After a first round where he got 5.25 million dollars, postponement, a “buy now, pay later” fintech services company (BNPL extension) won an even larger next round to expand adoption of its payments model approach throughout Mexico.

Angel Peña and Alex Wieland co-founded the company in 2020. Prior to Aplazo, Peña lived in New York and worked at Morgan Stanley investing in loans in Mexico, while Wieland had been launching businesses in Latin America after his career at companies like Uber and Lime.

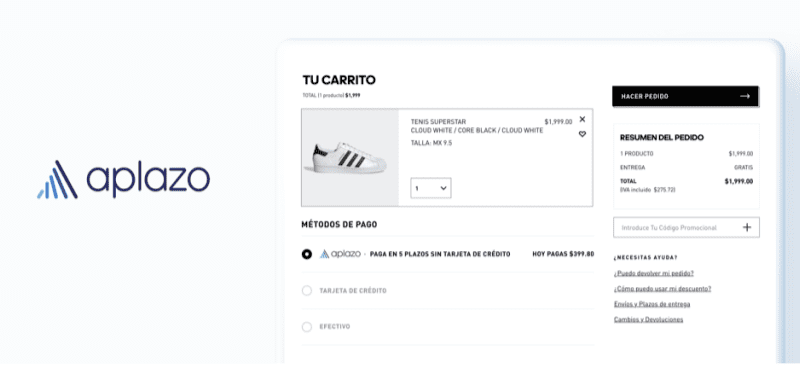

postponement It connects to the payment process of a business, online or in person, and allows users to buy items and pay in five equal installments without the need for a credit card.

That particular face-to-face component is what, according to Peña, differentiates the company from its competitors, since 95% of purchases are still made physically in Mexico. Generally, a credit card is required to take advantage of the installment model. However, credit penetration in Mexico is low, less than 10%, due to lack of confidence in the banking system. The most popular payment methods are still cash or a Debit.

“That means that 90% of people don't have access to any installment payment service,” Peña said. “There is great adoption, but the obstacles are the banks that have been super profitable, but have not democratized installment credit.”

The merchant is charged a fee to use the service, but customers are not, and postponement bears the risk of installment payments and chargebacks. The merchant benefits from increased conversion rates and higher average purchase values, due to the ease of payment by the customer, while maintaining a relationship with the consumer.

Since about 40% of the population has no credit history, postponement uses alternative data, such as open banking and telecommunications data, to measure consumers' creditworthiness and level of affordability, optimizing approval rates and providing fair credit products to underserved consumers.

Today, they announced 27 million investment in a Series A led by Oak HC/FT, with the participation of existing investors Kaszek and Picus Capital. This gives the company total funds of more than 35 million dollars.

postponement reported that the new funding was unexpected as the company had enough capital from its seed round. However, the opportunity provided the company with an opportunity to accelerate its goal, which includes technology and product development and investment on the business side. Additionally, the company intends to double its 50-person team by February and launch in two additional countries in 2022.

From the opening round, postponement increased its total processing volume more than eight times and in less than a year has partnered with more than 1,000 merchants operating in sectors such as fashion, footwear and beauty. Peña estimates that these categories represent some 70 billion dollars in consumption both online and in person.

postponement is one of the latest startups in the space BNPL extension which has been dominated by companies such as Afterpay, which was bought by Square earlier this summer, Klarna y Affirm. There is a great deal of activity in this type of services, between mergers and acquisitions such as those of Afterpay and companies like ShopBack, which agreed to acquire hello, and rounds of financing for companies of BNPL extension, for example, Billie, Nelo y scalapay.

"We've been fascinated by the global phenomenon of buy now, pay later," said Allen Miller, director of Oak HC/FT. “We wanted to make an investment in Latin America and we thought that the model buy now pay later would be an interesting entry point. The industry has the same interest as in the United States, but uses accelerators, such as Mexico's limited access to credit opportunities for buy now pay laters to be successful, Angel and Alex fit the blueprint."

Miller hopes that the future of buy now pay laters in Latin America is brilliant for a couple of reasons: First, fewer millennials are getting credit cards and relying on debit cards. And the second, businesses want to access a whole group of potential customers, but cannot due to the large number of them who do not have access to credit. postponement it is building an infrastructure around both elements and "has been able to attract talent from top brands, and when we saw that momentum, it was exciting."