With the increase in the ecommerce market and therefore in competition, new service models appear that expand the alternative financing model in different regions and categories.

Buy Now, Pay Later (BNPL, Buy Now, Pay Later) companies, which offer their fully digital services associated at the time of sale, are emerging around the world and gaining momentum among investors. In this first half of 2021, BNPL startups have already set an annual funding record of over $2,100 billion.

The BNPL market is growing beyond typical e-commerce categories like fashion and beauty into sectors including health, travel, entertainment and home improvement.

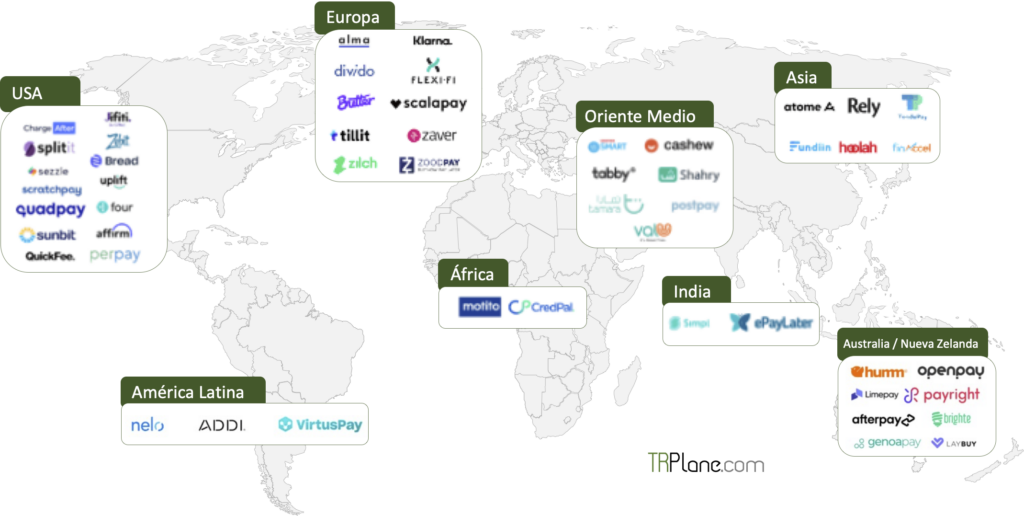

The United States leads the total number of companies of this style, followed by Europe. Companies are also springing up in Australia, New Zealand, Africa, Southeast Asia, the Middle East and Latin America.

There are more than 50 companies that are offering and improving this type of services. The most important ones are highlighted here without pretending to be exhaustive due to the novelty of the market.

United States

BNPL companies in this region offer increasingly verticalized solutions beyond e-commerce and retail. Since the market in general is dominated by leaders like Affirm, which went public last year, new startups have a better chance of success if they target niche markets.

For example, sun bit offers in-store and online financing solutions for more than 7,300 merchants, ranging from auto dealer service centers to opticians and dentists. The company raised $130 million at a valuation of $1.100 billion in May 2021.

Australia and New Zealand

Among those in this region stands out Pay RightAustralia-based , offers retail customers a range of financing options, covering everything from small-dollar items and bills to $20 nil home improvement plans. Merchants are paid in advance on the same day of purchase.

On the other hand, GenoaPay, based in New Zealand, offers a payment solution for small-scale payments up to $1,000. GenoaPay pays the merchant upfront and the consumer pays GenoaPay in up to 10 weekly installments, plus 10% upfront.

Africa

Startups in this region focus on purchase options no interest now and pay later.

motito, based in Ghana, offers interest-free credit at the point of sale. Associated stores offer a variety of products, such as home electronics, furniture, fashion and cosmetics.

credpal, based in Nigeria, offers point-of-sale loan options for businesses. CredPal allows customers to make purchases on credit and pay in fixed monthly installments. The company pays merchants in full on the same day and bears all risks associated with the credit.

Southeast Asia

Companies in this region mainly offer buy now and pay later platforms for online purchases.

For example, relay, based in Singapore, offers customers 2 financing options: the first option divides purchases into 4 payments that are paid every 2 weeks; the second allows customers to pay for their purchases in 3 monthly installments without interest.

TendoPay, based in the Philippines, offers installment plans for purchases of up to 30.000 Philippine pesos ($616) in 3 installments with a variable monthly interest rate.

Middle East

The main offer consists of buy now and pay later solutions for online and face-to-face purchases.

For example, Tamara, based in Saudi Arabia, offers customers the option to pay in 30 days or divide the purchase in 3 installments without interest. The company offers both online and in-store shopping through the Tamara mobile app.

Tabby, based in the United Arab Emirates, offers a payment option in 4 installments with interest-free payments that are billed monthly. Customers can earn rebates and rewards at select retailers.

India

There are relatively few BNPL companies in India, usually focused on enabling online shopping.

ePayLater, based in Mumbai, offers customers the option to pay for travel, food or other products and services online without interest within 14 days.

Simpl, based in Bangalore, has a platform where customers can select from more than 4500 online stores, buy with a click and pay later.

Latin America

Latin American-based buy now pay later providers cover various business options.

For example, Nelo, based in Mexico, offers BNPL to businesses, with services from ride-sharing like Uber to streaming platforms like Netflix and phone providers like AT&T.