industry is facing a wire fraud problem that has accelerated significantly in recent years,” Adams, who serves as CEO of CertifID, said via email. “The FBI recently reported loss of victims due to Email engagements from real estate companies increased to 72% from 2020 to 2022 … CertifID was created to help eliminate this electronic fraud.”

A “world without electronic fraud” is a bit hyperbolic. But CertifID offer tools to combat it.

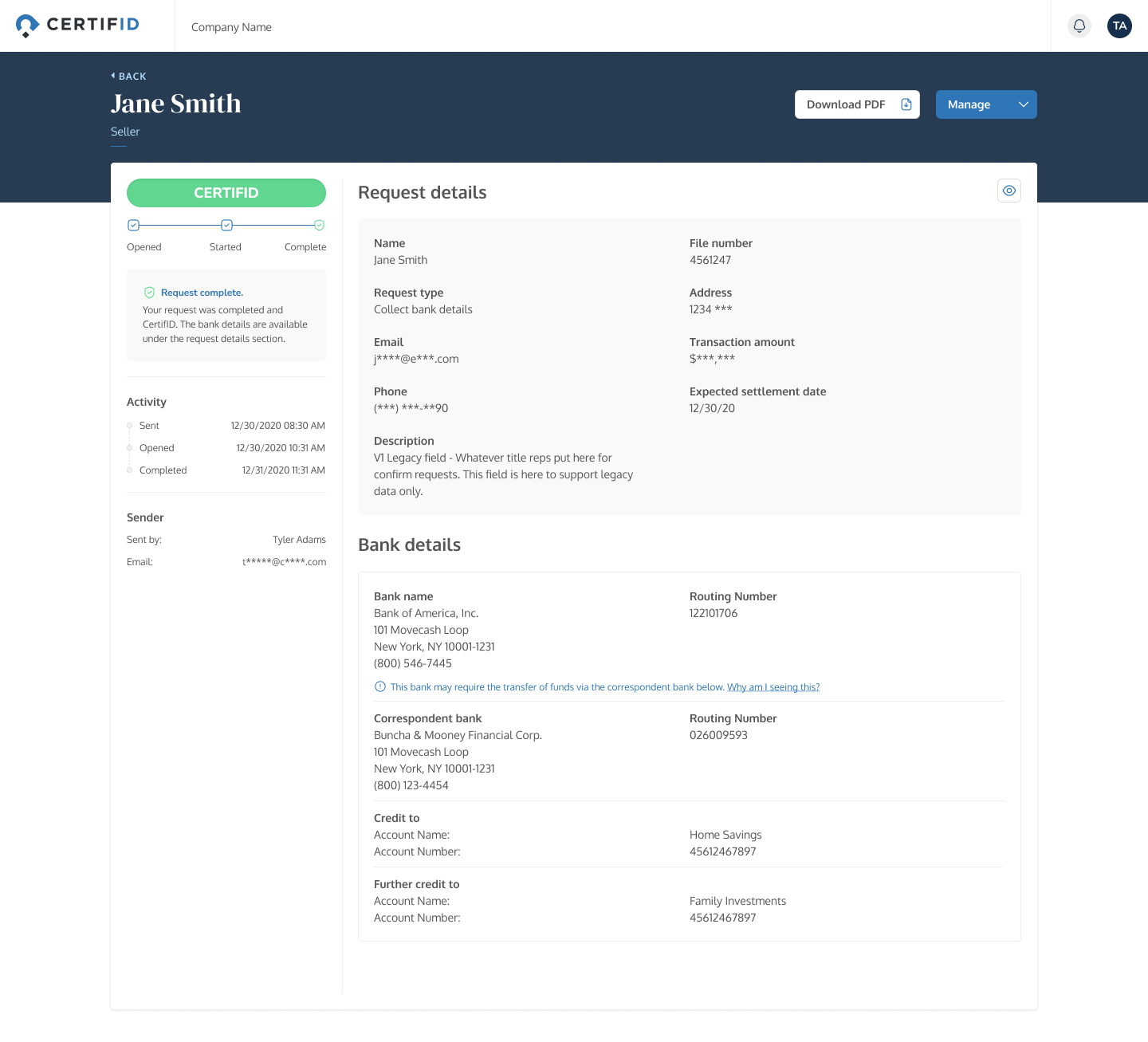

For title agents and real estate law firms, CertifID handles transactions and secures up to $1 million every time money changes hands. Homebuyers receive wiring instructions and have the option to purchase a cash protection plan for additional coverage. Meanwhile, home sellers are asked to provide banking information and undergo an identity verification process to prevent fraud attempts.

