Usuarios del Club TRPlane

la banca es esencial, los bancos no.

Bill Gates (1994)

Las fintechs de banca minorista están ganando impulso gracias al desarrollo de servicios bancarios pra clientes minoristas optimizados y accesibles digitalmente.

En Europa aparecieron los primeros con Atom Bank, Tandem, Monzo, Starling Bank, Revolut y N26 que, entre todos ellos, atrajeron un total de 4.200 millones de dólares de inversión y más de 30 millones de clientes desde 2014.

En el Reino Unido se ha experimentado mayor actividad bancaria de las fintechs en comparación con otras regiones, como resultado de regulaciones más progresistas promulgadas para promover la competencia y romper los monopolios. Este tipo de Fintechs ya han comenzado a aparecer en otras regiones del mundo, desde Australia hasta Asia y Estados Unidos.

¿Qué es un banco alternativo minorista?

Una fintech alternativa a un banco tradicional es una empresa de tecnología que aprovecha el software para digitalizar y agilizar la banca minorista. Este tipo de empresas utilizan canales de distribución digital, generalmente móviles, para ofrecer servicios bancarios a particulares más competitivos, como cuentas corrientes y de ahorro, préstamos, seguros y tarjetas de crédito.

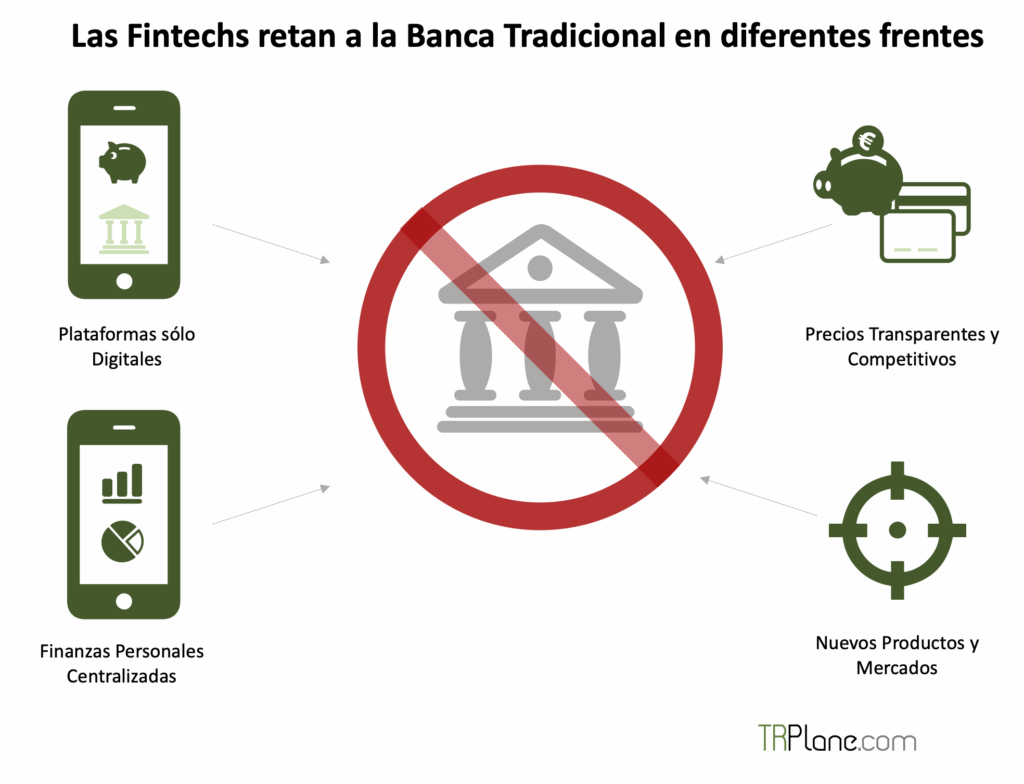

Bancos Alternativos vs. Bancos Tradicionales

A diferencia de los bancos minoristas tradicionales, que ofrecen sucursales físicas para la banca de personas, los bancos alternativos adoptan un enfoque que da prioridad a lo digital, y a menudo se basa únicamente en plataformas móviles y de web. Los bancos alternativos priorizan una experiencia de usuario mejorada, atrayendo a aquellos que quieren poder realizar operaciones bancarias desde sus teléfonos en lugar de visitar una sucursal minorista.

