Integrating with a payment API is something that most, if not all, business-to-consumer platforms are forced to do at some point. It is practically unavoidable if you want to accept credit card payments. The problem is that for platforms that deal with invoices and receipts, not just one-time charges, few payment APIs have all the features needed to fit your workflows.

That's why Ralph Rogge founded I grow.

“Having worked with thousands of small businesses, it is clear that bill payments continue to be an inconvenience, especially compared to the frictionless payment of consumer card payments,” Rogge said. (Previously, Rogge worked at YouLend, a startup offering a range of financing solutions aimed at merchants and small and medium-sized business owners.) “Businesses should be creating and selling products, not spending time and money setting up invoice payments. Crezco facilitates these payments.”

So, does Crezco really make payments easier? From the looks of it, yes.

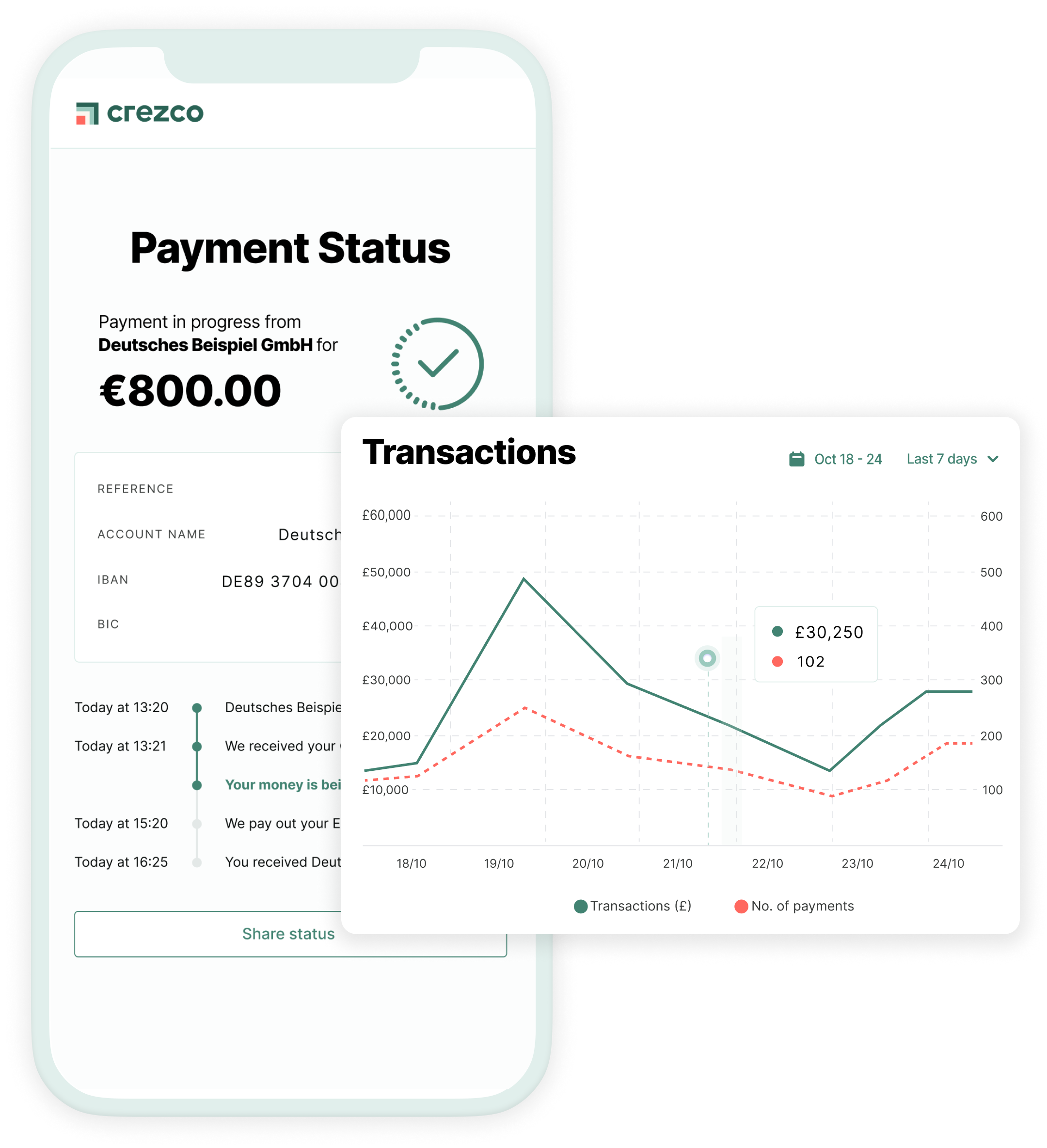

Crezco creates invoice payment collection workflows, specifically account-to-account invoice collection workflows. With these, payments, including those occurring abroad, are made directly from one account to another without transaction intermediaries such as those involved in card networks.

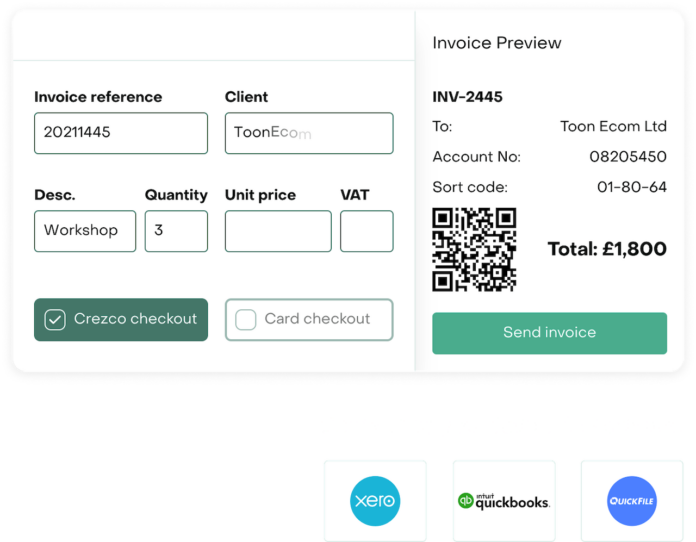

With Crezco, businesses get automatic invoice reconciliation integrated with their existing accounting software and tools that allow them to generate payment links, collect recurring payments, and split payments across multiple accounts. Crezco also offers a built-in fraud detection system, plus “instant” payment notifications via web and mobile.

