Marketing, Publicidad y Comunicación

Más de una vez, realizar una venta por tiempo limitado con un descuento salvó a alguna empresa, pero hacer los cálculos demuestra cómo, si bien vender con un gran descuento puede mejorar el saldo en el banco, puede ser algo desastroso para el resultado final.

A la gente le encantan los descuentos; y para un cliente, parece tan simple: el precio baja un 20% y obtiene una buena oferta. Sin embargo, como minorista o empresa nueva, las matemáticas no están a favor.

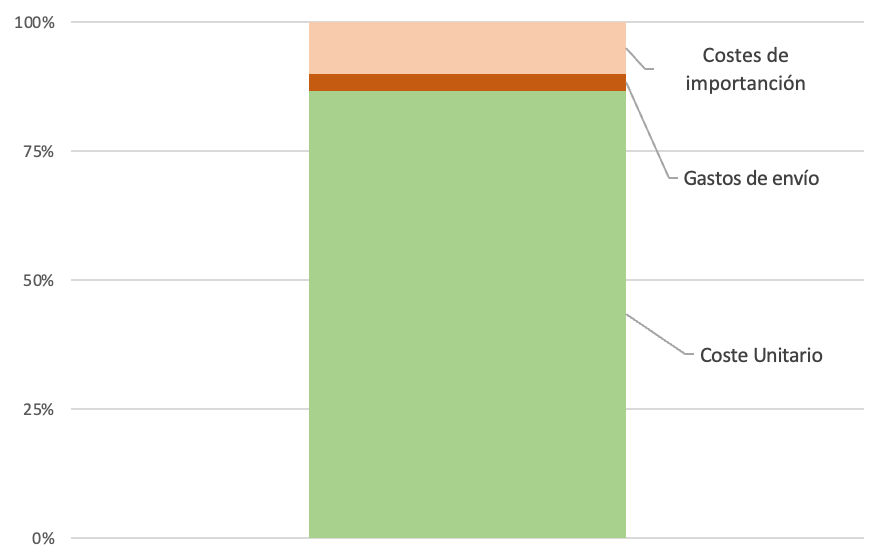

Por ejemplo, un pequeño negocio de importación: compra widgets baratos y se les pone una marca elegante antes de atraer clientes a través de anuncios de Instagram e imágenes de estilo de vida de moda. Cuando se compra 5,000 de estas unidades, se pueden adquirir por ejemplo en Alibaba a 9 euros la unidad, y eso es una buena ganga.

Por tanto, siguiendo con el ejemplo, se piden 5.000 unidades y se importan. Hasta ahora el gasto es de 45,000 en compras, otros 1,500 en envío y 10% en impuestos de importación y descubre que el 9% de las unidades no funcionan (después de todo, esto es Alibaba). Por suerte, como por arte de magia, descubres esto sin enviarlos a los clientes finales y tener que llevártelos a cambio de un cambio o un reembolso.