Las Fintechs de banca alternativa se iniciaron con clientes que perdieron la fe en las empresas históricamente tradicionales tras la crisis financiera mundial. Estas empresas «desafían» el modelo de negocio estándar al cobrar a los clientes tarifas bajas y transparentes, brindar servicios más rápidos y brindar una mejor experiencia de usuario a través de interfaces digitales siempre disponibles.

Además, muchos de estos nuevos bancos se dirigen a grupos demográficos concretos que están desatendidos por los bancos tradicionales, como los consumidores en los tramos de ingresos más bajos o aquellos que carecen de historial crediticio.

Desde el contacto personal a una banca digital

En 2009, había 240.000 sucursales bancarias en Europa. En ese momento, los clientes todavía dependían en gran medida de la visita a la sucursal y estaban empezando a usar la banca online. Pero las fintechs apostaron a que online, en concreto, el móvil, sería el próximo canal para la distribución de banca minorista. Eso fue profético profético.

Desde entonces, el auge de la banca digital ha impactado de forma sustancial en la caída del número de sucursales. El número de sucursales bancarias europeas se ha reducido a 165.000. Y se espera que una cuarta parte de estos cierren en los próximos 3 años, según la consultora Kearney.

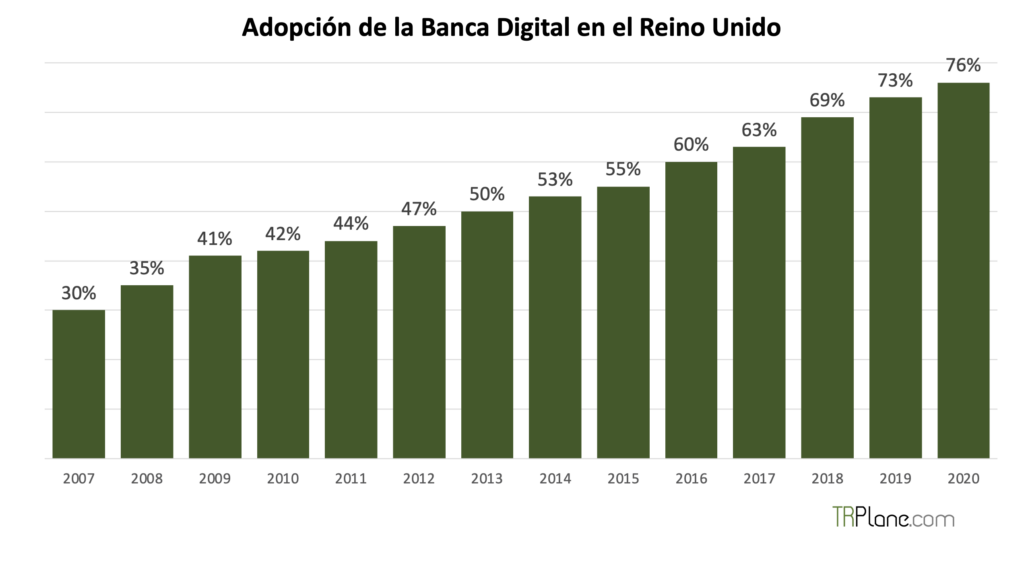

Juniper Research dice que, para 2024, 3.600 millones de personas, casi 1 de cada 2 adultos, utilizarán servicios de banca digital, que incluyen canales móviles y de sobremesa. Reino Unido ha experimentado una de las adopciones más generalizadas de servicios bancarios digitales gracias a los cambios en su regulación, por otro lado inevitables.

Durante la pandemia de Covid-19, los cierres por fusiones de bancos y cierre de sucursales aceleraron aún más la adopción de la banca digital, una bendición para muchos competidores. Por ejemplo, el uso global de aplicaciones de pago y banca móvil creció un 26% en la primera mitad de 2020 en comparación con el mismo período en 2019 según una encuesta de Adjust y Apptopia.

Las fintechs se han beneficiado enormemente de la transición a digital, ya que los bancos tradicionales aún mantienen un modelo de negocio centrado en las sucursales. Sin embargo, estos bancos, también han desarrollado sus propias ofertas digitales, invirtiendo significativamente en la transformación digital para mantenerse al día con la cambiante demanda de los consumidores.

