'Integrated commerce' started with companies like PayPal and has evolved to solutions such as Stripe, many years later. But 'integrated finance' is emerging as a new wave in FinTech, with companies like counts, Solaris, Swan y Stripe Treasury. In fact, you have to remember that Angela Strange (of a16z) made the proclamation in 2019 that “every business will be a Fintech,” with some predictions putting the integrated finance opportunity to be worth around $7,2 trillion by 2030.

Intergyro has been a startup that has subtly and privately funded over the last five years, emerging as part of the service integration banking movement, calling itself 'a financial cloud' in which almost any type of business can offer financial services.

Co-founder and CEO Nick Root is a computer science graduate and former CTO, COO, CFO and CEO who spent 12 years in the London banking industry before starting Intergyro.

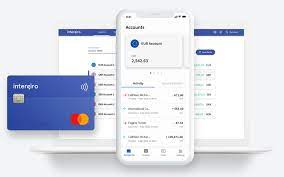

In an interview, he said: “Engineers using our tools don't need to jump in and tie together many different providers to build financial services. They can access the entire financial value chain… from payment to multi-currency wallets, SWIFT or local bank transfers or Visa or MasterCard networks. The all-in-one approach is not only more convenient for product creators, it enables entirely new product experiences.”

The story begins five years ago when Root wanted to create new kinds of banking services. He assembled the team of the current Intergyro to do so using traditional methods, but eventually had his eyes set on the crypto market as well. Intergyro it has been around (under a different name) since 2014, it was reworked in 2017, a closed beta was released in 2019. But the public release was in 2021.

This is how it works: a company joins Intergyro through the digital environment. Once their KYC process is approved, they gain access to a set of B2B and B2B2C APIs so they can start building their solution. They can automate their own flows (payroll, reconciliation, bill payment, etc.) or they can include financial products in their applications (payments, wallets, cards, etc.). They can combine these two platforms in various ways, such as creating “closed-loop” card payment systems or perhaps cryptocurrency exchange applications. Because it is the acquirer, account provider, and card issuer, it has its own card scheme, so cryptocurrency markets and trades, for example, can benefit from instant settlement. Revenue comes from card payments, foreign exchange transactions, and card payments (interchange fees).

Intergyro claims to be one of the few providers, perhaps the only one, in the market that is a card acquirer, card issuer, FX y bank account provider, going to market on B2B and B2B2C platforms: "We're not just the tech layer on top, we own the entire tech and regulatory base," Root said.

“If you look at how technology emerged, how Intel came up with the chip, how Google innovated in managing Internet links, or how Facebook created the social landscape, something similar is happening right now in finance, and it's going to permeate every industry. consumer interactions. So you're going to see money in products that you didn't expect to see,” he said.

So far, Intergyro It has about 2000 customers and says it's growing by about 200 a month. This translates to around €2.500 billion traded since its launch. The Stockholm-based startup now has a largely remote staff of about 140 people.