Apple Card customers in the US can open a savings account and earn interest. When the company originally announced the new financial product in October, Apple said it could not share the interest rate that I would pay in these accounts because rates fluctuate a lot these days.

Now, Apple will offer an APY of 4.15%. It looks like a competitive offer when you look at the data from bank fees — you can currently find savings accounts that offer an APY of 3.5% to 4.75%. The company does not make any promises regarding future interest rates. It could go up and down at any time.

Apple has partnered with Goldman Sachs once again for the banking function. Savings accounts are technically managed by Goldman Sachs, which means the balances are covered by the Federal Deposit Insurance Corporation (FDIC).

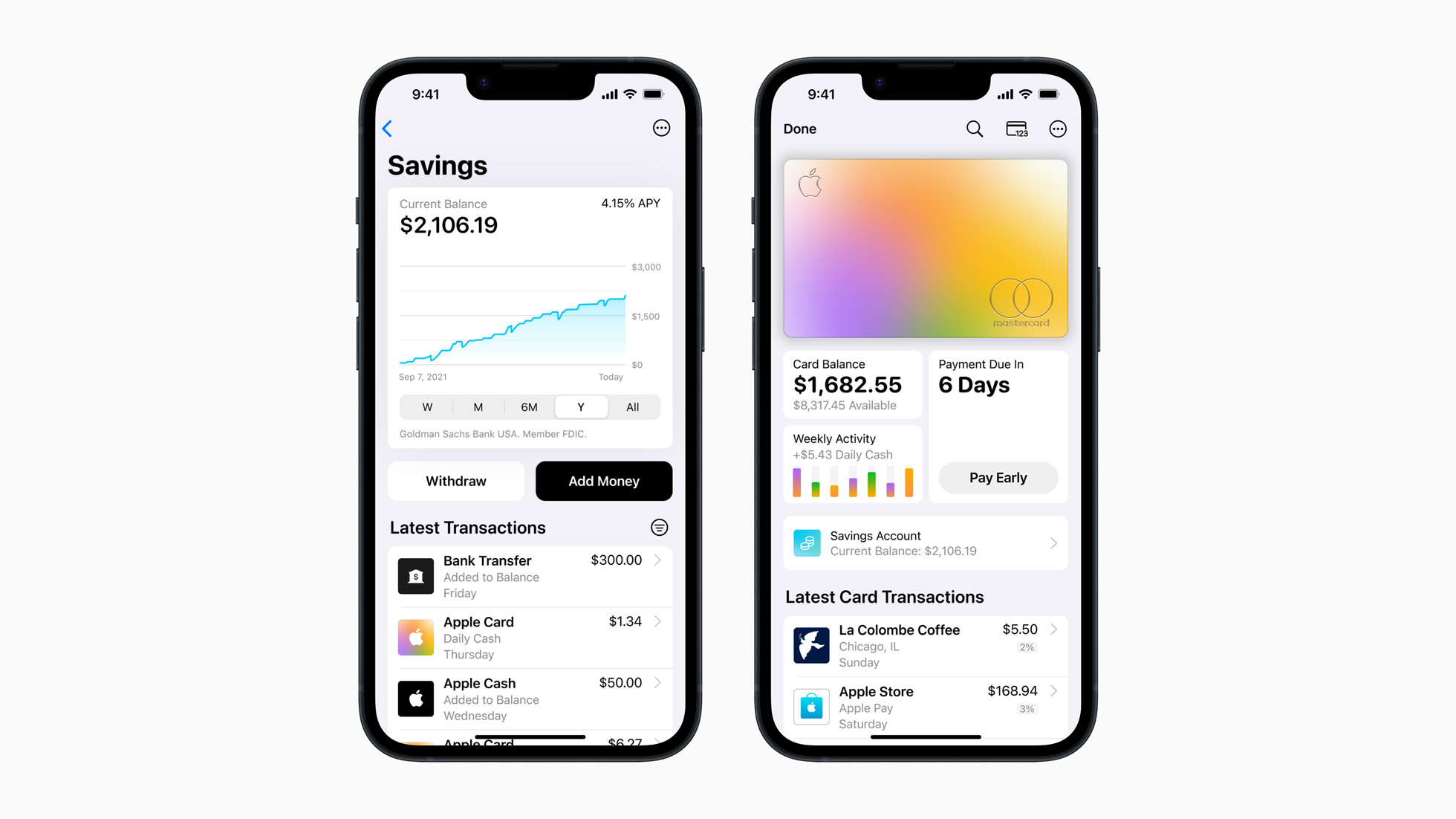

This high-yield savings account has been created specifically for Apple Card customers. When the customer pays with their Apple Card, they get cash back on all purchases. By default, all purchases earn you 1% in cash rewards and 2% for all purchases made with Apple Pay. Purchases with select merchants offer 3% in rewards.

By default, customers receive cash rewards every day in Apple Cash, a wallet that appears in the Wallet app and works more or less like a checking account. Your Apple Cash balance can be used to pay for things with Apple Pay, for credit card balances, or to send money to friends and family. You can also transfer this balance to a normal bank account.

The Apple Card users can choose to deposit their daily rewards in your savings accounts. It is a way to save money without having to pay attention to it.

