Less than six months after launching to the public and announcing an initial raise of $7,5 million, a startup that provides banking services to Americans 62 and older has raised additional funding.

The days of two capital raises closing in a matter of months are long gone, so naturally it caught our attention when Charlie reached out to share that he had secured $16 million in Series A funding and $7 in debt. TTV Capital led the latest round, which also included participation from FPV Ventures and existing backer Better Tomorrow Ventures, among others.

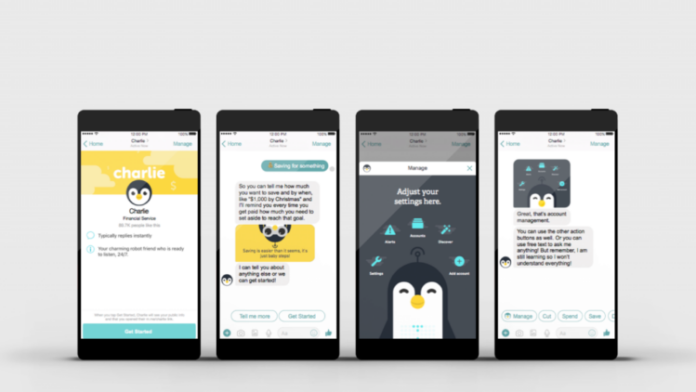

Kevin Nazemi co-founder and CEO, created Charlie at the end of 2021 with the mission of “transforming” financial services for the community over 62 years of age.

Since launching in May, Charlie has acquired several thousand customers in all 50 states, Nazemi said.

“Every time you launch a new company, it's stressful. “There was a collective sigh of relief when we saw so many customers signing up and we knew our approach… was working.”

Features include faster access to Social Security checks, 3% benefits on balances and no minimum monthly fees. The company says that one day users will also be able to get “frictionless, shame-free discounts” simply by using their debit cards, according to Nazemi, so they won't have to do things like show an AARP (American Association of Retired Persons) card or their identification to prove that they are elderly. Like many fintechs, Charlie is not a bank; Its banking partner is Sutton Bank, which insures all deposits up to $250,000.

"More than 50% of the 73 million seniors in the United States do not feel financially prepared for retirement and, for too long, their unique financial needs have been neglected," he said. “Charlie is designed to meaningfully address the many challenges facing this community, such as rampant financial fraud, the shift from asset accumulation to decumulation, and the lack of transparency, control, and trust in most service products.” financial institutions that they find.

One of the things Charlie is designed to address is the fact that until a person retires, they are accumulating assets. But once they retire, they go into “decumulation mode.” That can be scary and challenging. To help seniors adjust, Charlie says he allows clients to withdraw their Social Security benefit up to four weeks early.

The company makes money through interchange fees; When a customer spends money with their Charlie Visa debit card, Visa pays Charlie a percentage of what he earns from the merchant.

“This is our main source of income and allows us to offer customers no monthly fees and free access to more than 55.000 ATMs,” Nazemi said. "Other third parties involved in the transactions may charge fees outside of Charlie's control, which will likely be disclosed at the time of the transaction."

Charlie plans to use the new capital to implement a set of custom fraud protections designed specifically for his target customers, expanding his 15-person team and developing new products and features.

Gardiner Garrard, co-founder and managing partner of TTV Capital, said the COVID pandemic made more people, including those 62 and older, more comfortable with digital banking. This, she said, created “a huge opportunity for financial institutions to engage more directly with this demographic.”

"But until recently, the products and services retirees needed were often difficult to find online and the user experience was not intuitive," Garrard said. “The early feedback Charlie has received is very encouraging and his offerings fill an acute need in the market.”