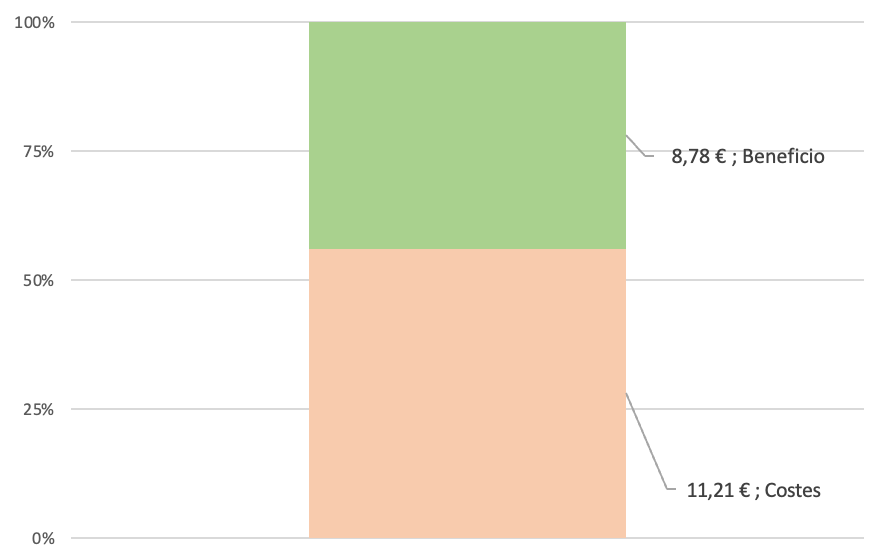

En cualquier caso, quitando las unidades que no funcionaron y el gasto total de 51,000, cada una de las 4,550 unidades que funcionaron le costó 11.21 cada una. Echemos un vistazo al desglose de costes:

Crees que puedes vender los productos a 19.99, lo que da un margen de beneficios muy bueno. Por cada widget que vendes, obtienes una ganancia de 8.78.

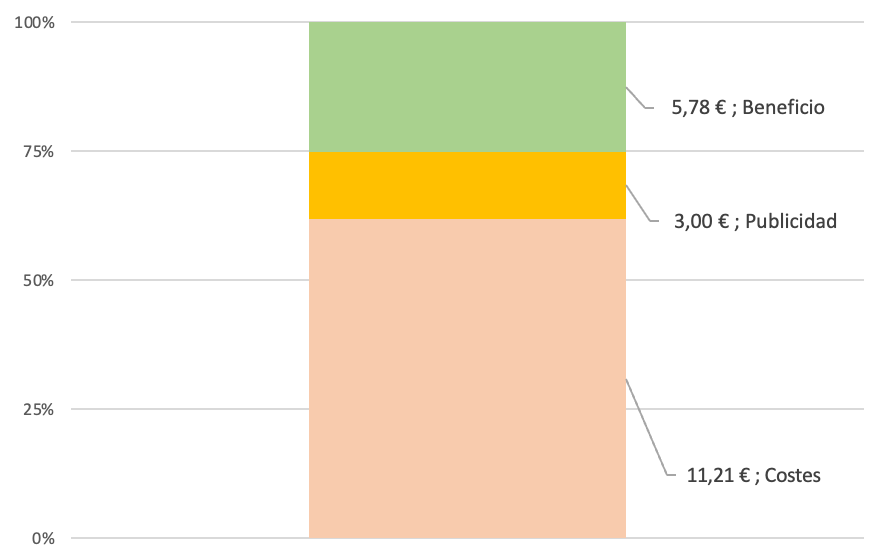

Por supuesto, también hay que hacer algo de publicidad. Tras analizar diferentes acciones, se puede adquirir un nuevo cliente por 3. De nuevo es un valor muy positivo y, por supuesto, eso también afectará al margen de beneficios:

