Fundadores e Inversores

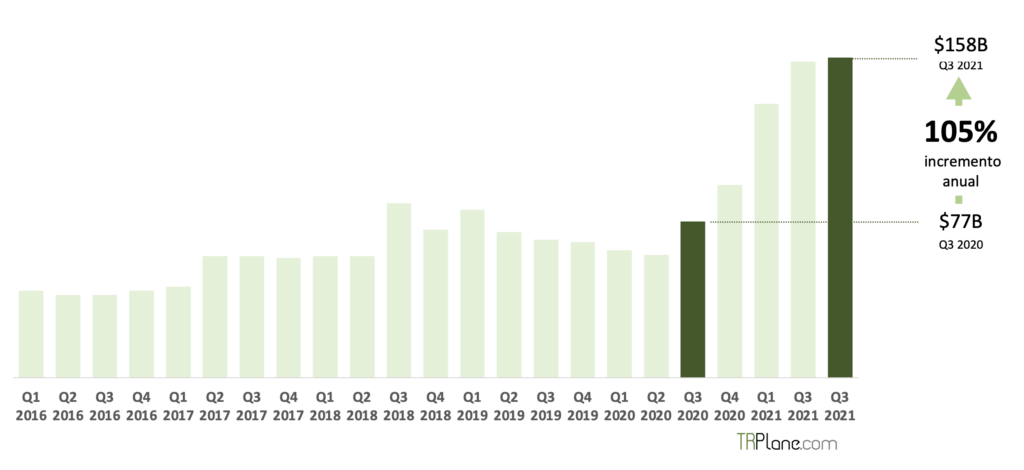

Después de un segundo trimestre récord, el capital de riesgo a nivel global, ese mismo nivel se mantuvo en el tercer trimestre, invirtiendo sumas astronómicas en nuevas empresas por un total de 158 billones de dólares con la característica común de tener perspectiva de negocio global.

Desde que comenzó la segunda mitad de 2020, el capital de riesgo y los mundos de las startups descubrieron que el COVID y sus impactos económicos estaban produciendo mayor impacto en las empresas tradicionales, los inversores han estado inyectando cantidades cada vez mayores de efectivo en startups en todo el mundo.

La aceleración en la aplicación de capital ha generado más unicornios, más rondas masivas y , en definitiva, más disponibilidad financiera del visto antes en la historia de las startups.

Récord histórico de actividad de capital riesgo

Después de 156 mil millones dólares en startups globales en el segundo trimestre, el tercer trimestre logró superar el récord en 2 mil millones y se invirtieron 158 mil millones de dólares. Los números son casi un empate, lo que significa que se ha atravesado dos períodos, los más fuertes en la historia, en la inversión.

Este año en su conjunto está siendo el más significativo. La financiación que ayudó a mantener vivo y en crecimiento al conjunto de startups fue enorme.

En el tercer trimestre se anunciaron 409 acuerdos individuales por más de 100 millones de dólares, frente a los 390 del segundo trimestre. Esoo supone alrededor de 4.5 por día, un punto de datos ayuda a enmarcar la increible actividad del mercado. Mantenerse al día con rondas de nueve cifras ha sido difícil; si se agrega el resto de rondas de menor importe y es una revolución total.

Aunque el capital en juego han aumentado, la geografía en el que están produciéndose la maypr parte de las opreaciones sigue siendo Estados Unidos. Mantiene este país una posición dominante, con una inversión de 72 mil millones durante el tercer trimestre, una ligera mejora de los 70 mil millones que acumuló en el período anterior.

Si bien el mercado global dónde se pueden desarrollar acuerdos con startups se ha expandido de forma global en los últimos años, impulsando geografías históricamente no relevantes, el mercado central tradicional ha mantenido su prominencia.

Otros mercados también obtuvieron buenos resultados, incluidos India y China. Los sectores se han ampliado, con el constante dominio de las fintechs pero con incrementos en salud, inteligencia artificial, educación, automatización, entre otros. El resultado final: más unicornios.

El incremento de unicornios continúa

Como era de esperar, el número de empresas valoradas en más de mil millones de dólares sigue aumentando. Llegaron a esta valoración 127 nuevos unicornios en el tercer trimestre, lo que eleva el número total a 848.

Es el tercer trimestre consecutivo en que los nacimientos de unicornios superaron las 100 startups.

La mayoría de esos nuevos unicornios, 69, se encuentran en Estados Unidos. Asia fue el segundo número más alto con 30. Actualmente, Estados Unidos consta de 429 unicornios en total, mientras que Asia tiene 271.

Curiosamente, sin embargo, los tres unicornios nuevos unicornios tienen su sede central fuera de los Estados Unidos. Y todas son fintechs.

