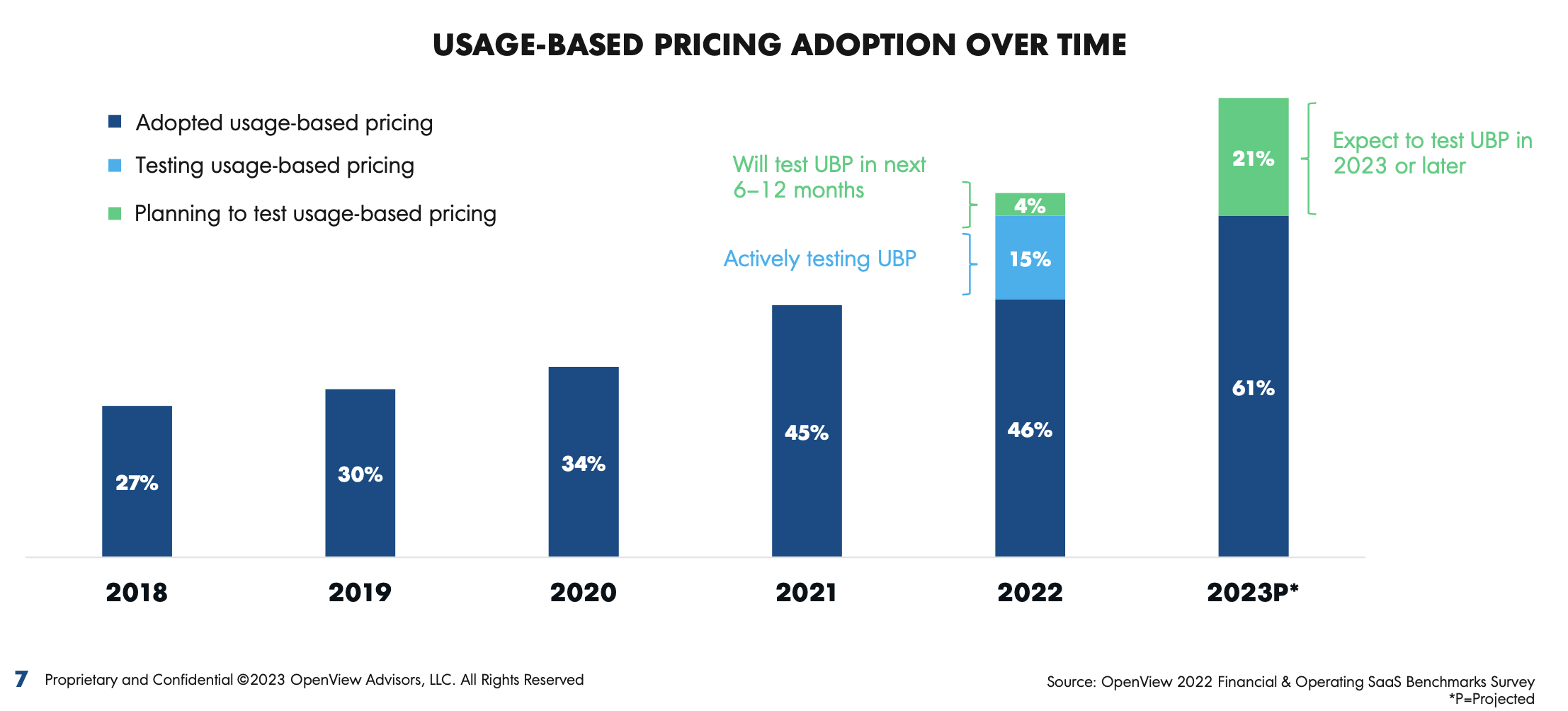

61% of SaaS companies used UBP in some way in 2022

Usage-Based Pricing (UBP) is on the rise: 61% of SaaS companies used this model in some form in 2022, according to a study by the venture capital firm OpenView.

UBP consists of charging based on how the service or product is consumed, not on how many people use it; that would be the user-based approach.

