Usuarios del Club TRPlane

Cuando Nvidia anunció las sorprendentes ganancias con un crecimiento interanual de tres dígitos, fue fácil quedar atrapado en la emoción. La compañía recaudó 13.500 millones de dólares durante el trimestre, un 101 % más que el año anterior y muy por encima de su previsión de 11.000 millones de dólares. Sin duda, eso es algo por lo que entusiasmarse.

Nvidia se beneficia de ser una empresa en el lugar correcto en el momento adecuado, donde sus chips GPU tienen una gran demanda para ejecutar grandes modelos de lenguaje y otras tareas impulsadas por la IA. Esto impulsó el sorprendente crecimiento de Nvidia el último trimestre. Vale la pena señalar que la empresa sentó las bases de su éxito actual hace algún tiempo.

«Los ingresos por computación del centro de datos casi se triplicaron año tras año, impulsados principalmente por la aceleración de la demanda de nube por parte de los proveedores de servicios Cloud y las grandes empresas de Internet de consumo para nuestra plataforma HGX, el motor de los modelos generativos y los grandes modelos de lenguaje», Colette Kress, vice presidente ejecutiva de Nvidia y directora financiera, dijo en el informe posterior a los beneficios con los analistas.

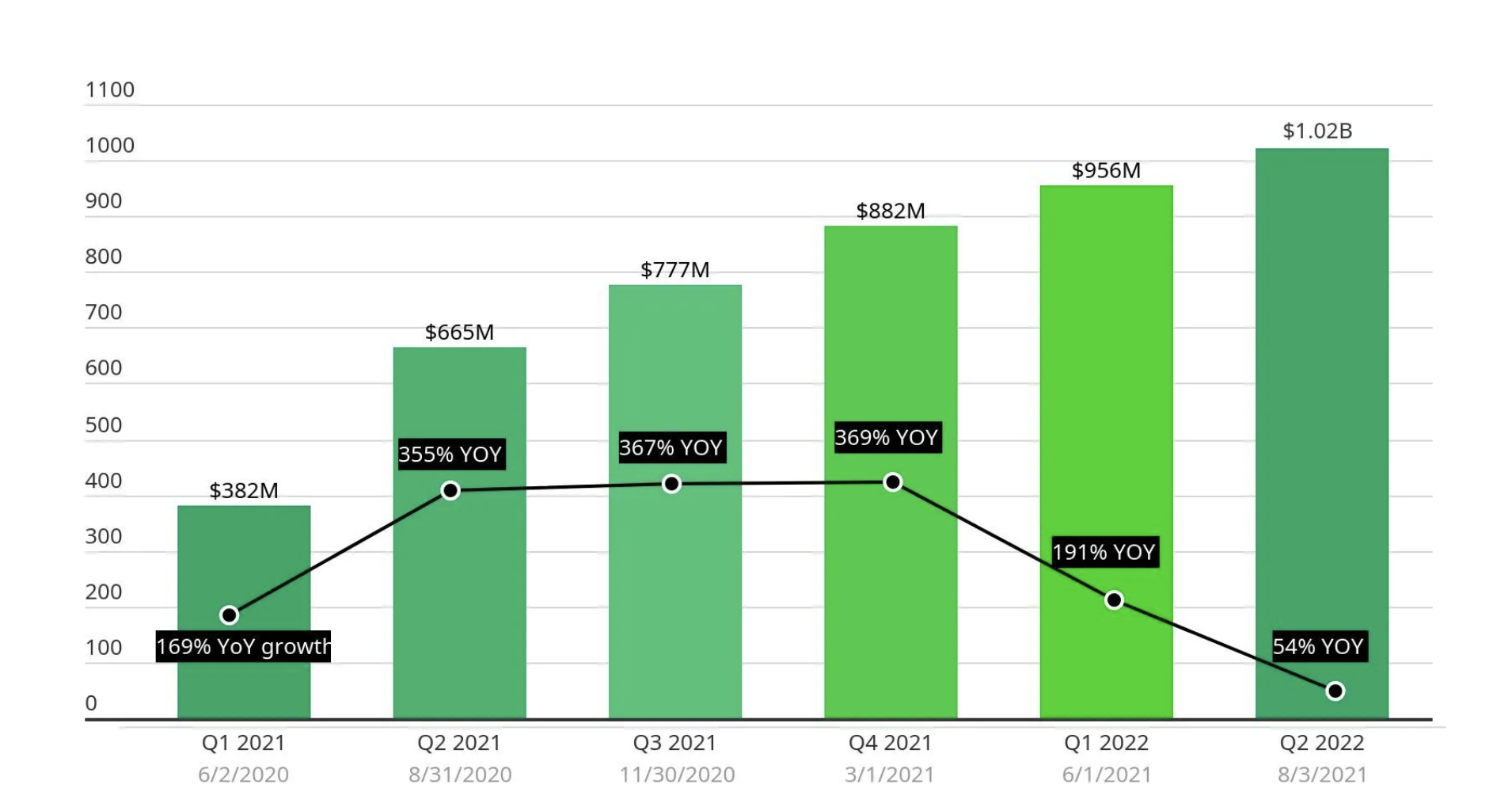

Este tipo de crecimiento recuerda los días embriagadores de las acciones de la nube, algunas de las cuales se dispararon durante el bloqueo de la pandemia cuando las empresas aceleraron el uso de SaaS para mantener a sus trabajadores conectados. Zoom, en particular, despegó con cinco trimestres de crecimiento absolutamente asombroso durante ese tiempo.

La pandemia impulsó el crecimiento de Zoom.

Hoy en día, cuando el crecimiento de dos dígitos ya no existe en el informe más reciente de Zoom a principios de este mes, informó de ingresos de 1.138 millones de dólares, un 3,6% más que el año anterior. Esto sigue a cinco trimestres consecutivos de crecimiento de un solo dígito, los últimos tres de un solo dígito bajo.

¿Podría Zoom ser una advertencia para una empresa como Nvidia que se sube a la ola de la IA generativa? Y quizás lo más importante: ¿impulsará esto expectativas irrazonables de los inversores sobre el desempeño futuro como sucedió con Zoom?

La demanda del centro de datos no va a ninguna parte