FTX, con sede en Hong Kong, consiste en un intercambio de criptomonedas que ofrece servicios de derivados, opciones y otros productos financieros sofisticados. Recaudó en una Serie B 900 millones en julio con una asombrosa valoración de 18 mil millones. El sitio cuenta con más de 1 millón de usuarios, con un promedio de más de 10 mil millones de volumen de operaciones diario.

Zepz del Reino Unido (anteriormente WorldRemit), es una plataforma de pagos transfronterizos digitales, recaudando 292 millones en agosto a una valoración de 5 mil millones. Esa empresa afirma tener más de 11 millones de usuarios en 150 países.

En septiembre, la startup francesa Sorare anunció que Vision Fund de SoftBank lideró su ronda Serie B de 680 millones, que valoró a la compañía en 4,3 mil millones. Sorare ha construido una plataforma de fútbol online basada en NFT, o tokens no fungibles. Cada tarjeta digital se registra como un token único en la cadena de bloques Ethereum. Los jugadores pueden comprar y vender cartas de otros jugadores. Todas las transacciones se registran en la cadena de bloques Ethereum.

En general, la valoración media de los acuerdos en etapa avanzada ha alcanzado un máximo de creación de unicornios en todo el año 2021. Hasta ahora (Q3): 1.1 mil millones en comparación con 523 millones en 2020. La valoración media de los acuerdos en la etapa intermedia es de 286 millones en lo que va del año, en comparación con los 150. millones el año pasado.

Estados Unidos y Asia lideran

En el tercer trimestre, el 46% de todo el capital se destinó a nuevas empresas en los Estados Unidos.Este total de 72,3 mil millones también generó un aumento interanual del 90%. Y no midiendo sólo en capital: el número total de acuerdos (3210) también batió récords.

El desglose dentro del país. Estados Unidos. es más abierto que el trimestre pasado, con Silicon Valley, Nueva York y Miami en una tendencia al alza, mientras que los totales parecen aplanarse o desacelerarse en algunas otras áreas metropolitanas importantes.

La financiación en Asia, particularmente en China, ha variado de forma relevante gracias al impacto en los cambios regulatorios.

El capital para la inversión en Asia aumentó un 95% interanual y no sólo gracias a India: también en China, tanto el volumen de capital como el número de transacciones alcanzaron nuevos máximos el último trimestre.

Si bien las cifras de financiamiento siempre tienen alguna demora por la complejidad de los acuerdos, la proporción de acuerdos en etapa inicial aumentó al 58% este año hasta la fecha.

A diferencia de Estados Unidos y Asia, la financiación se redujo en Europa, América Latina y Canadá en el tercer trimestre en comparación con el segundo trimestre de este año. Pero atendiendo al volumen en dólares en este año hasta la fecha, las tres regiones aumentaron en comparación con 2020, por lo que podría ser solo una cuestión de que los acuerdos no se producen de forma uniforme a lo largo del año.

La inversión en fintech cae ligeramente pero sigue siendo elevada

Fintech como categoría continuó siendo un punto brillante en el mundo de las empresas de capital riesgo, ya que la inversión en nuevas empresas de servicios y tecnología financiera durante los primeros tres trimestres de 2021 casi han duplicado la cantidad prevista para todo 2020.

Se han invertido 91.500 millones de dólares en nuevas empresas de servicios y tecnología financiera a través de más de 3.514 acuerdos hasta el tercer trimestre de 2021. El año anterior, 2020, fueron 47.200 millones de dólares invertidos en 3.404 acuerdos.

En el tercer trimestre, la cantidad de transacciones y la cantidad invertida en fintech se redujo ligeramente con respecto al trimestre anterior, pero no de manera dramática. Se invirtieron 31 mil millones de dólares en nuevas empresas de tecnología financiera en 1,178. Este dato , respecto al segundo trimestre, aparece como prácticamente plano con 34,8 mil millones en 1,192 acuerdos.

Aún así es notablemente superior al tercer trimestre del año anterior, cuando los inversores inyectaron 11,9 mil millones en 830 acuerdos en el sector fintech.

Estados Unidos sigue siendo el mercado más grande para la inversión en tecnología financiera, con 14.4 mil millones en el tercer trimestre. Le siguen con 6.0 mil millones Asia, 5.4 mil millones en Europa y 2.6 mil millones en América Latina.

Si bien está claro que 2021 acabará con un aumento significativoen la cantidad de acuerdos realizados, la gran diferencia en los totales de financiación proviene de la cantidad promedio comprometido por los inversores en cada acuerdo. El importe medio de un acuerdo con una fintech hasta 2021 fue de 31 millones (con una media de 5 millones), en comparación con un importe medio 18 millones por acuerdo (media de $ 4 millones) en el año anterior.