“It is not about replacing card payments with something cheaper, but about replacing manual bank transfers with something more convenient,” said Rogge. "The account payments on account and in real time are the future. They will be increasingly adopted country by country. Crezco's job is to connect these international payment methods to a single API for our partners and their customers; The ultimate goal is to make it easier for companies to send and receive payments, nationally and internationally, saving time and money.”

Crezco does not appear in an empty market. Some of its most formidable competitors include Intuit and Wise, as well as Brite Payments, TrueLayer, Plaid, Melio, and Tink (which Visa recently purchased for $2 billion).

Rogge sees Crezco's fraud prevention technology as a differentiator, among its other capabilities.

Beyond using account to account to process payments, Crezco takes advantage of the open banking to improve their fraud systems by analyzing historical banking transactions,” Rogge said. “Most tools use the same few data points, which are compared to public data sets such as government sanctions lists. “Open banking provides 10 years of every historical credit and debit transaction.”

Crezco claims to have more than 10.000 active customers and hopes to dramatically increase that number through a partnership with UK accounting technology company Xero. Crezco will replace Wise, with whom Xero previously had an agreement for integrated bill payment solutions.

Investors seem satisfied with Crezco's track record. The company announced that MMC Ventures and 13books invested $12 million in its round Serie A, bringing the total raised by Crezco to $18 million. Rogge says the proceeds will go toward expanding Crezco's account-to-account product and expanding the size of its team from 25 to 45 people.

“The structural tailwinds in business-to-business payments are significant,” Rogge said, “including the forced adoption of e-invoicing, the growing use of accounting software and business-to-business platforms globally, the growing adoption of account to bill payments and open banking, and continuously growing cross-border payments.”