But as is often the case with any pricing model, things are fuzzier, and many companies are actually using blended models. Zapier, for example: offers subscription levels that include consumption as one of its main variables.

That combination is one of OpenView's key findings in its Usage Status Based Pricing Report: “This is not a subscription or usage-based price. Today, SaaS companies are turning to more complex hybrid models.”

Now in its second edition, the company's report is based on responses collected between July and August 2022 from private SaaS companies. This is data from a few months ago, so the data may be a little behind, but it still reflects the new spirit that the founders are in.

We know that it is because it is the same survey sample as the comparative report of Chargebee-OpenView over SaaS which appeared previously, and the findings already showed a drastic mood swing compared to 2021. For example, an overwhelming majority of respondents said they would cut spending regardless of the price cut.

Creeping adoption and hybrid models

A 61% adoption of UBP represents a significant increase. In 2021, 45% of respondents said they were using this pricing model, up from 34% in 2020.

Image: OpenView

The fact that usage-based pricing has grown in adoption is remarkable in itself: companies are often anxious to change their pricing in a downturn and may feel that UBP is less predictable than more traditional models, such as multi-year commitments.

However, these fears can often be overcome by understanding that UBP does not have to replace older models. After all, companies can test it first: 15% of respondents said they were actively testing it and another 4% said they would in the next six to 12 months.

Even after this trial period, UBP can still be part of a hybrid model. "As software companies get more ambitious around the problems they solve for their customers, we should expect some level of complexity in pricing," said Poyar, one of the Openview study's authors.

