Apple is making Apple Pay Later available to all users in the United States, after initially launching it to a limited number of users last March. Apple Pay Later allows users to split the cost of an Apple Pay purchase into four equal payments over six weeks with no interest or late payment fees. The company first announced the feature in June 2022 during its Worldwide Developers Conference (WWDC).

El technology giant's website now announces that you can use Apple Pay Later for purchases between $75 and $1000 made on iPhone and iPad.

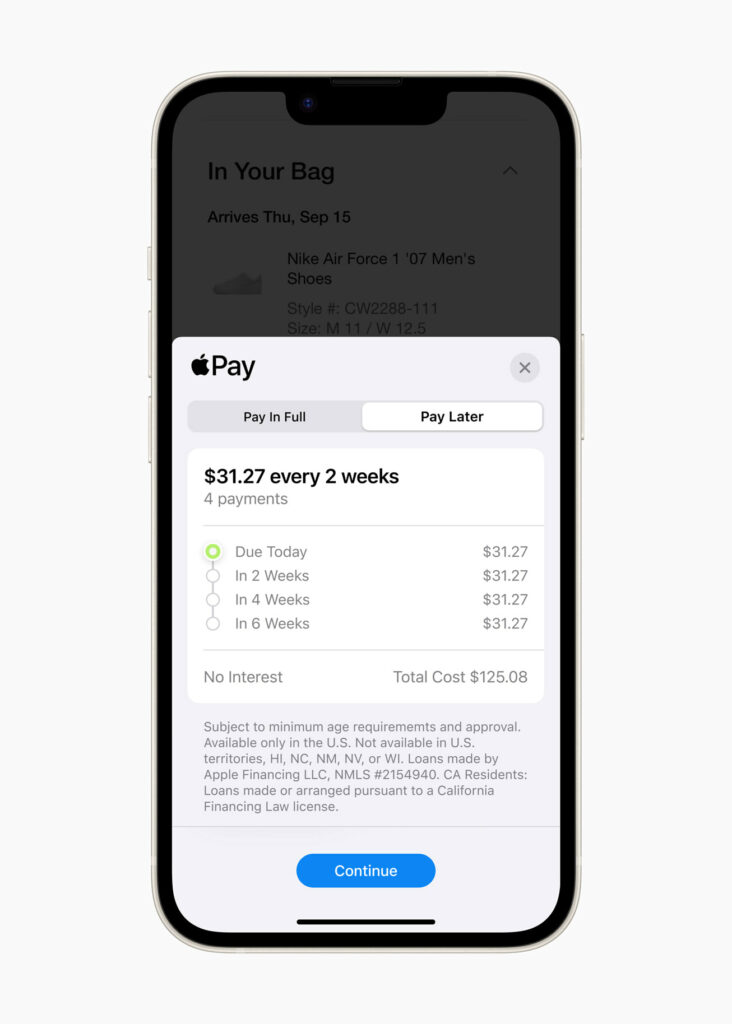

To get started with Apple Pay Later, a loan must be requested within the Wallet app. It will ask you to enter the amount you want and then accept the terms of Apple Pay Later. Once approved, you will begin to see a “Pay Later” option when Apple Pay is selected when checking out online and in apps on iPhone and iPad.

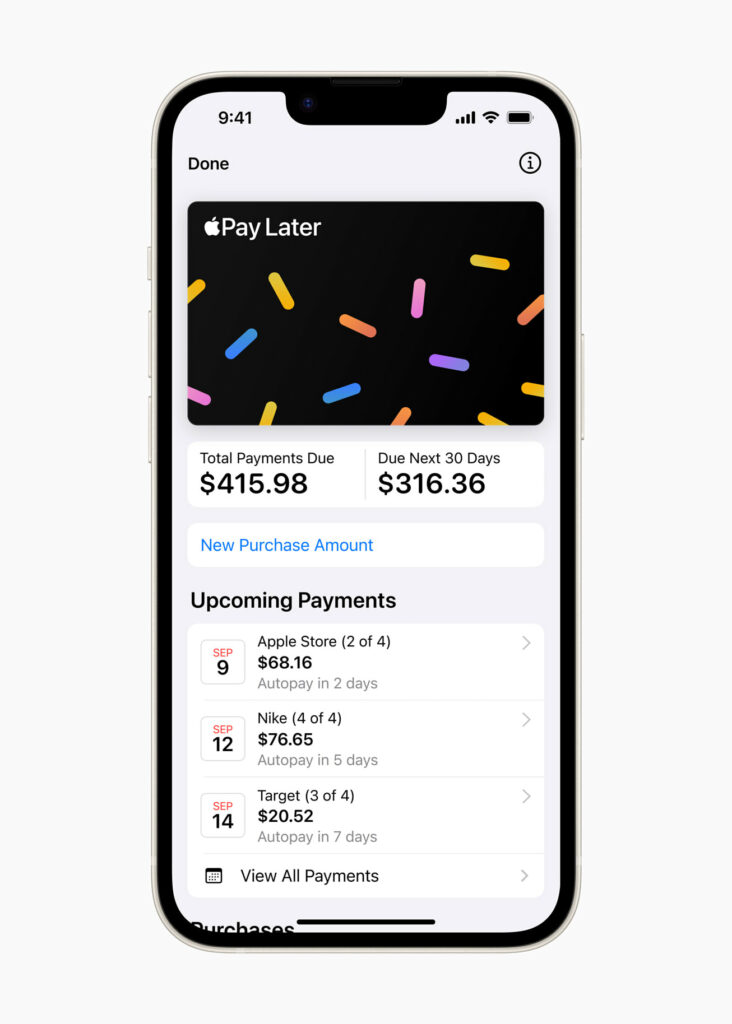

Before completing a purchase with Apple Pay Later, an overview of the four new payments is displayed along with the other upcoming Apple Pay Later payments. You have the option to use automatic payment to make payments or you can choose to pay manually. You receive alerts and reminders as your payment due dates approach, as well as access to all payment information in the Wallet app.

The tech giant's website notes that your bank may charge you fees if your debit card account does not have sufficient funds to make loan payments.

To be eligible for Apple Pay Later, you must be at least 18 years old and a U.S. citizen or legal resident with a physical address in the U.S. You also set up Apple Pay with an eligible debit card on your device. Apple notes that identity may need to be verified with a driver's license or state-issued photo ID.

Credit evaluation and lending for Apple Pay Later is handled by Apple Financing. In terms of the business side, Apple Pay Later is enabled through the Mastercard Installments program, while Goldman Sachs acts as the issuer of the Mastercard payment credential used to complete all Apple Pay Later purchases.

With this broader launch, Apple Pay Later now takes on buy now, pay later (BNPL) services from PayPal, Affirm, Klarna, and many others.