Cómo las fintechs han impactado en la regulación

A raíz de la crisis financiera de 2008, los reguladores más avanzados de la UE han facilitado que las fintechs obtengan licencias financieras necesarias para operar. Por ejemplo, puede apreciarse como las más importantes fintechs han aprovechado la nueva regulación para crecer: Atom Bank, Tandem, Monzo, Starling Bank, Revolut y N26.

Atom Bank, Tandem, Monzo, Starling Bank, todos con sede en el Reino Unido, y N26, con sede en Alemania, obtuvieron una licencia bancaria completa, con una de demora hasta 2 años en ser procesada por el regulador, pero amplía los servicios que estos bancos pueden ofrecer a los consumidores. Al perseguir este proceso que requiere mucho tiempo, estos nuevos entrantes apuestan a que este reconocimiento por el regulador generara confianza con los consumidores y les permitiría una mayor flexibilidad en la construcción de sus ofertas. Es interesante como este mismo proceso es el que siguió hace mas de 20 años Paypal en Estados Unidos, descrito en el magnífico libro The Paypal Wars (2004).

La estrategia de Revolut, en el Reino Unido, por otro lado, era disponer de una licencia de dinero electrónico, que se puede obtener mucho más rápidamente, aunque el alcance de los servicios que se pueden ofrecer es más limitado. Esta opción se creó en 2011, como parte de las Regulaciones de dinero electrónico del Reino Unido.

Las fintechs también han podido expandirse dentro de la UE aprovechando el pasaporte del Espacio Económico Europeo (EEE). El pasaporte permite a una empresa con licencia en 1 de los 27 estados miembros de la UE proporcionar productos o servicios financieros en otro país sin necesidad de autorización adicional. N26, por ejemplo, ha utilizado el pasaporte para expandir su servicio a más de 20 países de la Comunidad Europea.

Inversión y principales inversionistas de los nuevos bancos

$643M

BBVA, Toscafund Asset Management, Anthemis,

Woodford Investment Management

$251M

e.ventures, Route 66 Ventures, Qatar Investment Authority,House Of Fraser

$641M

Accel, Y Combinator, General Catalyst, Thrive Capital, Stripe

$906M

GS Growth, Fidelity Investments, Qatar Investment Authority, JTC Group

$916M

Index Ventures, Ribbit Capital, Balderton Capital, DST Global

$822M

Tencent, Insight Partners, Allianz X, Earlybird Venture Capital

Estrategias frente a los Reguladores

Atom Bank, Tandem y Starling Bank tuvieron una estrategia más tradicional priorizaron tener una licencia bancario antes del lanzamiento y crearon un conjunto de servicios que requerían dicha licencia, creyendo que con ello obtendrían una ventaja compatitiva alrededor de su plataforma. Atom Bank, por ejemplo, lanzó una cuenta de ahorros y un producto de préstamo para pequeñas y medianas empresas (PYMES) tras la aprobación del regulador.

El mayor inconveniente de esta estrategia es perder el impacto de la entrada de oferta en un mercado nuevo. Debido al lento proceso de los reguladores, Atom Bank se retrasó en la comercialización de su producto y no lo lanzó hasta mediados de 2016, 18 meses después de registrarse en la Autoridad de Conducta Financiera (FCA).

Otro inconveniente es que puede producirse una revocación. Tandem perdió su licencia bancaria al no poder asegurar la financiación. Adquirió la división bancaria de Harrods a fines de 2017 como una forma de restaurar la licencia, pero ese fue un proceso añadió mayor coste y tiempo.

Monzo y N26 adoptaron una postura intermedia. Querían atraer clientes a sus plataforma mientras buscaban métodos más ágiles de regularizarse.

En el caso de Monzo, lo hizo lanzando una tarjeta prepago en lugar de un producto de cuenta corriente completo. Los beneficios de esta estrategia incluyen llevar los productos al mercado más rápido, obtener comentarios de los clientes y corregir errores durante los primeros lanzamientos de productos. Pero el inconveniente es que puede poner en peligro el crecimiento posterior.

Monzo estaba atravesando un período de rápido crecimiento, añadiendo unos 60.000 usuarios al mes cuando se le otorgó la licencia bancaria. En diciembre de 2017, dejó de añadir nuevos clientes según su lanzamiento inicial y anunció planes para transferir a sus 500 mil clientes existentes de las tarjetas prepago a las propias cuentas corrientes de Monzo. Hasta que pudiera completar esta tarea y reabrir el registro, Monzo perdió la actividad de cientos de miles de clientes en lista de espera.

