In February 2022, Share, a startup that offers clients the hiring of professionals in different countries, announced that it had developed the ability to pay workers with cryptocurrencies.

Why? Because the former startup has posted historic rapid growth, with CEO Alex Bouaziz sharing in December 2021 that it had climbed $50 million in annual recurring revenue, or ARR. The same CEO indicated that Deel had started the year with around 4 million in ARR.

Keep in mind that the company raised $425 million at a $5.5 billion valuation in October 2021.

Share shared that it crossed the 100 million ARR threshold, a key moment for any tech startup as it implies that it has reached public market scale and is therefore no longer a startup in any sense of the word.

Deel's data point regarding its historical growth comes on the heels of Firstbase, a startup that helps companies acquire and provide hardware and other remote work needs to remote employees, raising $50 million after posting growth revenue of approximately 16 times since last April.

It seems that supporting remote workers is big business.

Revenue growth of Share

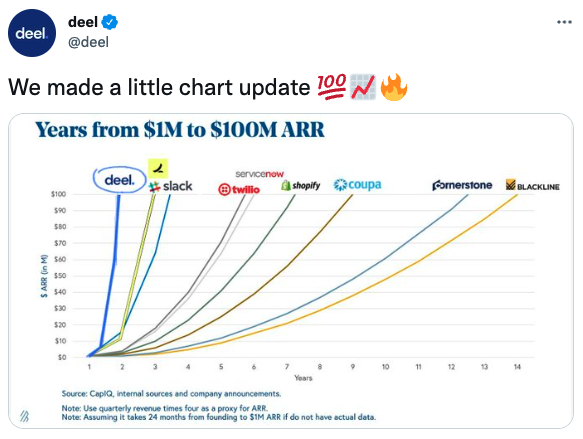

One way that startups like to show their fitness to the market is to reference the Bessemer chart that shows historical examples of startups rapidly scaling to 100M in ARR in a short period of time. This is the tweet in the Deel shared his new milestone:

Image credits: Deel

To understand the income number, you have to understand how Share set the price for your services. He generates income in two main ways: charging $49 a month per outside contractor he manages for a client, or $599 a month per employee he supports. As you can imagine, $599 a month scales nicely; to get to 100 million in ARR, the company would only have to manage around 14,000 workers.

The possible error is that the company was abusing the term ARR which ended up being incorrect. Asking on Twitter if the company had similar gross margins to SaaS (for example, in the high 60% to mid 80% range). The CEO replied yes. And in a follow up email, Share it said its "gross margins are slightly above the SaaS range."

So from a gross margin perspective, the company's revenue fits perfectly under the ARR rubric. Share he also shared that his ARR is calculated as the "annualized value of [his] contractor and employee subscriptions," which seems fair. Unfortunately, the company declined to share information about its gross margin forecasts (there is always a curiosity as to whether or not a company's earnings quality is improving) and its revenue mix.

The reason given for not sharing those metrics was rapid growth, which is reasonable; a fast-growing company might see its revenue composition change from quarter to quarter. If one of its revenue streams was lower margin and it became a big hit, it could lead to gross margin erosion in the short term that the company wouldn't want to divulge and discuss.

Still, it would be preferable to know and understand why Share you might want to keep potential short-term margin changes in-house. If your gross margins were improving, you would potentially be inviting more competition into your market space.

Finally, Share he said he is "short-term in control" of his spending, referring to his own spending, not that of clients. This is a non-GAAP (generally accepted accounting principles) earnings metric that can be calculated, but Share you are implying with these messages that your rate of consumption of cash is not very high. All these data will be confirmed when the first half is presented, since for now, it can only be inferred that the company's losses may be due more to stock-based compensation than to pure consumption of cash.

So far, on the known data, their ARR seems so strong without being able to access an income statement and historical cash flow data.

That means Share it is currently valued at roughly a 55x revenue multiple, given its previous valuation of $5.5 billion. If it can double this year, that multiple will drop to something close to a sensible level. Maybe Share will handle the 2021 peak surge and valuation surge without tripping. But given that this performance feels like an outlier, you can tell he won't have many other startups on this stage if he manages to pull it off.