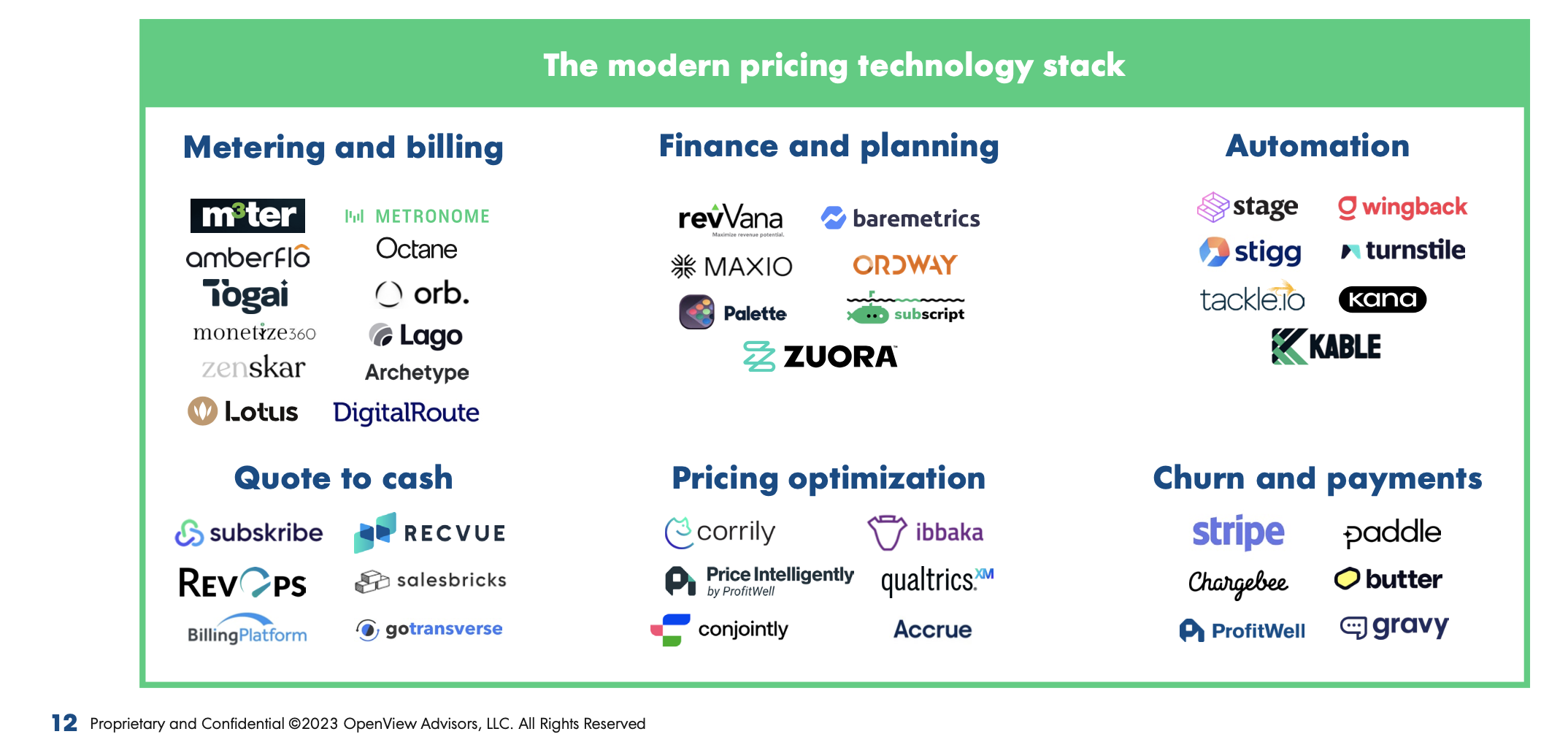

This pricing complexity is also creating opportunities for B2B startups that focus on issues like metering and billing in a product-based environment. OpenView refers to these as "the foundation of modern pricing technology," a topic we'll explore further shortly.

Image: OpenView

There is a more pressing issue: are UBP adopters faring better than their peers? As we recently explored, PLG (product-led growth) companies currently appear to be less profitable than their sales-driven peers, so we're curious how UBP performs as a variable.

