It was only a matter of time. As more technology companies go public, disclosing necessary information about them has meant that, when it comes to their financial condition, major investors have begun to question their profitability and sustainability.

This has generated some skepticism, and tech companies around the world are slowly changing the way they operate to address these concerns.

A number of key trends can be observed in the evolution of the startup ecosystem.

Beyond innovation on demand

Build a differential factor for the customer network defensible Facing the competition is essential to the long-term success of any startup. For undifferentiated technology services, such as food delivery or mobility, it is difficult to achieve user exclusivity as the user base is quite volatile and has little or no switching costs. In such cases, innovating just to meet customer demand might not be enough. It is interesting to note that startups are focusing on supply-side innovation to build long-term competitive advantage.

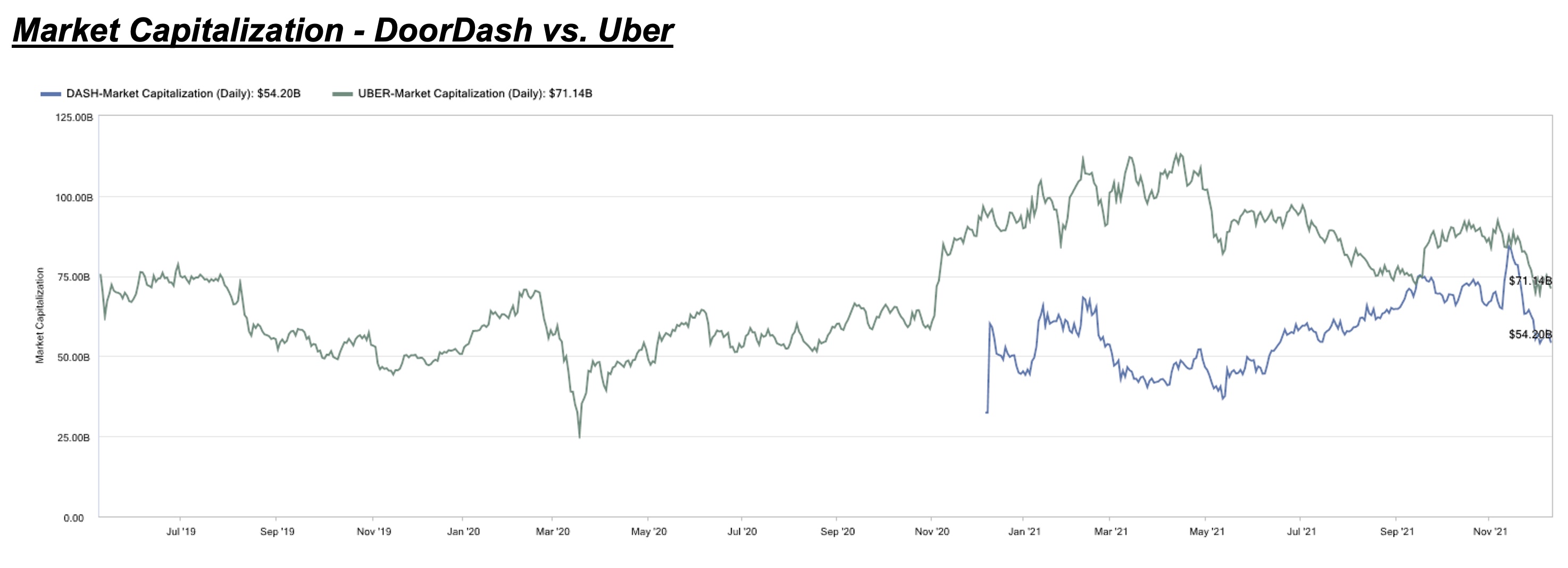

One of these success stories is Doordash, which managed to outperform Grubhub and reach to Uber Eats despite arriving relatively late on the US food delivery scene. Instead of just focusing on user acquisition (the demand side), Doordash has launched services to empower its restaurant partners and help them grow their businesses.

For example, Door Dash Drive is a white-label, flat-rate delivery service that allows merchants to generate their own orders and use Doordash to execute deliveries.

They also have DoorDash Storefront, which allows restaurants to create their own online stores (in Doordash) for pickup and delivery orders. It provides restaurants with customer data, which other delivery platforms typically don't share.

Such initiatives and value-added offerings helped Doordash increase your restaurant associations (the supply side) and exclusivity, which, in turn, improves user retention and engagement.

The Indian food delivery company Zomato also has a similar business/B2B initiative called hyperpure, a one-stop procurement solution that supplies fresh, hygienic, quality ingredients directly to restaurant partners of farmers, producers, etc.

Although hyperpure represents a small portion of revenue (about 10% of its total revenue in fiscal 2020), the company plans to invest more than $50 million in the business over the next 18 to 24 months.

Zomato plans to offer more services to its crestaurants, similar to Doordash, to foster stronger partnerships. The company is currently in talks with restaurant POS partners and electric vehicle fleet operators. One of its long-term strategies is to invest in companies in the food ecosystem.

Create an ecosystem to maximize value

Startups have long been advised to focus on one problem and be the best at solving it. Lately, though, you're seeing tech companies building an ecosystem of offerings to help address different but related pain points for their customers.

One of the main benefits of having an ecosystem for the client is the convenience, since they don't have to switch between different platforms and applications to find solutions. For businesses, this could generate new revenue streams, help them learn more about users, and gain higher loyalty and retention.

On the surface airbnb it may seem like a platform to connect owners and guests. But behind it there is an entire ecosystem of services and offers that help owners to host their properties on the platform.

