Almost two years after raising $20 million in Series A capital, the B2B financial solutions startup Symmetrical is back with additional investment to the tune of $55 million in Series B funding.

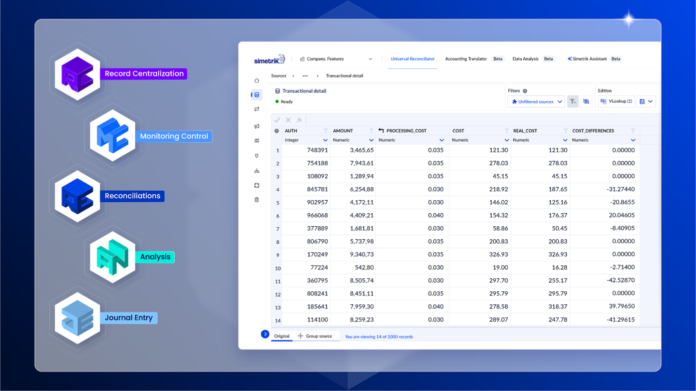

The Colombia-based company is developing financial automation technology around the centralization of records, reconciliations, controls, reporting and accounting. Where it is differentiating itself is through its Simetrik Building Blocks, or SBB, which are scalable and adaptable concepts based on no-code development and generative AI technologies.

“There are a number of controls and automations that need to be done in the CFO's office, including financial flows, and many others that are currently executed manually,” said Santiago Gómez, co-founder and COO of Simetrik. “This approach has never existed before. We had an orchestration platform, which we left behind and are now dedicated to software for CFOs.”

Goldman Sachs Asset Management led the investment and was accompanied by FinTech Collective, a Series A leader, and Cometa, a seed investor, Falabella Ventures, Endeavor Catalyst, Actyus, Moore Strategic Ventures, Mercado Libre Fund and the co-founders of Vtex.

The new capital brings Simetrik more than $85 million in total venture-backed investments to date. When we previously looked at Simetrik in 2022, the assessment of the company exceeded 100 million dollars. This new round is considered a “positive round,” however, co-founders Alejandro Casas and Santiago Gómez declined to say to what extent.

Over the past two years, the company has grown to have customers in more than 35 countries, up from 10, and monitors more than 200 million records every day. Previously, that was 70 million daily registrations. Revenue also grew four times since Serie A.

In addition to high-growth Latin American entities such as Rappi, Mercado Libre, Nubank, Oxxo and PayU, the company is working with PagSeguro, Falabella and Itaú, and has partnerships with firms such as Deloitte. Simetrik also expanded its presence in Asia to include India and Singapore.

The use of the new funds will go towards further developing Simetrik Building Blocks, improving AI capabilities and continuing to expand Simetrik's international reach.

“There is an explosion of fintechs and fintech products and services, not only with new companies, but also with banks and institutions that are entering these products,” added Alejandro Casas, co-founder and CEO of Simetrik. “They have more reporting and higher volumes of records, but they still use manual processes. “They need a new approach, and that's where our core components have a strong piece of the product market.”