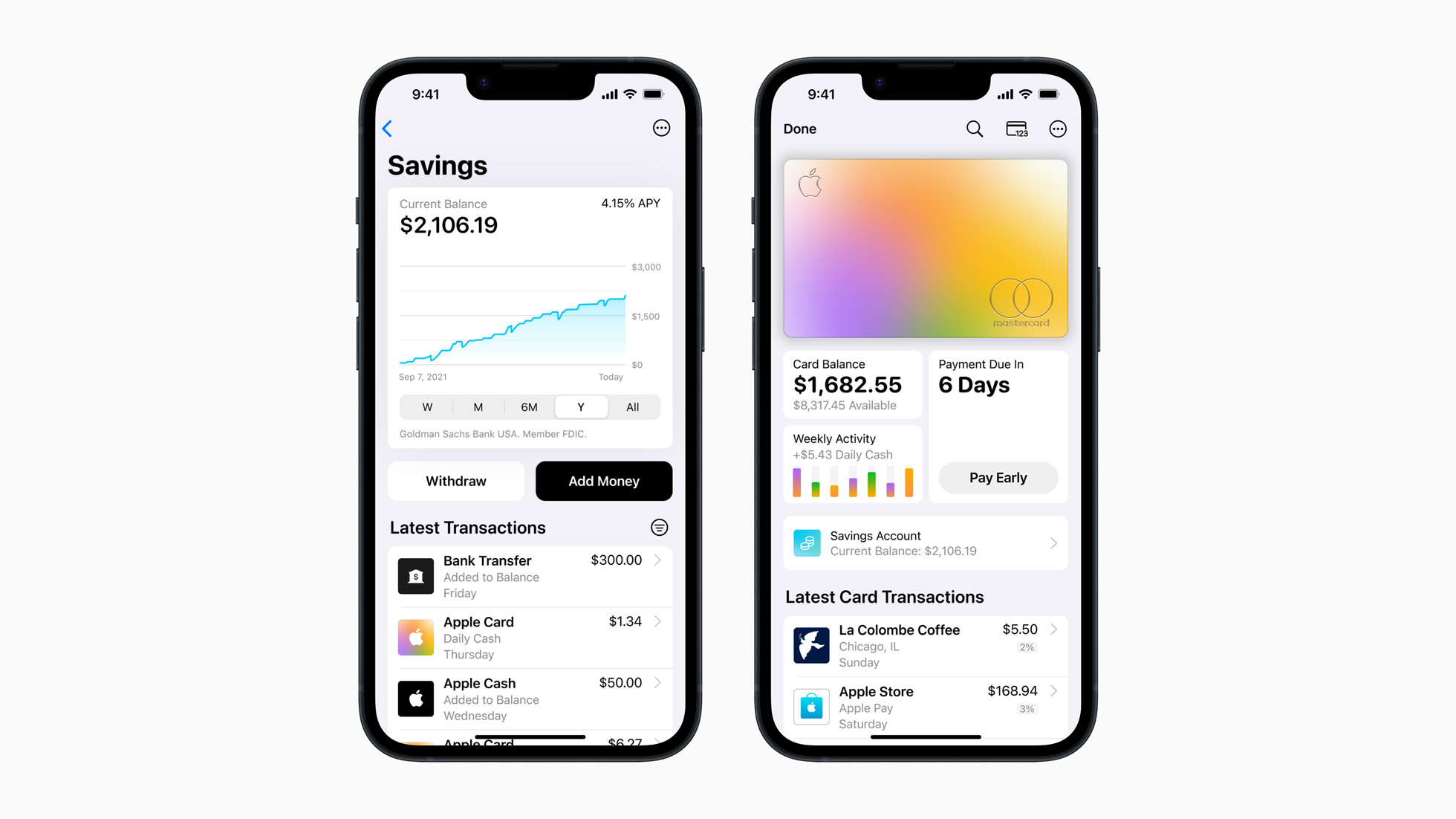

The savings account can also be accessed from the Wallet app. You can see the current balance, the current interest rate and the most recent transactions. From this screen, users can also manually add or withdraw money. The balance can be transferred to Apple Cash or a regular bank account.

"Savings helps our users get even more value from their favorite Apple Card benefit, Daily Cash, while giving them an easy way to save money every day," said Jennifer Bailey, vice president of Apple Pay and Apple Wallet at Apple, in a statement. “Our goal is to create tools that help users lead healthier financial lives, and the addition of Savings to Apple Card in Wallet allows them to spend, send and save Daily Cash directly and seamlessly, all from one place. ”.

There are no fees associated with the Apple Savings account. However, there is a maximum balance of $250,000.

Image: Apple Lossless Audio CODEC (ALAC),

Apple Card customers in the US can open a savings account and earn interest starting today. When the company originally announced the new financial product in October, Apple said it couldn't share the interest rate that would be paid on these accounts because rates fluctuate so much these days.

Starting today, Apple will offer an APY of 4.15%. It looks like a competitive offer when you look at the data from bank fee — you can currently find savings accounts that offer an APY of 3.5% to 4.75%. The company does not make any promises regarding future interest rates. It could go up and down at any time.

Apple has partnered with Goldman Sachs once again for the banking function. Savings accounts are technically managed by Goldman Sachs, which means the balances are covered by the Federal Deposit Insurance Corporation (FDIC).