For example, it has an insurance program (owner protection insurance) for hosts, and its trust and safety initiatives help hosts conduct background checks and guest risk scores, prevent fraud and scams, etc. to complete the ecosystem airbnb and address the pain points of the owners.

Complementary ecosystem services airbnb:

- FlyCleaners. Dry cleaning application on request.

- Guesty. Helps to answer guest queries, filter potential guests, coordinate key, changes, etc.

- Beyond Pricing.Suggest and automate pricing based on listing, marketing, events, and season.

- keycafe. Integrates with Airbnb to streamline key exchange between owners and guests.

- Full service management. Reservation management, price optimization, communication with guests, key exchange, etc.

In India, Razorpay has been building an ecosystem of services that caters to SMEs rather than just being a payment gateway and infrastructure for merchants, its initial core product. The following is a snapshot of their current ecosystem and services, which are aimed at helping merchants manage and grow their business.

The company's ecosystem benefits from these services as they attract new customers with new needs. This allows you to Razorpay Increase the value of your offer over time.

Ecosystem of Razorpay

- Payment gateway and infrastructure for merchants is their initial core product

- It launched Razorpay X, a neo-banking platform, to serve the banking and financing needs of SMEs in the country.

- Razorpay X provides credit, working capital loans, payroll management, etc.

- Razorpay X Tax Payment Suite launched to automate tax payments for companies

- It also has Razorpay Rize that helps entrepreneurs incorporate their companies and provides mentorship by connecting them with other startups and mentors.

- Actively partnered with other B2B technology companies to bring their offerings to the ecosystem. For example, Shiprocket (B2B logistics provider) and MSMEx (small business consulting).

- Planning to make more future acquisitions to further enrich its ecosystem.

Similarly, in Southeast Asia, nium it has become the first B2B payments unicorn in the region thanks to its “payments + ecosystem” business model. Initially, the company focused solely on international payments, and while cross-border payment infrastructure remains its core product, nium has expanded to offer a full suite of banking-as-a-service solutions for its corporate customers. Clients now use the platform nium for international payments, card issuance, payment collection, etc.

Other profitable secondary operations

The pandemic has also made founders and investors realize the importance of building a resilient business.

Moving from seeking growth at all costs, companies are creating more synergistic offerings from non-core businesses that have higher margins compared to core businesses. This helps improve profitability as a whole so that the business can be more sustainable in the long term without having to rely solely on external capital.

The trend is most apparent among more established tech companies, as they have a user base that can be more easily monetized through additional offerings.

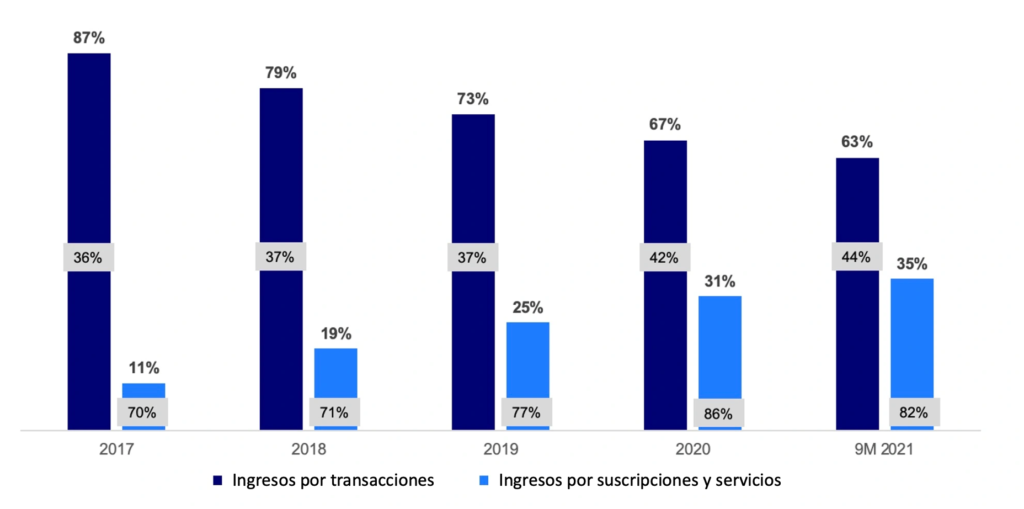

For example, Block (formerly known as Square), which generates most of its revenue through payment and transaction processing, has expanded its offering to offer subscriptions and services. These include software subscriptions by sellers, an instant deposit feature that allows both customers and sellers to instantly deposit funds into their bank accounts, and Square Card (a prepaid Visa card).

The subscription and services segment Block It operates with almost double the gross margins (82%) compared to its transaction-based services (44%), and has a steady increase in its contribution to the business, from 11% in 2017 to 35%. in the first nine months of 2021.

Breakdown of net income and gross margin of Block by type of service

In Southeast Asia and India, some leading tech companies have taken this approach lately, but as many of their initiatives were launched not too long ago, the impact on their overall business models has yet to materialize.

For example, the business and new initiatives segment of Grave launched in 2018 with GrabAds, an advertising and marketing service for businesses. In 2020, the company launched GrabDefense, which provides fraud detection and prevention technology to third parties.

What does it mean for a startup?

Whether trying to increase the profitability of secondary operations, focusing on supply-side innovation, or maximizing value by creating ecosystems, these three trends all point to a common theme: becoming more sustainable and resilient.

Instead of chasing growth, founders and management should consider building a more sustainable business instead of just focusing on raising the next round of capital.