Banking is undergoing a major transformation and it is also affecting services such as the way recoveries and collections are managed. This is a relevant challenge, especially when models such as BNPL (Buy Now, Pay Later). Hundreds of billions of dollars have been invested in recent years to digitize financial services, but debt collection operations remain highly manual and archaic, leading to frustration for customers and loss of money for service providers. services. Banks are having to deal with this change and fintech startups are looking to embrace this opportunity.

receive, has launched a SaaS solution that makes it easier for companies to collect and recover debts and increased its seed funding to $13,5 million with venture capital funds from Seaya Ventures and 14W. Previous investors Mangrove, Speedinvest and Seedcamp also participated in the expansion round, bringing the round to over 12 million.

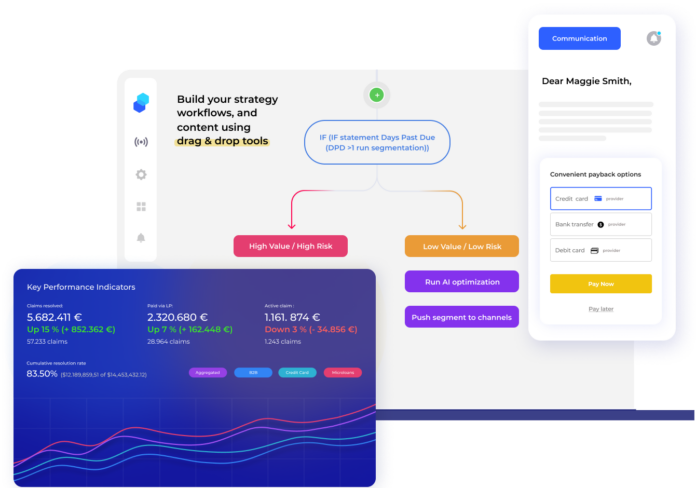

With receive, company teams can automate processes across the credit management value chain. Its clients include banks, other lenders, utilities and telecommunications companies.

It has now enlisted ABN AMRO, the third largest bank in the Netherlands, as a partner and investor, getting an initial €4m spread of bank risks. So now you have 16 million.

receive and ABN AMRO Ventures are also entering into a strategic partnership. This means that bank customers most vulnerable to debt get more support options.

ABN AMRO can now access the platform for receive and get a “unified view” of the customer in addition to that offered by your current technology.

Paul Jozefak, CEO of receive, said: “Both companies share a vision of delivering advanced information and digital solutions to create the best experiences for customers. The commitment to innovation is reflected in ABN AMRO Ventures' partnership with receive to help create the solution roadmap and be the leader in creating a better offering for the most vulnerable customers while empowering your employees to continually improve the experience. «

Hugo Bongers, director of ABN AMRO Ventures adds that “the approach of receive and the growth trajectory immediately intrigued us. We look forward to collaborating with the entire team to not only deliver great value to ABN AMRO, but also why we are excited to partner as investors to drive growth and expansion and build a market leader in Europe and globally.”