If the fintech of banking as a service Unit it does its job well, it will be ubiquitous among companies and, at the same time, it will have a name unknown to the end user. The company offers businesses a way to integrate financial services into their product, and after launching debit cards, Unit is officially entering the credit card game.

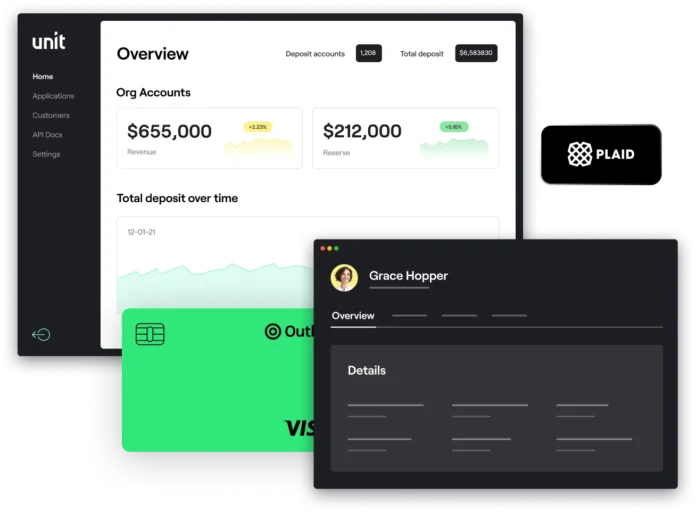

Unit's clients can use the startup's API to create custom designed charge cards for their own end users. Clients can offer their customers a charge card, credit card, revolving loan, or any other credit product offered by Unit's banking partners. On the back-end, Unit will handle card printing, fulfillment, and , once the card is in use, also transaction tracking.

According to the co-founder and CEO Itai Damti cards are Unit's fourth and final pillar as a venture capital-backed company, adding to its products in the area of debit, bank accounts and payments.

Just six months ago, Unit announced that it raised a Serie C from $100 million at a valuation of $1.2 billion, bringing its total capital raised since inception to nearly $170 million.

The charge cards, which are more popular than credit cards for small businesses, they give Unit a way to let customers build and offer loan products, even though the startup isn't a lender itself. "Once you can store money for people, you can move money for people, and you can give money to people, this is the full spectrum of banking that all of these software products can use to launch within their environments," he said. Damti.

If Unit's new line of cards sounds competitive with multi-billion dollar Brex and Ramp, it sounds the same, but it's a bit more complicated. Instead of selling a card to startups like its well-capitalized competitors, Unit is selling customers a way to create personalized cards for their own end users. It goes for a classic B2BC model instead of a B2B model.

“If you're a company that sells to builders, instead of your customers finding other solutions on the market, you can just embed loans into the software,” Damti said. "We do not compete with Brex and Ramp per se, but we allow companies to offer an equivalent product and do so in an integrated way."

Unit's expansion sits differently during a particularly difficult economic spell for fintech companies like Chime and Stripe, which have made layoffs in recent weeks. The vice president of the loan unit david sinsky who recently joined the company after a 7-year stint at Opendoor, explained that the new product could help their clients introduce a new line of revenue through exchange fees.

"Maybe there's less VC money to spend on Google and Facebook ads, but we're working with companies that have built differentiated software," Sinsky said. “And I see Unit as an opportunity to better serve those users and improve their economy.” Unit claims that a card swipe transaction will generate 0,5% more revenue per interchange when done with a credit card compared to a debit card.

Damti added that “there is less competition in vertical finance… there is a huge opportunity, because they have data, they have distribution and they can be very effective underwriters who are very effective lenders in their vertical.”