Under the hood, an engine rule-based along with a model AI experts trained on “internally vetted data,” “expert decisions,” and reviews of their own decisions drive CertifID's identity verification and payment disbursement processes. Regarding the quality of this data, CertifID did not go into great detail. The model evaluates various fraud markers, incorporating new data points as malicious actors take new approaches.

“We believe automation and artificial intelligence have incredible potential for the market,” Adams said. "But we also recognize that fraud and breach of trust disproportionately leverage the human factors of technology and we address the problem of fraud with a people-centred approach."

With the new funding, CertifID says it plans to support continued product development and scale operations to meet demand for its products. CertifID claims to have “several hundred” commercial title and real estate clients and partnerships with federal authorities to support fraud recovery efforts where its verification software is not used.

CertifID management panel for the prevention of electronic fraud.

To date, CertifID has raised more than $40 million, in a combination of equity and debt.

“Despite the slowdown in the housing market, CertifID continued to see increased demand for its products and services,” Adams said. “Fraud has continued to rise despite the pandemic, a banking crisis and the double threat of inflation and recession. And it is expected to continue increasing for the foreseeable future. Since the majority of the real estate industry has not yet adopted anti-fraud technology, the company expects continued growth in the future.”

CertifID A startup that develops fraud prevention technology for the real estate market, announced it raised $20 million in a financing round led by Arthur Ventures at “more than double” its previous valuation.

CertifID primarily develops products to combat electronic fraud. The startup's co-founder, Thomas Cronkright, launched the company in 2017 after losing $180.000 to fraud at his real estate title agency in Grand Rapids, Michigan.

Typically, in wire fraud involving real estate transactions, criminals find information about upcoming real estate closings by hacking into email accounts (often of potential homeowners). Posing as legitimate representatives of financial institutions, they send emails to home buyers with fraudulent instructions for making wire transfers.

More than 13.000 people were victims of electronic fraud in the real estate and rental sector in 2020 in the United States, with losses of more than $213 million, an increase of 380% since 2017. according to to FBI data.

Cronkright later partnered with Tyler Adams, former senior product manager for BCG's corporate investment and incubation division, to build a platform to protect home buyers, sellers and real estate companies from this form of cybercrime.

“The real estate industry is facing a wire fraud problem that has accelerated significantly in recent years,” Adams, who serves as CEO of CertifID, said via email. “The FBI recently reported loss of victims due to Email engagements from real estate companies increased to 72% from 2020 to 2022 … CertifID was created to help eliminate this electronic fraud.”

A “world without electronic fraud” is a bit hyperbolic. But CertifID offer tools to combat it.

For title agents and real estate law firms, CertifID handles transactions and secures up to $1 million every time money changes hands. Homebuyers receive wiring instructions and have the option to purchase a cash protection plan for additional coverage. Meanwhile, home sellers are asked to provide banking information and undergo an identity verification process to prevent fraud attempts.

Under the hood, a rules-based engine along with an AI model trained on “internally vetted data,” “expert decisions,” and reviews of its own decisions power CertifID’s identity verification and payment disbursement processes. Regarding the quality of this data, CertifID did not go into great detail. The model evaluates various fraud markers, incorporating new data points as malicious actors take new approaches.

“We believe automation and artificial intelligence have incredible potential for the market,” Adams said. "But we also recognize that fraud and breach of trust disproportionately leverage the human factors of technology and we address the problem of fraud with a people-centred approach."

With the new funding, CertifID says it plans to support continued product development and scale operations to meet demand for its products. CertifID claims to have “several hundred” commercial title and real estate clients and partnerships with federal authorities to support fraud recovery efforts where its verification software is not used.

CertifID management panel for the prevention of electronic fraud.

To date, CertifID has raised more than $40 million, in a combination of equity and debt.

“Despite the slowdown in the housing market, CertifID continued to see increased demand for its products and services,” Adams said. “Fraud has continued to rise despite the pandemic, a banking crisis and the double threat of inflation and recession. And it is expected to continue increasing for the foreseeable future. Since the majority of the real estate industry has not yet adopted anti-fraud technology, the company expects continued growth in the future.”