dapio UK-based provider of payment solutions for businesses, announced the push to launch its “Tap to Pay” solution for Android users in the UK and Europe.

The African payment giant Flutterwave co-led the growth round with Techstars, featuring Daniel Gould, venture partner at Asymmetry Ventures, and PactVC.

Before paymob (not to be confused with the Egyptian payment processor of the same name) dapio allows businesses to accept cashless payments at their stores, as its technology turns the back of any Android smartphone into a direct card reading terminal.

For micro businesses and individuals, especially those run by immigrants, it is not easy to invest in hardware and purchase point of sale systems because of how expensive they can be. And this affects how they can receive payments from customers.

Se estimate a total of 3,2 million of this type of business in the UK and apart from the fact that these systems are difficult to buy in this segment, which represents 75% of all businesses in the UK, is neglected by traditional payment providers.

"I entered the UK a few years ago and always had trouble getting financial services like insurance, opening bank accounts or starting to accept payments," said co-founder and CEO Kosta Du.

“I understand exactly how difficult it is to go to a bank and go through the exact procedure that they are applying to a large company. It is a problem that my wife also faced when she had to send bank transfers to pay clients because these micro-businesses were not eligible for large entities. And I just thought there should be a more elegant solution for independent entrepreneurs and micro-businesses to make payments."

Du, together with his co-founder Grigori Gurbanov started dapio in 2019. And in the years since, to this point where it has raised some money, the company has engaged with various financial institutions for licenses to operate a mobile app that replaces card-based fare machines.

The launch of dapio is a sign of where the UK payment scene is today, where contactless payments with the help of NFC technology have exploded, forming a quarter of all payments in the country.

It's even catching on globally, as Apple plans to release Tap-to-Pay in United States. But dapio is only targeting the Android market which account with 42% of the US mobile market, 46% in the UK and 71% worldwide.

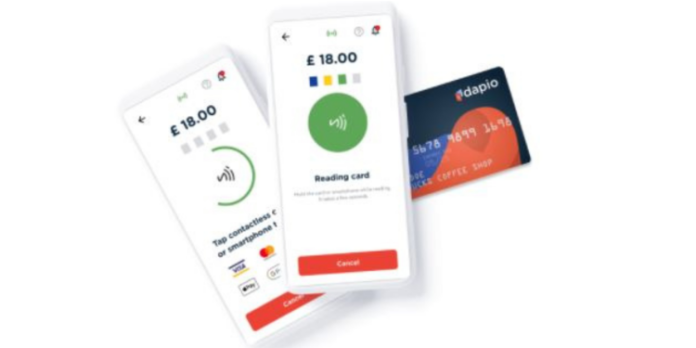

According to the company, its 'Tap to Pay' mobile app, due to launch this spring, will allow any business to instantly accept contactless payments with the tap of a card or mobile phone. Its current partners include ZmBIZI and Payment Plus.

“If you are starting a business or you are an entrepreneur, you may need to go to a bank, open a bank account and apply for a machine that costs around $300. But what we offer from dapio it's just a mobile app on your phone,” Du said.

“You, as a business owner or independent entrepreneur, when you need to opt in to collect a payment, you basically just have to open the app while the customer's card is placed behind the phone.”

Image credits: dapio

With several players offering contactless payments, such as Zilch and Nomod, and others enabling Apple Pay as one of their payment options, how do you plan dapio stand out among them?

“The key differentiator between us and other players is that we are eager to go through integrated finance. We don't just want to reach businesses directly, instead we want to embed our payment acceptance feature within existing applications from fintechs, POS providers, banks and telcos who will integrate our technology for all of their business customers." CEO.

dapio you have up to 20 merchants currently testing your product. CEO Du said that by the time dapio eventually go live with the few associations secured, it will have onboarded over 3.500 merchants on the platform.

And like ZmBIZI and Payment Plus, they drive the technology behind the expansion of dapio in the US, UK and Europe, the co-lead investor Flutterwave will be key for when it expands to Africa and the Middle East.

An investment of Flutterwave off the shores of Africa, considering that it had only made a public investment in Ivorian fintech CinetPay and seemed determined to make more investments to consolidate its presence on the continent. But still, the fintech unicorn is also particular about penetrating advanced markets and thus investing in startups there as it has with dapio it's part of a long-term game that CEO Olugbenga 'GB' Agboola described in a February interview.

“We want to shift our focus from just Africa to emerging markets and finally the US, the UK, Europe. Our goal is to ensure that our infrastructure feeds those markets,” he said.

commenting on why Flutterwave endorsed his company, Du added, “The key point for us is that we are enabling payment acceptance for micro and small businesses, that is what is driving recent economic trends.”