Otro inconveniente es tener que depender de socios corporativos mientras se espera la licencia. En el caso de N26, utilizó el back-end del procesador de pagos Wirecard para poner en funcionamiento su interfaz de pagos. Esto significó darle a Wirecard una parte de cada transacción.

Con una estrategia completamente diferente, Revolut desafió la estrategia convencional de comercialización al solicitar una licencia de dinero electrónico más fácil de adquirir y apuntar al cambio de divisas en lugar de las cuentas corrientes (de uso similar a las cuentas corrientes en los Estados Unidos). Revolut se centró inicialmente en los viajeros frecuentes, un nicho que creía que estaba desatendido. Creó una aplicación de cambio de moneda digital, que permitía a las personas intercambiar dinero con más frecuencia entre países sin necesidad de establecer varias cuentas bancarias.

Revolut aprovechó el pasaporte del europeo para expandirse por Europa y se asoció con otras fintech para crecer rápidamente. Pudo lanzar este producto sin esperar una carta, mientras obtenía acceso a una lista de clientes potenciales para una eventual oferta bancaria.

A partir de entonces, Revolut recibió una carta de pasaporte europeo a través del Banco de Lituania y solicitó otra en el Reino Unido en el primer trimestre de 2021. La compañía ahora cuenta con 15 millones de clientes individuales y 500.000 clientes comerciales.

Las fintechs de más rápido crecimiento (Monzo, Revolut y N26) adquirieron clientes rápidamente a través de estrategias de crecimiento viral y sin buscar primero una licencia bancaria. En mayo de 2021, entre los 3 bancos tienen una base de clientes combinada de más de 27 millones de usuarios.

Las otras 3 compañías, Atom Bank, Tandem y Starling Bank, esperaron hasta recibir sus licencias, lo que demoró su crecimiento hasta 2 años. Debido a esto, estos bancos quemaron más efectivo en el camino que sus contrapartes no autorizadas. Hasta la fecha, tienen 2.9 millones de clientes combinados, solo una décima parte de lo que sus competidores han acumulado colectivamente.

Las nuevas regulaciones impulsan los modelos de negocio de las Fintechs

En los últimos años, los reguladores de la UE y el Reino Unido han continuado permitiendo activamente el crecimiento de los nuevos bancos o fintechs. Esto incluye regulaciones como los estándares de banca abierta del Reino Unido y la Directiva de servicios de pago (PSD2) de la UE, que se implementaron por fases en enero de 2018.

Los estándares de banca abierta requieren que los 9 bancos más grandes del Reino Unido de cuentas corrientes personales y comerciales implementen estándares abiertos para acceder a ellos a traves de interfaces de programación de aplicaciones (API).

Los estándares de banca abierta y PSD2 permiten que terceros accedan de forma segura a los datos de las cuentas de los clientes cuando lo soliciten. Esto significa que existe una gran oportunidad para que las empresas de tecnología financiera, como estos nuevos bancos, se conecten a los bancos tradicionales y creen nuevos servicios para los clientes.

Nuevos Mercados, Productos y Partners

Estos nuevos bancos tienen el reto de ampliar sus servicios bancarios minoristas, expandirse a nuevos mercados y orientar sus plataformas hacia los clientes no bancarizados.El camino por el que optan es a través de acuerdos y colaboraciones con terceros que completen su oferta a cambios de acceder a su base de clientes.

Para Revolut y N26, asociarse con otras empresas de tecnología financiera para agregar nuevos servicios les ha ayudado a reducir los costes y empezar a cubrir gastos.

Tras ellos, otros nuevos bancos fomentan sus acuerdos con terceros, especialmente a raíz de los estándares de banca abierta del Reino Unido y la PSD2 de la UE. Starling Bank sacó partido rápidamente a estos estándares, lanzando al mercado APIs de banca en 2018 y buscó integraciones con 25 nuevas empresas de tecnología financiera.

Moneybox, por ejemplo, fue una de las primeras asociaciones de Starling Bank. Moneybox es una startup de gestión de patrimonio por vía digital digital que realiza inversiones fraccionadas para los clientes que se materializan con cada compra con otro clientes que también realizan las compras. Moneybox aprovechó la API de Starling Bank para mejorar el tiempo de asignación de inversiones de una vez por semana a tiempo real.