still ahead

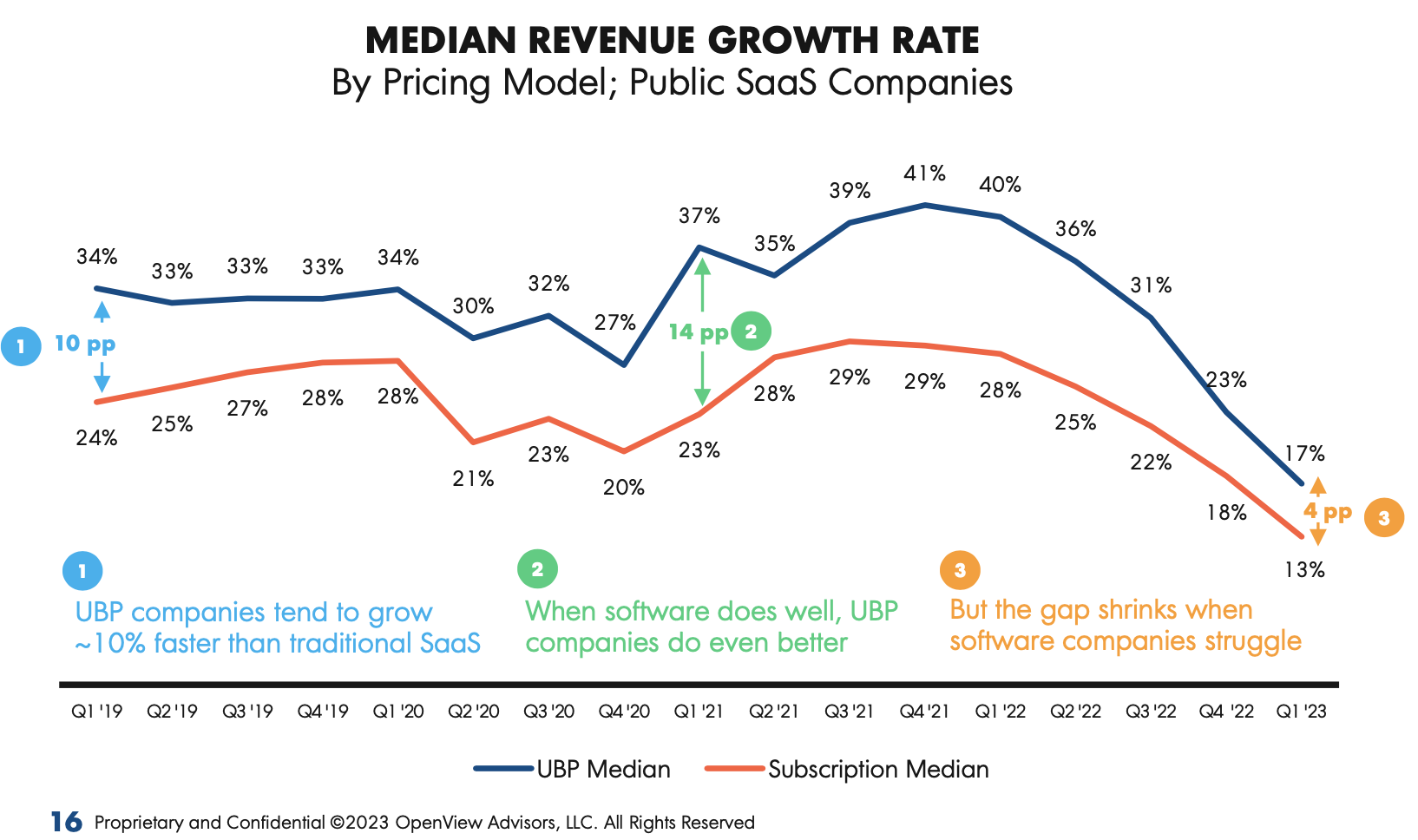

An interesting chart in the report draws on data from PitchBook to compare the average revenue growth rate of public SaaS companies based on their pricing models: usage-based or subscription-based.

As you can see in the graph below, around 2019, UBP companies tended to grow faster than their peers and outperformed them further in 2021, when the software sector was shining.

However, the gap has narrowed significantly in recent months; in the first quarter of this year, UBP companies were only 4% ahead in terms of revenue growth (and that's not even touching profitability).

Image: OpenView

OpenView's Kalevar doesn't think the shrinkage comes as a surprise. However, he said: “What might surprise some people is that usage-based companies were still growing faster, on average, than their traditional subscription peers. […] The fact that they are still growing faster, even in a recession, even though they have no contracts and very little commitment, speaks to that model.”

Usage-based pricing is more directly aligned with current customer needs, but that's also what makes it more volatile. Hence these three recommendations from OpenView:

- Know what's coming: usage-based price growth rates will overreact when businesses increase spending and when businesses cut back.

- Invest in the predictable: Develop the right internal finance and analytics group to identify early signs of contraction/expansion.

- Keep CAC flexible: keep an eye on how much of your CAC can be moved up (in good times) and down (in bad times).

Justin Dignelli, CEO of Pace, a startup helping companies adjust to the rise in product-based selling, had this to say about UBP:

Usage-based pricing has become very popular in recent years. I think a big part of that has to do with AWS, [which] I would say is the largest PLG company in the world. They conditioned people to want that kind of experience. Usage-based pricing makes it much more important to understand customer status in detail. You have to ask questions like: Will they be customers tomorrow? Can you get them to use more than they are using today tomorrow? Can you get net new projects? […] I think more and more customers will demand usage-based pricing, which means that the onus of understanding retention and expansion will be for vendors and [relevant customer] people much more important on a day-to-day basis.

It is true that infrastructure was ahead of other sectors in terms of adopting usage-based models. But, OpenView noted, "they are now also found in horizontal and vertical application software."

Poyar and Kalevar said the software vertical will be worth watching in terms of UBP adoption. "It's lower than other categories right now, but I'm seeing more and more companies adopting that [model]," Kalevar said, adding that "there's a growing class of API verticals" that fit this model well. This also sounds like an interesting trend for us to follow.