Usuarios del Club TRPlane

Watershed, compañía de tecnología climática, recaudó una ronda de Serie B de 70 millones de dólares que produjo una valoración de la empresa de gestión y medición de emisiones de carbono de 3 años en mil millones de dólares. ¿Cuántas otras empresas de tecnología climática son ya unicornio?

Actualmente existen 43 unicornios dedicados al clima y medioambiente:

Fuente: HolonIQ, valoración por Pitchbook

La tecnología climática es una raza rara pero creciente de unicornios. De los 1000 unicornios de hoy, los 43 en tecnología climática representan el 4,3 % del total (frente a fintech del aproximadamente el 20 % o el 18 % del software de Internet). Pero restecto al año pasado la tasa de nacimientos de unicornios climáticos ha aumentado drásticamente. 29 empresas de tecnología climática alcanzaron el estatus de unicornio en 2021, lo que representa más del 60 % de los unicornios climáticos de todos los tiempos y ~6 % de los unicornios nuevos en general ese año. Las grandes valoraciones de la tecnología climática fueron tan altas en 2021 que incluso superaron al mercado general, con una tasa de crecimiento del 625 % de los unicornios tecnológicos climáticos recién acuñados en comparación con el crecimiento de referencia de la industria del 287 %.

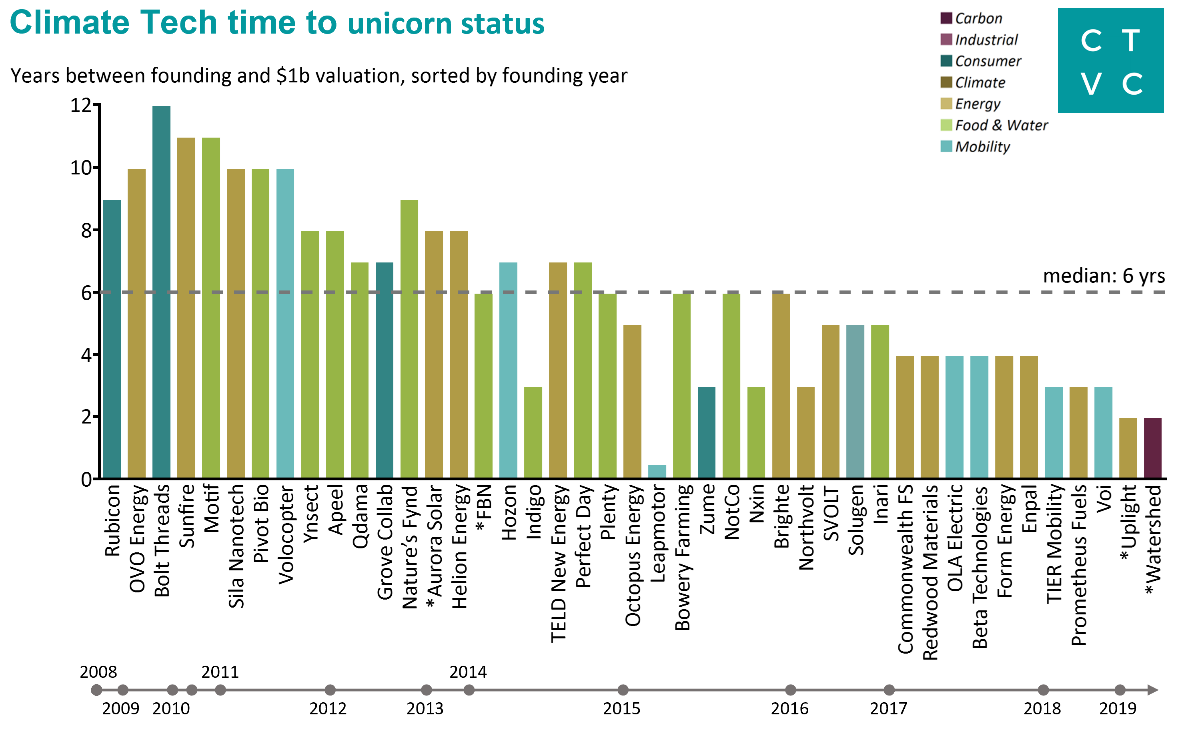

Las empresas tecnológicas climáticas más jóvenes están acelerando a los unicornios mucho más rápido. No sólo se ha expandido rápidamente la cantidad de unicornios tecnológicos climáticos, sino que la aparición de nuevos unicornios se está acortando. Casi el 60 % de los unicornios tecnológicos climáticos en 2021 alcanzaron el codiciado estatus de 1000 millones de dólares en menos de 7 años, que es el estándar en startups. Las empresas emergentes fundadas después de 2017 crecieron constantemente hasta convertirse en unicornios en 4 años o menos, lo que representa en particular un 40% del total de unicornios de tecnología climática de 2021. Si bien las altas valoraciones de los unicornios climáticos indican un mercado candente, también contrastan con el bajo rendimiento de las nuevas empresas públicas de tecnología climática a través de SPAC, que en su mayoría han tenido una tendencia por debajo del precio base de 10 dólares hasta la fecha. La relajación de los mercados públicos y una oferta de SPAC menos atractiva probablemente incentivarán a las empresas tecnológicas de clima cálido a permanecer privadas durante más tiempo y producirá más unicornios.

Watershed trae más software añadiendo carbono a la combinación de tecnología climática. A pesar de la inclinación de las empresas hacia el software como servicio, la tecnología climática se ha desviado más hacia el hardware a lo largo de los años. La última financiación de la Serie B de 70 millones de dólares de Watershed pone el software B2B de carbono en el mapa y potencialmente presagia otras combinaciones de software y carbono que ingresaránn en el club del unicornio. Pero tanto el software como el hardware serán fundamentales para una descarbonización profunda, con «software para guiar la estrategia de la empresa y el despliegue de capital, y hardware para construir la infraestructura química y física necesaria para cambiar las industrias actuales», como lo expresó Nat Bullard.

Unicornios tecnológicos climáticos concentrados en los sectores y geografías más emisores. De manera similar a la distribución del capital de riesgo de tecnología climática en 2021, más del 80 % de los unicornios climáticos se clasifican en las tres categorías principales de energía (35 %), alimentos y agricultura (33 %) y movilidad (16 %). Los unicornios climáticos también aparecen en geografías que ocupan los más grandes índices de emisiones, con el 95 % de los unicornios provenientes de EE. UU. (60 %), Europa (21 %) y China (14 %).