It doesn't matter how much users love your product; Every founder knows that if he runs out of funds, he's gone. In a tight funding environment, this is happening more and more frequently.

Trading in unpredictable markets was what teaches the art of treasury management. It can be a lifeline and a safety net, which can sometimes be decisive for a startup during its growth moments more crucial.

Simply put, treasury management is the task of managing a startup's capital and orchestrating cash flows. At the heart of the strategy is a triple objective: safeguard cash, optimize liquidity and find solid avenues to put idle cash to work.

It's also about forecasting, visualizing the cash needed to power daily operations today and projecting it into tomorrow.

Large corporations have the luxury of dedicated treasury teams. For startups, driven by the mission to grow, they often find themselves in a difficult situation. You cannot dedicate the same amount of time and resources, which can lead to a haphazard approach to treasury management.

This mess can inadvertently expose hard-earned capital to a myriad of risks, one of them being the corrosive power of inflation, especially when cash remains stagnant and undiversified in accounts with barely breathing interest rates.

How to calculate your cash position: the basis for effective treasury management

Before delving into your options for managing your company's cash, you first need to determine what actually counts as "liquid cash" to run your business. This is the cash that a company has available for immediate use, whether to manage payroll, cover operating costs, make investments or meet unexpected expenses.

At the core of my startup strategy is a triple objective: safeguard cash, optimize liquidity, and find solid ways to put idle cash to work.

Calculating how much cash you have on hand may seem obvious, but it is often not as simple as how much is in your bank accounts. For example, the fact that you have earned income does not mean that you actually have that cash available. Accounts receivable (money customers owe) are not liquid cash until they are actually paid.

A common mistake startups make is counting all revenue earned against expenses. But time matters and the cash you haven't received is not liquid cash. It may be the case that some of the customers pay late and others end up paying nothing. This must be taken into account when calculating liquid cash.

A good treasury function is able to periodically observe both the balances and cash flows of all of a company's financial accounts with a high degree of accuracy. From there, it is possible to gain an accurate view of key financial metrics such as utilization rate and trend, exit or zero cash date, asset allocation across multiple accounts, and key revenue and cost drivers. . More context allows for better decisions.

But understanding cash and liquidity is one thing. How to start managing it?

How should startups manage idle cash?

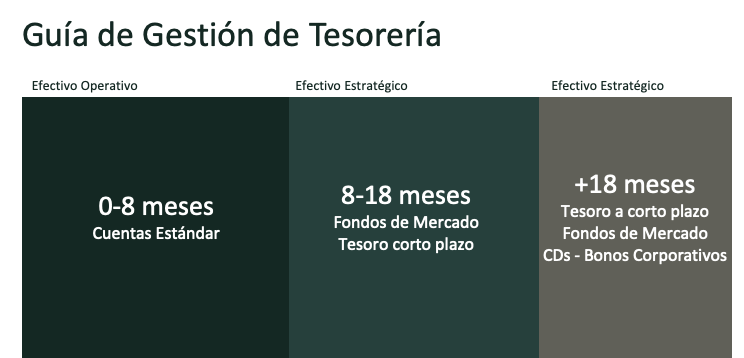

The key to developing a successful treasury management strategy is understanding the difference between strategic cash and operational cash, and developing a definition that works well in the context of the business.

Operating cash can be seen as all your business needs to run for the next six to eight months. This includes salaries, rent, marketing costs, etc.

Strategic cash, on the other hand, is cash that your business won't need for a longer period of time. This can be reserved for future investments, acquisitions, new product development and other longer-term initiatives.

Having an idea of your anticipated cash needs can help you determine where to put it. Some operating cash can be kept in an account from which it can be withdrawn when needed; This means there will always be enough available for short-term payments. Strategic cash, on the other hand, can be strategically invested in fixed income instruments to earn higher returns.

because you will always have enough on hand for short-term payments. Strategic cash, on the other hand, can be strategically invested in fixed income instruments to earn higher returns.

Manage operating cash

Often, startups manage their cash by simply depositing it all into a business checking or savings account. As the business grows, it may make sense to open multiple checking accounts for different purposes. Checking accounts make the most sense for ongoing operations, such as operating costs and salaries.

However, there are a few things to keep in mind when choosing the right place to leave your cash:

- There may be monthly maintenance fees, transaction fees, or out-of-network ATM fees.

- There may be a minimum deposit requirement or minimum balance maintenance per statement cycle.

- Some accounts limit the number of transactions, withdrawals or deposits you can make in a given cycle, or cap amounts, which can be frustrating.

- Not many trading accounts offer attractive returns compared to low-risk investment options such as treasuries. Some banks that do so may be running a short-term promotion to gain new customers or may not be able to sustain those higher returns for long periods due to the nature of the banking business model.

The average current account rate in the United States remained at a negligible 0,03% in 2021. By July 2023, even after an aggressive year of rate hikes by the Federal Reserve, it had only risen to 0,07%. But with inflation at record highs, the money left in a checking account essentially sits idle and is gradually consumed by inflation.