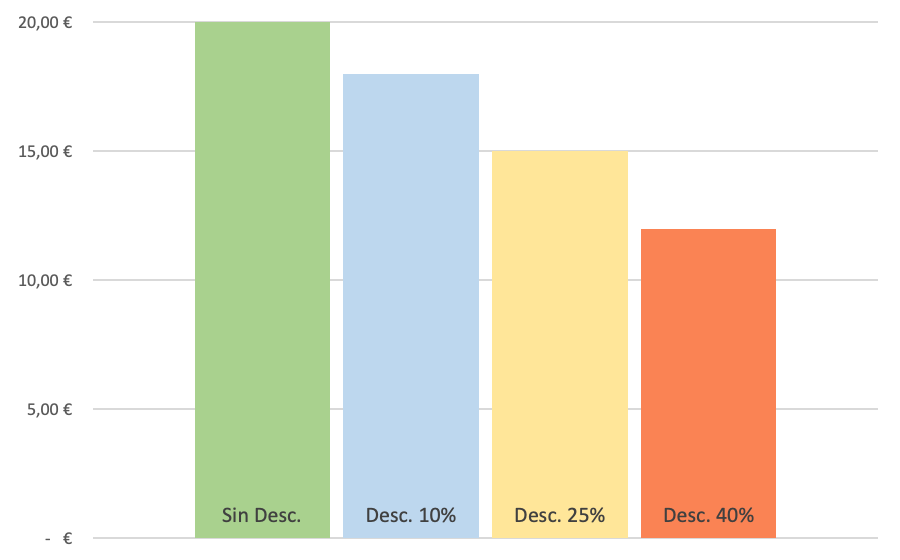

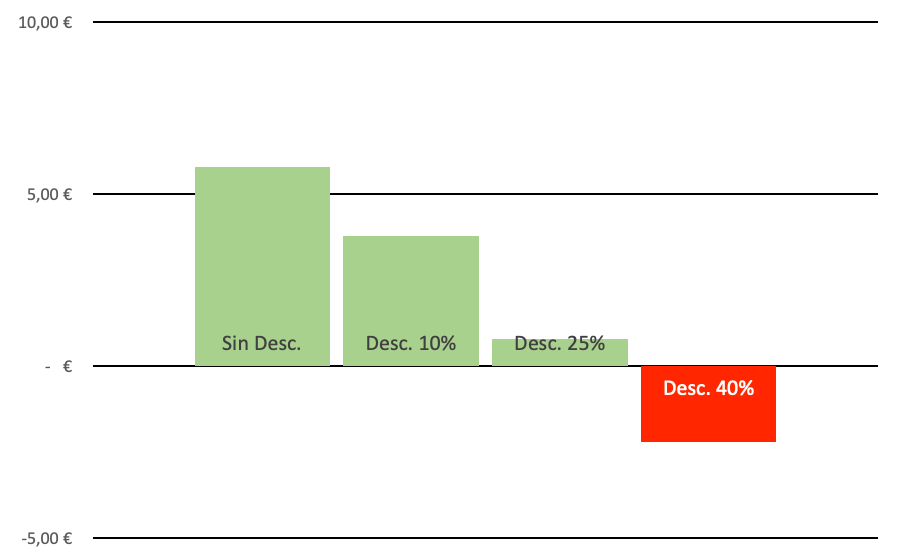

Tras unos meses, las ventas empiezan a desacelerarse significativamente porque hay otras personas que invierten al mercado. Aún no siendo preocupante, se suele empezar a aplicar políticas de descuento. Al principio, se intenta con un 10% de descuento. Ese primer descuento suele funcionar bastante bien. Pero los competidores siguen en el mercado, por lo que se opta por una política más agresiva. Primero con un 25% de descuento, luego con un 40% …

Para el cliente es una gran oportunidad:

Los clientes notan que los precios están bajando y se incrementan las ventas

En algún momento, nota algo: solo ha reducido su precio un poco, pero no está ganando tanto dinero. ¿Qué sucedió? Bueno… Lo que hay que recordar es que estás dando descuentos no sobre el precio de venta; usted está dando sus descuentos de sus ganancias. Todos los demás costos siguen siendo los mismos.

Tan pronto como empieces a mirar los números con más cuidado, verás por qué tal vez el descuento no fue una gran idea. Claro, bajar el precio de $ 19.99 a $ 14.99 es solo una diferencia de $ 5.00… pero sus ganancias se han desplomado de $ 5.78 por unidad a $ 0.78. Eso… no es un negocio.

Por supuesto, si no tiene logística de productos físicos, el costo unitario probablemente sea menos dramático que estos gráficos, pero incluso en un negocio SaaS tendrá costos; atención al cliente, costos del servidor, etc. Asegúrese de saber cuál es el costo de los bienes vendidos (COGS) antes de comenzar a reducir sus precios.

Además, todo esto no significa que nunca debas hacer descuentos; si tiene artículos en su almacén y se acerca una factura, liquidarlo y pagar sus facturas tiene más sentido que cerrar el negocio. Tal vez desee liquidar las existencias antiguas, tal vez desee recompensar a los nuevos clientes o tal vez esté tratando de atraer a nuevos clientes. Todo tiene sentido, pero tenga en cuenta lo que significa para su resultado final ofrecer un descuento. Desglose las hojas de cálculo, haga los cálculos y no termine vendiendo accidentalmente sus artículos con un margen donde no tiene sentido.