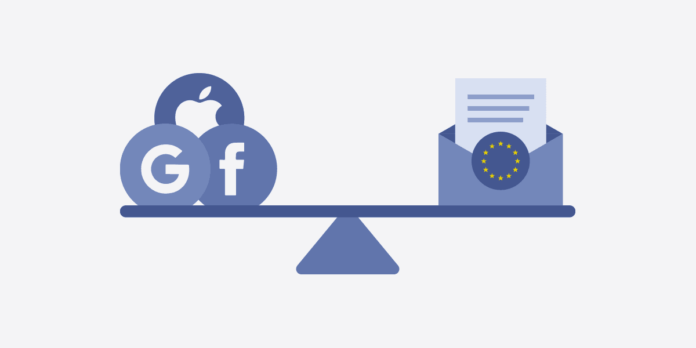

The GAFAM giants will have marked on their calendars as the moment of the Digital Markets Law (DMA), the European Union's plan to curb the market power of Big Tech, which is already being applied, after entering into force last November.

The next major milestone will be in a few months, in early autumn, when the Commission will confirm which of the usual suspect tech giants will be subject to the bloc's shiny new competition regulation regime. Tech giants face a busy summer preparing their regional compliance strategies.

As a quick recap: The DMA applies a fixed set of obligations to so-called "gatekeepers" of the Internet who meet specific cumulative criteria:

First, they must operate at least one "core service on a single platform" (these include online search engines, social networking services, app stores, certain messaging services, virtual assistants, web browsers, operating systems, and Internet services). online intermediation).

Second, they must be large enough in size and have an entrenched market position to be subject to the regime. This means reporting annual revenue in the European Economic Area that reached or exceeded €7.500 billion in each of the last three financial years; or have an average market capitalization “or equivalent fair market value” that amounted to at least €75 billion in the last financial year, as well as provide a centralized service in at least three EU Member States.

As a third point, the managers of these platforms must also be an "important gateway for business users to end consumers". As quantified by the Commission, the DMA considers that it falls into that case group if the company in question operates a centralized service with more than 45 million monthly active end users in the EU and more than 10.000 active business users in the EU per month. year in the last financial year.

Finally, an established and durable position is presumed if the company met the other criteria in each of the last three years. Although the Commission may also apply a subset of DMA rules to companies, it suspects that they will soon become relevant central platform operators.

Certain big names will obviously hit the DMA threshold (Apple, Amazon, Google, Meta, and Microsoft seem completely safe bets to be considered in this group). But we will have to wait a few months to see if the complete list contains any surprises.

And on that front, European music streaming giant Spotify clearly doesn't expect to be one of them… that will become clear in a moment.

This is big. Totally agree with @vestager that the Internet was never built to be controlled by a small number of dominant players. Effective enforcement is critical because we've seen Apple try to circumvent the rules around the world. Here is our opinion: https://t.co/PnzglOaafZ. https://t.co/QL61DIonn7

Daniel Ek (@eldsjal) May 2 2023

“Now that the WFD is applied, potential platforms that meet the established quantitative thresholds have until July 3 to notify their core platform services to the Commission. After that, the Commission will have 45 business days (until September 6, 2023) to decide if the company meets the thresholds and designate them. After their designation, companies will have six months (i.e. until March 6, 2024) to comply with the requirements of the WFD,” the Commission writes in a release.

If you're feeling a sense of déjà vu, it's probably because EU lawmakers recently designated 19 "Very Large" Online Platforms (VLOPs) that are subject to the WFD's sister regulation, the Services Act. Digitales (DSA), which restarts the EU's e-commerce governance regime.

Some of the same companies that have already been named VLOPs under the DSA are also likely to be designated gatekeepers under the DMA, meaning they will accrue additional "specific obligations" on top of the algorithmic transparency requirements mandated by the DSA.

The DMA's "permitted and disallowed" operations are clearly aimed at ensuring that digital markets remain "open and contestable" by enforcing a fixed set of behavioral conditions on platform managers that aim to curb anti-competitive actions. .

Examples of DMA obligations include limits on how monitoring platforms can use third party data along with requirements that they provide third parties with data about the usage their apps generate; prohibitions on self-preferences and indelible default applications or settings that are imposed on consumers; interoperability requirements, including access control messaging services; requirements that app stores not block sideloading or require developers to use their own services (eg payment systems); and a ban on tracking users for targeted ads without consent, among other conditions.

Most of the list of operations relates to the Commission's experience in past Big Tech antitrust cases, such as various EU applications against Google. However, there were some later additions, by co-legislators in Parliament and Council, such as messaging interoperability (which took many by surprise), as well as limits on ad tracking.

Some similar types of conditions have already been applied to some tech giants in certain EU markets, using existing competition powers. Like the Netherlands, which last year forced Apple to allow dating app developers to choose to use alternative payment systems.

Germany has moved ahead at the national level, having updated its own competition regime in early 2021, and has some enforcement measures in place at a number of tech giants it has designated as being of "primary importance" to local competition (such as Google).

EU data protection law enforcement is also curtailing Meta's ability to force behavioral ads on users. So you can see from this sample, bigger things to come when the DMA is running full steam ahead.

The novelty is that the conditions are applied in advance, so the idea is regularly proactive to the digital giants that they have the power to set rules on others who need to access their core platform services and force them to support competition and be sensitive to consumer needs (rather than just favoring themselves).

Rather than antitrust regulators having to spend years investigating and amassing evidence of abuse to bring cases against misbehavior before it can be stopped, usually long after the damage has taken hold, the goal is to act preemptively and not as has been the case in most of Europe under the classical model of Competition Rules.

That being said, pan-European regulation will take some time to kick in. And there are ongoing concerns about resourcing and how prepared the Commission is to stretch its value to the limit and take on such a significant oversight role by leaning on some of the most powerful platforms in the world.

Time will tell how much pushback the DMA gets from tech giants accustomed (for the most part) to operating how they like and/or lobbying like damned when lawmakers suggest making changes that could hamper their money-minting machines. It also remains to be seen how willing the Commission is to stand its ground and firmly enforce the digital new world order (especially as the upcoming EU elections will reshape the bloc's political power structures and bring in new leaders who may not be as committed with the approach as those who wrote it).

We probably won't see any DMA compliance until next spring, as platform managers named in September will have six months to get their house in order. But we may see some operational changes in preparation for the new rules. And possibly new business models will emerge in the future, as, for example, ad tracking without consent becomes less and less viable for major social media giants. Much legal action to test the limits and mettle of the DMA also seems inevitable. So the next few years in Europe will be full of new and interesting power struggles.

In the UK, which left the bloc after the Brexit referendum vote, the government has also recently signaled it will move forward with a tailored ex-ante reset to confront anti-competitive tech giants.