Es interesante observar que el área de mayor crecimiento de Nvidia es el centro de datos, y que todavía se están construyendo a un ritmo rápido con planes para agregar más de 300 nuevos centros de datos en los próximos años según una investigación de sinergy de 2022.

“El futuro parece brillante para los operadores a hiperescala, con un crecimiento anual de dos dígitos en los ingresos totales respaldado en gran parte por los ingresos de la nube que crecerán en el rango del 20-30% anual. Esto, a su vez, impulsará un fuerte crecimiento del gasto de capital en general y del gasto en centros de datos específicamente”, dijo John Dinsdale, analista jefe de Synergy Research Group, en un comunicado sobre el mencionado informe.

Al menos un porcentaje de este gasto seguramente se dedicará a recursos para ejecutar cargas de trabajo de IA, y Nvidia debería beneficiarse de esto, dijo el miércoles a los analistas el director ejecutivo Jensen Huang. De hecho, cree que el crecimiento expansivo de su empresa es mucho más que temporal.

“Hay aproximadamente 1 billón de dólares en centros de datos, o dicho de otro modo, un cuarto de billón de dólares de capital de coste anual. Estamos viendo que los centros de datos de todo el mundo están tomando ese gasto de capital y centrándolo en las dos tendencias informáticas más importantes de la actualidad: la informática acelerada y la IA generativa”, dijo Huang. “Y por eso creo que esto no es algo a corto plazo. Esta es una transición industrial a largo plazo y estamos viendo que estos dos cambios de plataforma ocurren al mismo tiempo”.

Si tiene razón, tal vez la empresa pueda sostener el nivel de crecimiento, pero la historia sugiere que lo que sube eventualmente bajará.

Gravedad empresarial

Si Zoom sirve de indicación, algunas empresas que experimentan un rápido crecimiento por una razón u otra pueden conservar esos ingresos en el futuro. Si bien es ciertamente menos emocionante para los inversores que la tasa de crecimiento de Zoom se haya moderado drásticamente en los últimos trimestres, también es cierto que Zoom ha seguido creciendo. Eso significa que ha conservado toda su escala anterior y algo más.

Pero el software no es hardware. Zoom es un buen ejemplo histórico de que el crecimiento rápido a menudo se convierte en un crecimiento más lento más adelante, pero las empresas de hardware lo tienen más difícil que sus primos digitales. En el caso de Zoom, parece haber experimentado un aumento de la demanda en lugar de un cambio a largo plazo en sus tasas de crecimiento.

