Usuarios del Club TRPlane

Pagos, es una startup de inteligencia en fundada por ejecutivos anteriormente en Braintree y PayPal que ha recaudado 10 millones de dólares en fondos ya en su fase inicial.

Habiendo iniciado su actividad mismo año 2021, Pagos, totalmente orientado a transacciones en remoto, está construyendo una plataforma combinada de datos y microservicios, basada en APIs consumibles por terceros que, según su estrategia, pueden integrarse con cualquier sistema de pago. El objetivo final es impulsar un mejor rendimiento y la optimización de la infraestructura de pagos existente de una empresa.

El concepto nació de la experiencia del equipo fundador en sus anteriores empresas. El CEO Klas Bäck y el CPO Albert Drouart ocuparon puestos ejecutivos en Braintree / Venmo y PayPal durante los últimos ocho a nueve años (Braintree / Venmo fue adquirido por PayPal). Ambos también trabajaron en el procesador de pagos Netgiro (luego vendido a Digital River).

Por otro lado Daniel Blomberg, el director de tecnología de la empresa, ha lanzado siete nuevas empresas (y ha vendido cinco) en las últimas dos décadas.

Cómo curiosidad: Bäck y Blomberg crecieron en la misma pequeña ciudad rural en Suecia, y ambos han vivido en el extranjero, en diferentes lugares, durante las últimas dos décadas.

“El desafío que afrontapos para nuestros clientes es que, en muchos casos, no tienen el conocimiento, los datos ni las herramientas suficientes para poder ejecutar una estrategia en torno al procesamiento del pago o capacidad de optimizarlo”, dijo Bäck, que dirigió las operaciones internacionales de Braintree desde el inicio y trabajó para PayPal después de la adquisición de la startup. «Esto significa que son mucho más lentos y les cuesta mucho más hacer todo lo que necesitan y producir los resultados esperados».

En términos reales, esto puede generar mayores costes operativos, pérdida de ingresos y “fricciones innecesarias, lo que hace que la ejecución de la estrategia comercial sea mucho más difícil de lo que debería ser”, agregó Bäck.

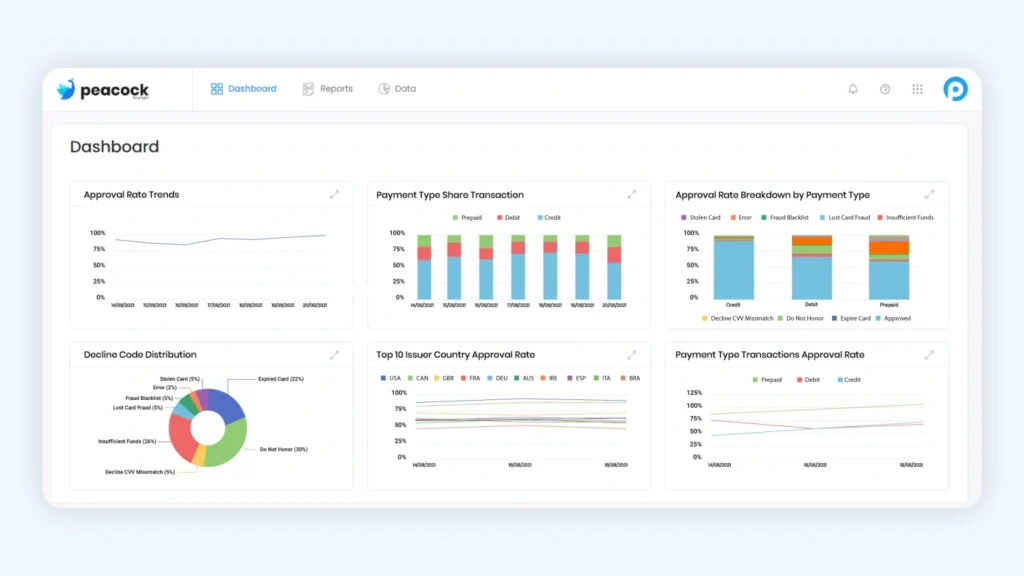

Así que Pagos se propuso construir una plataforma SaaS con microservicios basados en APIs para ayudar a las empresas a optimizar el procesamiento de pagos y la ejecución.

“Queremos darles la información y los datos que necesitan para responder:» ¿qué significa? ¿Cómo puedo hacerlo mejor? ¿Cómo puedo ejecutar más rápido? ”, Dijo Bäck. «Queremos brindarles esas herramientas de una manera fácil de consumir».

Fue suficiente para ganarse la confianza de Underscore VC y Point72 Ventures, que codirigieron la ronda de inversión en Pagos, así como a business angels como el ex gerente general de Venmo y el actual inversionista de Accel, Amit Jhawar; Bill Ready, presidente de comercio y pagos de Google; Billy Chen, vicepresidente de asociaciones financieras de Finix y ex director de pagos de Uber; y Rich LaBarca, director general de Dynamics 365 Customer Insights en Microsoft.

A corto plazo, Pagos ofrece servicios como visualización de datos de pago “inmediato”, notificaciones automáticas sobre tendencias o problemas de pago y detalles actualizados del número de identificación bancaria (BIN) para administrar clientes y controlar costes. De cara al futuro, la compañía planea ofrecer servicios de tokenización de red y actualización de cuentas.

“Las empresas medianas y grandes están obteniendo un impulso razonable en las ventas online o mediante aplicación propia de móvil. Una vez que empiezan a alcanzar números significativos, su infraestructura de pago los está frenando ”, dijo Bäck. «Queremos ayudarlos a escalar y ejecutar más con menos recursos».

Desde el primer día, la compañía ha estado trabajando con clientes a escala global, desde compañías de 50 personas hasta otras que venden miles de millones de dólares en productos y servicios en línea.

La compañía planea utilizar su nuevo capital principalmente para ampliar su equipo de 20 personas, concretamente ingenieros, señaló Bäck.

Los inversores son optimistas, como es natural.

Chris Gardner, socio de Underscore VC, con sede en Boston, comentó que se sintió atraído por Pagos porque su equipo tiene un historial de décadas trabajando con los clientes objetivo, «haciéndolos excepcionalmente cualificados para darles servicio».

“Pero su mercado potencial son todos los comerciantes de comercio electrónico del mundo, y hay millones de ellos”, añadió. «Esos son dos ingredientes clave en una solución ganadora».

En su opinión, la oferta de Pagos es única tanto en las capacidades de sus servicios como en el modelo de entrega a los clientes. Con el tiempo, el equipo planea ofrecer más de una docena de microservicios individuales que resuelvan desafíos específicos de optimización de pagos, todos accesibles a través de API.

«Y dado que no existe ‘una talla única'», dijo, «están disponibles completamente desagregados, gratis para probar y con precios individuales cuando en función de la escalabilidad».

Dave Matter, socio de Point72 Ventures, cree que a medida que el comercio se digitaliza cada vez más, las mecanismos de pago de los comercios se vuelven más complejos y difíciles de administrar.

«Pagos está dirigida por dos de los expertos en productos de pagos más exitosos del negocio, y sus relaciones, experiencia en el dominio y experiencia de primera mano con estos puntos débiles en el mercado es de un valor esencial», Apuntó en la misma entrevista.