Artificial intelligence (AI) companies are a prime target for acquisitions by companies, including big tech, looking to harness AI technology and knowledge without having to build it from scratch.

Artificial intelligence has long been a relevant focus for all industries. From healthcare to retail to agriculture, companies are trying to integrate machine learning (ML) into their products.

At the same time, there is a huge shortage of talent in AI.

This combination drives a fast-paced race to land the top startups in AI, many of which are still in the early stages of research and funding.

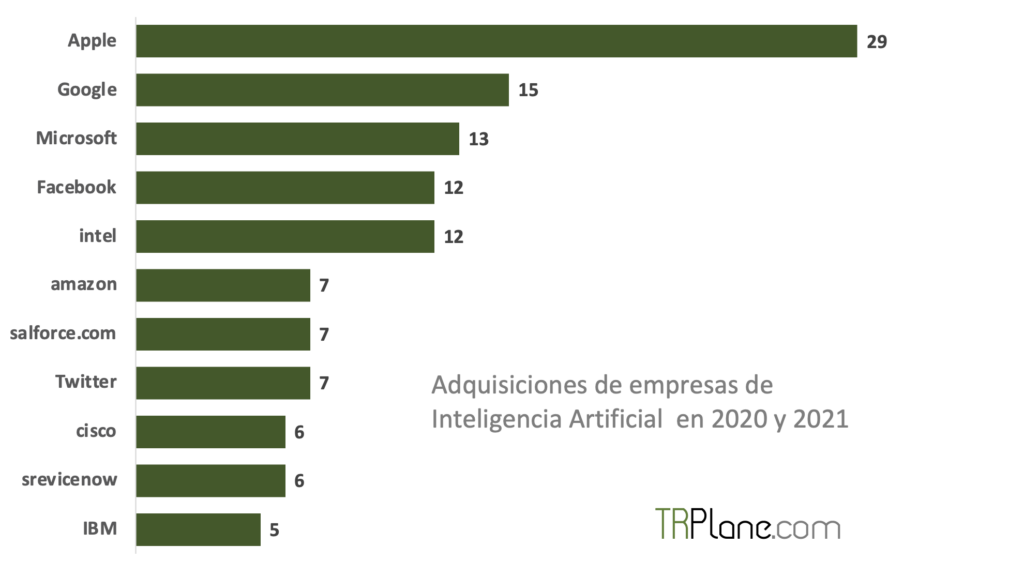

Apple is ahead of the rest

The tech regulars are leading the AI race: giants like Facebook, Amazon, Microsoft, Google and Apple (FAMGA) have been steadily acquiring AI startups for the past decade.

Among the FAMGA, Apple stands out above the rest. With 29 acquisitions of AI companies since 2010, the company has made nearly twice as many acquisitions as second-place Google (the leader from 2012 to 2016), with 15 acquisitions.

They are followed by Microsoft with 13 acquisitions, Facebook with 12 and Amazon with 7.

Apple's wave of AI acquisitions, which has seen it overtake Google in recent years, has been key to the development of new iPhone features. For example, FaceID, the technology that allows users to unlock their iPhones with facial recognition, stems from M&A moves in processors and digital imaging, combined with the acquisition of Israeli artificial intelligence company RealFace.

In fact, many of FAMGA's featured products and services, like Apple's Siri or Google's contributions to healthcare through DeepMind, arose from acquisitions of artificial intelligence companies. Other major tech buyers include Intel, Salesforce, Twitter and IBM.