¿Cómo logró Zoom seguir creciendo después de un período de adquisición desmesurada de clientes? Un elemento clave del software en el contexto empresarial moderno es que los clientes existentes tienden a gastar más con el tiempo. Este crecimiento nativo, llamado retención neta por los expertos en SaaS, ayuda a garantizar que las empresas de software rara vez vean disminuir sus ingresos. Claro, el crecimiento puede desacelerarse a medida que se vuelve más difícil conseguir nuevas cuentas y las ventas adicionales se vuelven más difíciles, pero que una partida de ingresos realmente caiga es raro para las empresas de software hoy en día.

La historia de Nvidia muestra cuán diferentes son las cosas para las empresas de hardware. Por ejemplo, en el primer trimestre de 2023, la empresa registró unos ingresos de 7.190 millones de dólares, una cifra un 13% inferior a su resultado del año anterior. Luego, Nvidia aplastó por completo el segundo cuarto.

Por lo tanto, cuando consideramos la desaceleración del crecimiento del software (las cifras de retención neta en caída, aunque aún impresionantes, de Snowflake, por ejemplo), la analogía solo se extiende hasta cierto punto al mundo de la fabricación y venta de chips. En otras palabras, no podemos esperar que Nvidia siga una trayectoria similar a la de Zoom.

Pero si los ingresos por hardware son más caóticos que los ingresos por software, ¿cómo puede Nvidia capitalizar el aumento de la demanda y las ganancias actuales, asegurándose de aprovechar el momento lo mejor que pueda? Muy simple: puede invertir la enorme escala que tiene hoy en ingresos futuros y en la satisfacción de los accionistas. Ambos deberían ayudarle a defender su valoración en el futuro, y ambas líneas están en marcha.

En cuanto a I+D, Nvidia gastó 2.040 millones de dólares en el segundo trimestre en investigación y desarrollo. Eso es más que los 1.820 millones de dólares del mismo trimestre del año anterior. En lo que va de 2023, la empresa ha gastado 3.920 millones de dólares en I+D, frente a los 3.440 millones de dólares del primer semestre del año pasado. Se trata de una gran inversión en la competitividad del producto a corto plazo y en su ascenso a largo plazo; Nvidia está utilizando sus beneficios para ayudar a construir más chips, mejores y más rápidos.

La segunda área en la que Nvidia podría invertir su actual auge de la demanda es haciendo que sus acciones sean más valiosas individualmente. Lo hace recomprando su propio capital. Claro, Nvidia está comprando a un precio bastante alto hoy, pero eso no parece frenarlo. Como escribió la compañía en su carta más reciente sobre ganancias para los accionistas :

Durante el segundo trimestre del año fiscal 2024, NVIDIA devolvió 3.380 millones de dólares a los accionistas en forma de 7,5 millones de acciones recompradas por 3.280 millones de dólares y dividendos en efectivo. Al final del segundo trimestre, a la empresa le quedaban 3.950 millones de dólares bajo su autorización de recompra de acciones. El 21 de agosto de 2023, el comité de dirección aprobó $25.000 millones adicionales en recompra de acciones, sin vencimiento. NVIDIA planea continuar con la recompra de acciones este año fiscal.Esos 25.000 millones de dólares son una suma enorme para cualquier empresa. Y al aprobar ese nivel de gasto, Nvidia está trabajando para garantizar que las ganancias futuras se distribuyan entre menos acciones, aumentando la rentabilidad por acción y, por lo tanto, el valor.

Si bien ha habido problemas en la cadena de suministro para las empresas de chips en particular en los últimos años, la compañía insiste en que pueden mantenerse al día con la demanda en los próximos trimestres. «En cuanto a nuestro suministro, sí, esperamos seguir aumentando nuestro suministro durante el próximo trimestre, así como durante el próximo año fiscal», dijo Kress a los analistas.

Es poco lo que Nvidia puede hacer para controlar la economía, o incluso influir plenamente en la demanda del mercado de sus chips. La compañía ha demostrado que al fabricar chips como el H100 puede impulsar la demanda, pero nadie considera que Nvidia tiene el control total del destino de su mercado. Pero puede invertir en su futuro y en sus accionistas. Y lo está haciendo.

Hay que prestar atención al gasto en I + D del resto de 2023 de Nvidia y cuánto cambia con respecto a sus niveles del segundo trimestre. Si se aprecia que la cifra aún crece más, servirá como evidencia de que la empresa no se acomoda en los resultados.