This high-yield savings account has been created specifically for Apple Card customers. When the customer pays with their Apple Card, they get cash back on all purchases. By default, all purchases earn you 1% in cash rewards and 2% for all purchases made with Apple Pay. Purchases with select merchants unlock 3% in rewards.

By default, customers receive cash rewards every day in Apple Cash, a pocket of money that appears in the Wallet app and works more or less like a checking account. Your Apple Cash balance can be used to pay for things with Apple Pay, for your credit card balance, to send money to friends and family. You can also transfer this balance to a normal bank account.

Starting today, Apple Card users can choose to deposit their daily rewards into their savings accounts. It's a way to save money without having to think too much about it.

Your savings account can also be accessed from the Wallet app. You can view your current balance, the current interest rate, and your most recent transactions. From this screen, users can also manually add or withdraw money. The balance can be transferred to Apple Cash or a regular bank account.

"Savings helps our users get even more value from their favorite Apple Card benefit, Daily Cash, while giving them an easy way to save money every day," said Jennifer Bailey, vice president of Apple Pay and Apple Wallet at Apple, in a statement. statement. “Our goal is to create tools that help users lead healthier financial lives, and the addition of Savings to Apple Card in Wallet allows them to spend, send and save Daily Cash directly and seamlessly, all from one place. ”.

There are no fees associated with the Apple Savings account. However, there is a maximum balance limit of $250,000.

magen: Apple Lossless Audio CODEC (ALAC),