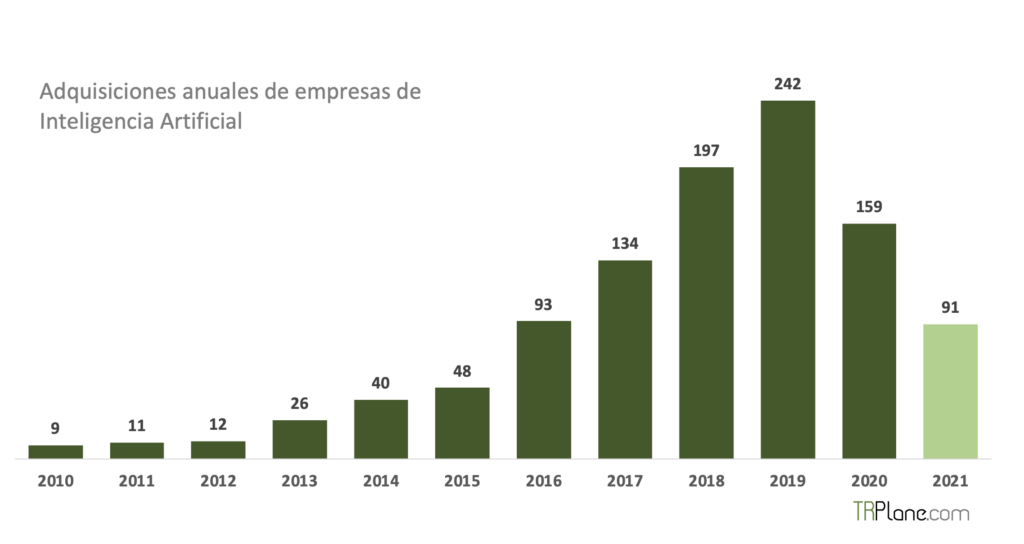

Despite the pandemic, AI is an attractive specialty for buyers

The pace of AI company acquisitions rose steadily for a decade, only falling for the first time in 2020, when acquisitions dropped 34%. The decline came during the COVID-19 pandemic, which created economic uncertainty that led many companies to emphasize internal operations over new acquisitions.

However, the space continues to attract buyer attention, with more than 90 acquisitions in 2021, suggesting a possible return to growth trajectory for this tech specialty.

While tech giants are leading this acquisition space, you don't have to be a huge company to be a player in acquiring AI companies.

Since 2010, there have been more than a thousand acquisitions of AI startups made by more than 800 buyers. Of them, almost 90% have only made one acquisition.

This is due in part to the growing diversity of companies interested in this technology. Where AI was once the exclusive turf of major tech companies, today smaller startups are becoming acquisition targets for companies in retail, health care, insurance and more.

For example, in May 2021, the retail giant Walmart acquired virtual clothing fitting startup zeekit. The acquisition made by mind med for $32 million from AI clinical trials startup HealthMode it marked one of several AI acquisitions for healthcare in the past year. In the field of renewable energies, skyspecs acquired Vertical AI 2021 in May.

In the last month, the field of human resources with solutions based on artificial intelligence have set a trend, with recent agreements such as:

- Acquisition by OutMatch of the candidate evaluation platform Harrows.

- step stone acquires AI-based recruiting platform Mya Systems.

- PandoLogic buy the recruitment platform Wade & Wendy.

Popular sectors: NLP, trade and health

Looking at acquisitions by sector, startups focused on Natural Language Processing (NPL) and digital imaging have seen the most traction, with 106 acquisitions in this space since 2010.

Retail and non-perishable consumer goods have also been popular with 101 acquisitions in the same time period. .

Third place is occupied by artificial intelligence applied to the Healthcare sector with 78 acquisitions. Healthcare was the leader in AI procurement in 2020, amid the global Covid-19 pandemic.

Since 2020, AI acquisitions for the healthcare sector have included:

- CellLetter acquired the computational pathology company Reveal Biosciences.

- The acquisition of Nuance Communications from the artificial intelligence startup Saykara, which offers a voice-based application to automate the registration of doctors.

- Verata Health was purchased by Olive , which leverages artificial intelligence to improve the pre-authorization process for medical tests.

- ValoHealth bought the biotech company Numerate, which applies machine learning algorithms to improve applied drug research.