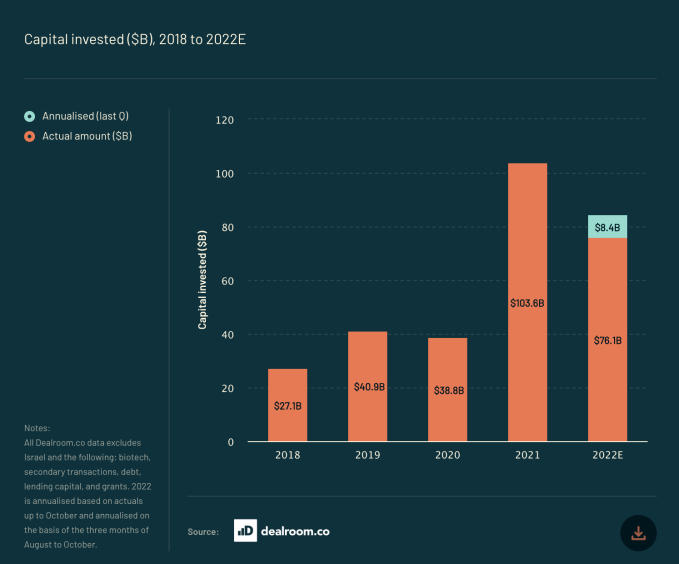

Startups across Europe are on track to raise $85.000 billion in funding this year, a $15.000 billion drop from 2021 levels when funding topped $100.000 billion, according to a report on the state of European technology. The figures come from the annual report of the London venture capital firm (European state of technology), which has become a benchmark for the technology industry in the region, and underscore the pressure being placed on it as the region grapples with an ongoing war in Ukraine, a declining economy and a population reeling from getting back on her feet and productive again after two years of the Covid-19 pandemic. In total, the European tech industry has lost around $400 billion in value, now valued at $2,7 trillion.

The report, which includes a survey of venture capitalists and founders as well as research from third-party firms such as Dealroom, also notes that tech layoffs in the region will be shaping up to be around 14,000 per year, a giant number, but still only 7% of the total number of layoffs globally, which number around 200,000, he said.

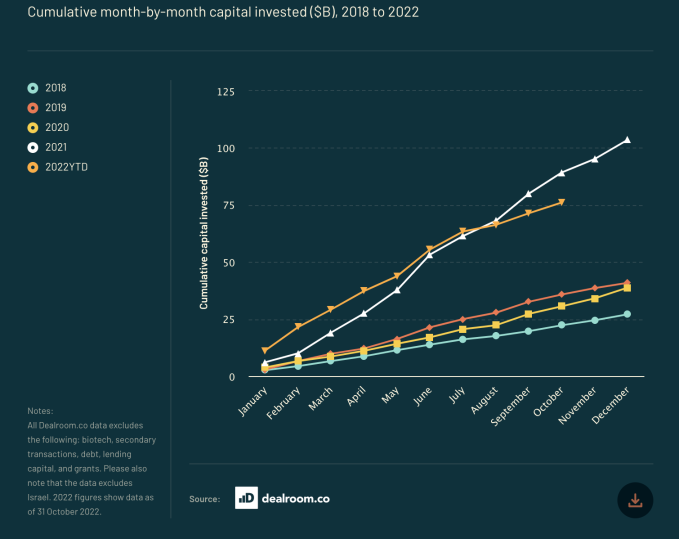

The total figure raised is also not entirely a grim message when put in context. Atomic He noted that funding for the year was actually on track to exceed 2021 levels until mid-year, when activity fell off a cliff, not a great sign for 2023. But the $100 billion raised from 2021 also They were in an atypical year. The 2020 numbers were just $39 billion, a year in which all kinds of activity came to a halt with the start of the pandemic.

Why the fall? Interestingly, respondents said that while the economy, specifically higher interest rates and inflation risk, were the biggest cooling factors impacting Europe's tech industry, the second biggest factor was a hostile regulatory environment. , followed by the performance of public market companies and general public sentiment around technology, with the geopolitical situation in fourth place.

In fact, some of the other big takeaways from Atomic They confirm what many of us have been seeing. IPO markets, notes AtomicThey are totally closed. There were only three IPOs this year in the region, compared to a staggering 86 the year before.

And the number of "unicorns" being produced, that is, companies that reach a valuation of more than a billion dollars, also fell. There were 31 of these this year, up from 105 in 2021. But again, as with funding, this seems to indicate that last year was an outlier: 2020 had 25 and 2019 had 35 companies with $1 billion or valuations. higher.

Similarly, the funding rounds themselves were reduced in size as the year progressed. Again, as with overall funding, the first half of the year was record-breaking, with 133 rounds of equity funding of $100 million or more (not including debt or secondary rounds), which was more than 2019 and 2020 combined. . However, they may have been founders looking to make hay while the sun was still shining: in the second half of the year, that total dwindled to "merely" 37 rounds of that size. US investors are also making fewer moves in the region: their share has dropped by 22% in 2021.

In particular, it's not just those at the growth end of the spectrum who are feeling the comedown: "82% of founders who responded to the survey believe that it is more difficult now to raise venture capital than it was 12 months ago,” the report states.

Unsurprisingly, all of this has resulted in a massive devaluation. The wave of downgrades by private companies and the loss of market capitalization for public companies has resulted in a loss of about $400 billion for the technology as a whole, he notes. Atomic. It is now collectively worth $2,7 trillion, up from $3,1 trillion at the end of 2021.

One silver lining to the trickle-down effect in technology, where the largest companies (the ones that are publicly traded, or the ones that are very mature and privately owned) may be feeling the most pressure, is that the early stage is still very much up and running. Good overall in Europe. The youngest startups in the region account for a whopping 51% of investment going to tech companies”purpose driven". (Note: These are startups that mix science with technology or use technology to solve bigger problems in the world, like climate change; not the same as investing in all early-stage startups).

And just as we've been charting a number of venture funds in the region that raised over $1 billion this year, Atomic notes that there are, in fact, many funds ready to invest when the right opportunities arise.

As of the end of 2021 (the latest full period available), InvestEurope estimated that there were around $84bn of uninvested funds across Europe, coincidentally not far from the total amount startups will have raised this year. That $84 billion includes venture capital and given the amount of crowdfunding across the industry this year, and the subsequent drop in investment, especially in the second half of this year, Atomic he thinks the capital buffers could be even higher when everything is evaluated, although right now it seems to be half:

“The technology ecosystem as we know it is barely twenty years old and in that time we have matured at an incredible rate. The true success of the sector is based on talent, innovation and the creation of companies in the long term”, writes Tom Wehmeier, partner of Atomic and chief knowledge officer, and co-author of the report. “The crucial pieces of this puzzle remain in place, with $ 44 billion in European venture capital funds ready to be invested in the right opportunities. In terms of the underlying strength of our ecosystem, it has changed a lot less than we thought."