Finally, given the recent crises like those in the United States of SVB, First Republic and other startup-focused banks in all countries, it is vital to find ways to protect cash. Startups need to redouble their efforts to protect their cash more than ever, especially if it's at a small or mid-sized bank. FDIC insurance offers cash protection of up to $250,000 in the event of a bank failure, but there are other options that could provide businesses with more than standard FDIC coverage and help diversify coverage.

For these reasons and more, startups should consider opening checking or savings accounts at a “too big to fail” institutional bank with a long-term track record and strong capital position, but only use these accounts to maintain their operating cash. .

Manage strategic cash

Corporate treasurers have relied on fixed income strategies for their cash reserves for decades. Some popular investment options include:

- Treasury bills, promissory notes and bonds: Treasury bonds are backed by the government and are historically considered some of the lowest risk investment options.

- Money Market Funds: They are mutual funds that invest in very short-term, lower-risk securities, from government-backed securities and obligations to corporate repos and commercial paper.

- Certificates of Deposit (CDs): These bank deposit accounts have a fixed maturity rate and generally offer higher interest rates than regular savings accounts.

- Corporate bonds: Investment grade corporate bonds are loans that investors make to financially stable public companies, which they are expected to repay with interest.

These four options each have different benefits and risks. Some aspects of each of them are described below.

The Bonds of Tesoro They are liquid, conservative, short-term investments that are backed by the full faith and credit of the government. They come in different forms, with maturities from months to several years (Treasury notes) or decades (Treasury bonds). Since these are guaranteed by the government, they carry virtually zero default risk (unless the government defaults) and are popularly known as “risk-free assets.” Additionally, the treasury market is very liquid and positions are easy to buy and sell if the money is needed before the bill matures.

the market funds Monetary funds are mutual funds that invest in low-risk, highly liquid instruments, such as Treasury bonds, government obligations, commercial paper and CDs. They have a short-term average maturity which makes them low risk. There may also be some variability in yield, with minimal yields in periods of low interest rates. However, their high liquidity and low risk make them a popular choice as part of a diverse treasury management strategy, especially institutional-class funds with low fees (expense ratio) that aim to maintain a constant share price throughout. moment.

the Deposit certificates (CDs) are time deposits offered by banks that allow you to invest your money at a fixed interest rate for a fixed period of time. They are insured by regulators, which makes them very safe. CDs lock money for the agreed upon term, so withdrawing money before the maturity date may not be possible or incur a penalty, so they are best for cash that won't be needed anytime soon.

the corporate bonds with a lower risk of default are called “investment grade” because they are considered safe enough for most investors, including large institutions such as pension funds and insurance companies.

Corporate bonds typically promise higher returns than Treasury bills and also pay regular interest. This can be great for startups looking for a regular cash influx. However, this type of investment may carry a higher probability of default and may be less liquid than Treasury bills. Its price also fluctuates more with changes in interest rates. These risks can be reduced by diversifying overall assets, as well as by using bond funds that invest in dozens or hundreds of bonds rather than just a few. With the right mix of assets, companies can hold a mix of short- and medium-term bonds, and can mix corporate, treasury, and municipal bonds.

Timely strategies to maintain liquid cash

Treasury dates are a way to stagger the maturity dates of Treasury bills, bonds or CDs to ensure that some strategic cash matures when needed, according to key company milestones. Typically you will want to have a mix of maturities with different time scales. Treasury maturities, if well planned, can help startups avoid being caught off guard by rising interest rates that can cause a drop in bond prices.

Simplify treasury management

It can be difficult to stay on top of fluctuations in interest rates and cash flows. Automating treasury options can increase visibility and control while reducing risk while saving time. Common services include:

- Visibility and cash forecasting.

- Fast electronic transfers between different accounts.

- Liquidity and investment management.

- Detailed information on financial data.

Technology platforms can give smaller companies the power of an entire treasury management department on a single platform at a low cost, compared to hiring an entire treasury team. Because every coin counts for a startup, it is worth considering several aspects when evaluating the ROI of these types of platforms.

weigh the risks

All investments in the market carry some risk. But by choosing low-risk fixed income instruments and combining them into highly liquid strategies over a short-term horizon (typically one month to three years), startups can access the returns they deserve while maximizing security.

Higher performance options may be available. But it is often not worth it for startups to pursue high-risk options with the potential for high returns, mainly because they can perform poorly in challenging market conditions, which tend to be unpredictable. High-yield crypto accounts, for example, are not attractive because they are often unsecured and suffer from high price volatility.

Another big risk factor is the strength and stability of the institution where your assets will be stored. In this case, it may be advantageous to work with registered investment advisors, who operate under strict regulatory safeguards and are subject to oversight.

In this way, startups retain the rights and access to their assets at all times and entrust them to a large institutional custodian that is in excellent financial condition.

Custodial accounts, which are brokerage accounts, are also subject to higher insurance coverage.

A solution for each case

One of the benefits of a treasury management platform is the high degree of customization. What works for a pre-seed stage company will not work for a growth stage company with hundreds of millions in the bank. You must develop a personalized plan that adapts to your financial situation and takes into account your own investment restrictions, reserves on the board of directors and cash projections.

In summary, as a founder, your top priorities for your cash are:

- Preserve capital.

- Maintain liquidity.

- Generate a significant return.

Switching to a treasury management system can help transform your idle cash into a strategic asset.