Sin embargo, el inconveniente de este enfoque es que es fácil de replicar con otros competidores. Por ejemplo, Moneybox también se asoció con Monzo y tenía una asociación existente con Revolut. Es probable que otras fintechs también aumenten sus acuerdos para lograr una adquisición de clientes más barata, aumentar la velocidad de comercialización con nuevos servicios y contener los costes iniciales de infraestructura.

Los nuevos bancos también pueden buscar asociarse con los bancos tradicionales para aprovechar los nuevos requisitos de banca abierta, acelerar la velocidad de la red y garantizar la seguridad de la información. Por ejemplo, los más pequeños como Tandem y Atom Bankpueden buscar beneficiarse de acuerdos institucionales más grandes a medida que lanzan nuevas categorías de productos como tarjetas de crédito e hipotecas alternativas.

Debido a que estos acuerdos generan en muchos casos reducción de margen y crean riesgo con la competencia, algunas fintechs buscarán incrementar productos internamente a través de adquisiciones. Tandem, por ejemplo, adquirió Allium, un prestamista que ayuda a los consumidores a llevar energía verde a los hogares, en agosto de 2020.

Mientras tanto, otros apuntan a lanzar sus propios productos exclusivos para ampliar la gama de servicios que ofrecen. Revolut, por ejemplo, ya ha establecido un brazo de inversión (Revolut Wealth) con licencia para respaldar pensiones, ETFs (exchange-traded fund) e hipotecas, al tiempo que lanza el comercio de acciones sin comisiones para complementar su oferta de criptomonedas.

Cuando se apruebaela licencia de Revolut en Reino Unido, el reto para sus competidores tradicionales y fintechs se enfocará en función de qué nuevos productos y mercados ss priorizan en la empresa. El enfoque convencional sería lanzar un producto de cuenta corriente con licencia completa en el Reino Unido, pero Revolut puede buscar primero oportunidades de crecimiento en otros sectores.

Oportunidades por Orientación Demográfica

Algunas fintechs se orientan a productos dirigidos a comunidades y demografías socioeconómicas muy específicas para diferenciarse en un mercado cada vez más concurrido.

En Estados Unidos, por ejemplo, empresas como First Boulevard, Greenwood y Cheese se centran en las comunidades minoritarias desatendidas, mientras que Daylight se centra en la comunidad LGBTQ+. Letter y Unifimoney están desarrollando productos de banca privada para personas de alto patrimonio neto, mientras que Capway y One se están enfocando en los sub-bancarizados. TomoCredit lanzó una tarjeta de crédito en marzo de 2021 que no se basa en el ratio de crédito FICO (criterio USA), sino que utiliza el flujo de efectivo para calcular la solvencia del cliente, flujo de datos de uso para determinar la solvencia de un consumidor. Con este producto, TomoCredit se dirige a los jóvenes que pueden no tener historial crediticio.

La misma diversificación se está produciendo en Brasil, que ha demostrado ser un terreno idóneo para los nuevos bancos. Por ejemplo, Elas Bank atiende las necesidades de las mujeres de negocios, Pride Bank atiende a la comunidad LGBTQ+ y Zippi atiende a autónomos y trabajadores independientes el sector de transporte compartido.

Este enfoque de mercado cada vez más granular introduce una capa adicional de competitividad y presión sobre la banca tradicional de cara a definir una propuesta de valor diferencial.

Oportunidades en Soluciones Financieras Finanzas Integradas

Las finanzas integradas, la práctica de las empresas no financieras que ofrecen servicios financieros dedicados, como préstamos, a los clientes, también está en aumento. En los últimos meses, empresas tan variadas como la cadena de farmacias Walgreens, el proveedor de servicios fiscales HR Block o la plataforma de comercio electrónico Shopify han anunciado planes para lanzar cuentas bancarias para los clientes.

Para empresas no financieras brindar servicios financieros seleccionados a sus clientes, supone disponer de una infraestructura fintech, que requiere mucho tiempo y es costosa de construir. Debido a que los nuevos bancos ya tienen esta infraestructura y la experiencia para implementar estos servicios, todos, incluidos los clientes, se encuentran en una posición ventajosa al integrar los servicios financieros.